No doubt, even after a viable vaccine is released to the general public and things begin to return to some semblance of normalcy, there will be long lasting effects on society and the economy. It’s been said that COVID-19 has hit fast forward on a number of trends, from e-commerce to workplace culture. Today, we’ll highlight five of these accelerating trends.

#1: Screen Life Takes Hold

Smartphones have drastically altered many parts our lives – including how we spend time. In the decade from 2008 to 2018, screen time on mobile devices increased 12x.

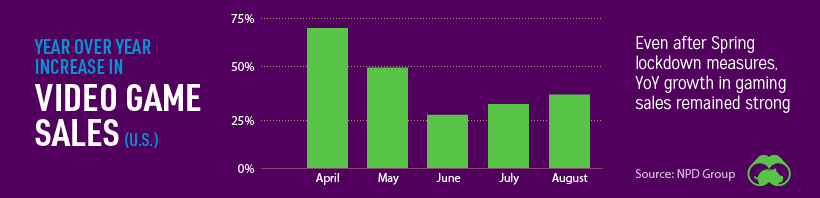

Fast forward to today, and screen time is up across the board, with some of the most dramatic increases seen among kids and teenagers. 44% of people under the age of 18 now report four hours or more of screen time per day – up from 21% prior to the pandemic. Gaming is another digital segment that has benefited from the pandemic. Video game revenue spiked in the springtime, and sales have remained strong going further into 2020. Companies are hoping that casual gamers won over during lockdown will continue playing once the pandemic has come to an end.

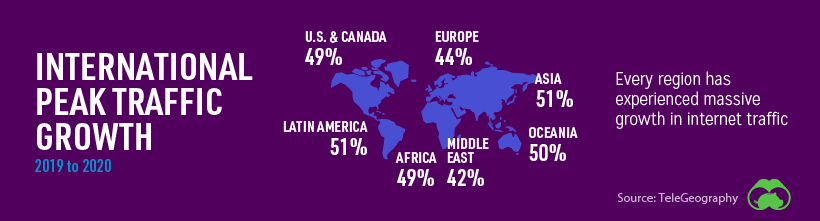

Acceleration signal: International bandwidth and internet traffic was already increasing steadily, but COVID-19 stay-at-home activity has blown away previous numbers.

Even as more workplaces and schools begin to operate normally again, it’s doubtful that screen time will drop back down to pre-COVID levels.

#2: The Big Consumer Shake-Up

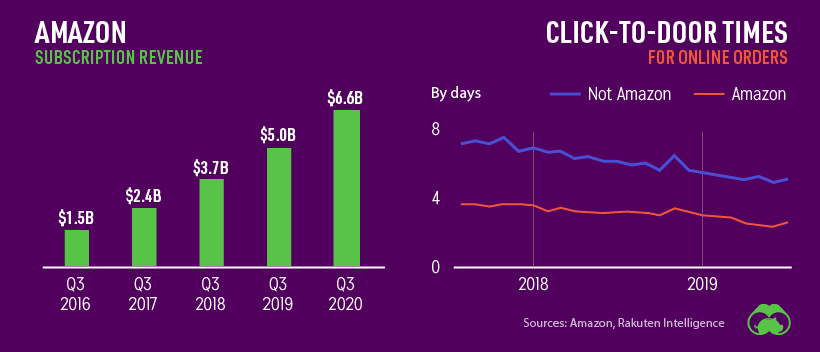

The consumer economy has been innovating on two fronts: making physical buying as “frictionless” as possible, and making e-commerce as nimble as possible. COVID-19 broke old habits and sped up that evolution. Innovations in real world shopping appear to be moving in the direction of cashierless checkouts, but in order for that model to work, people first need to embrace contactless payment methods such as mobile wallets and cards with tap payment. So far, the pandemic has been an accelerant in moving people away from cash and pin-and-swipe credit cards in lagging markets. Once people get used to the convenience of contactless payments, it’s likely they’ll continue using those methods.

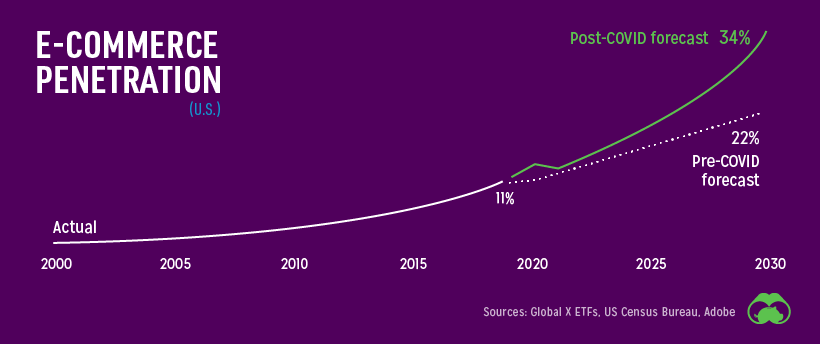

Acceleration signal: E-commerce penetration projections have shifted upward.

In hindsight, 2020 could be an inflection point where e-commerce gained a much bigger slice of the overall retail pie.

#3: Peak Globalization

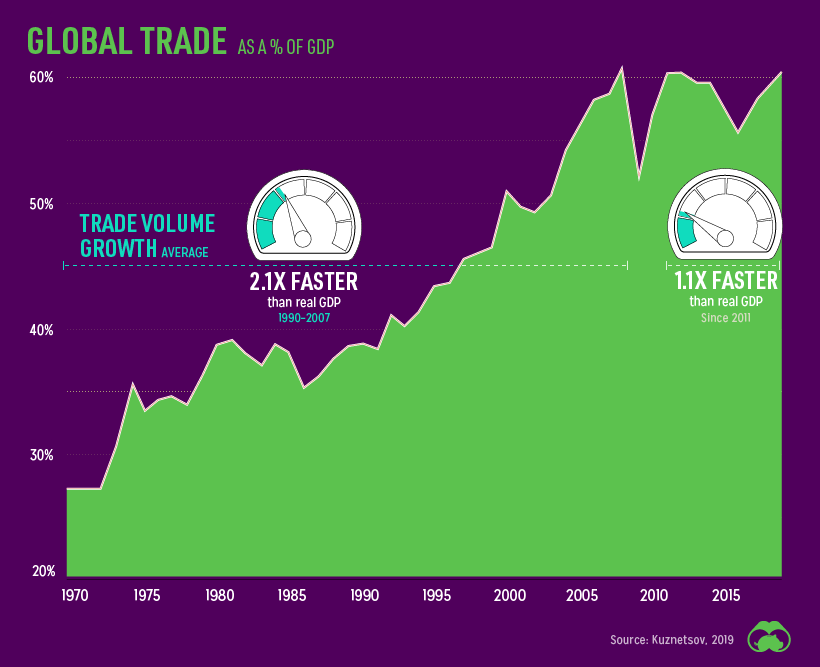

Globalization went on a tear starting from the mid-1980s until it hit a plateau during the financial crisis. Since that point, global trade as a percentage of GDP has flat-lined in the face of trade wars, and now COVID-19.

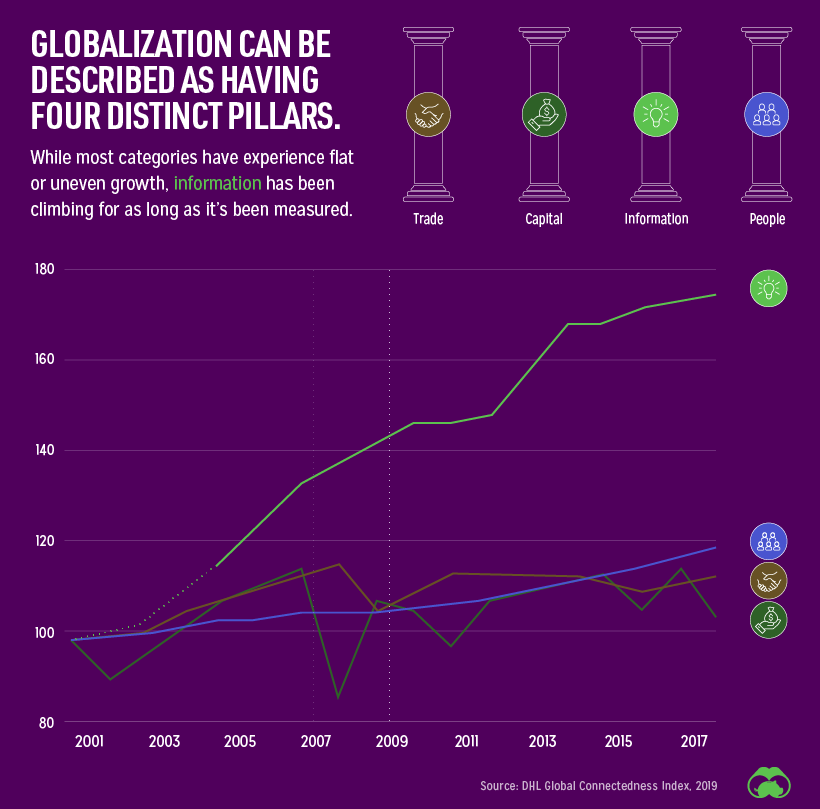

Trade was obviously impacted by the pandemic, and it’s too early to say what the long-term effects will be. One thing that is clear is that the information component of globalization is becoming an even more important piece of the world’s economic puzzle.

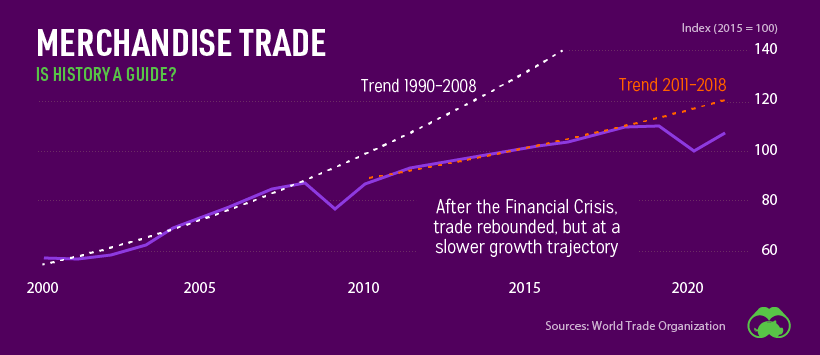

Even before COVID-19 took hold, the global services trade was growing 60% faster than the goods trade, and was valued at approximately $13.4 trillion in 2019. Acceleration signal: The dip in merchandise trade looks eerily similar to the one that took place in 2008.

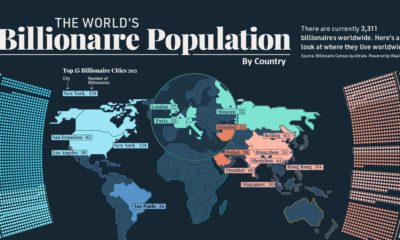

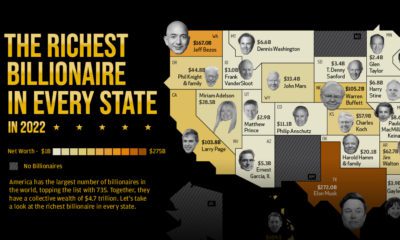

#4: The Wealth Chasm

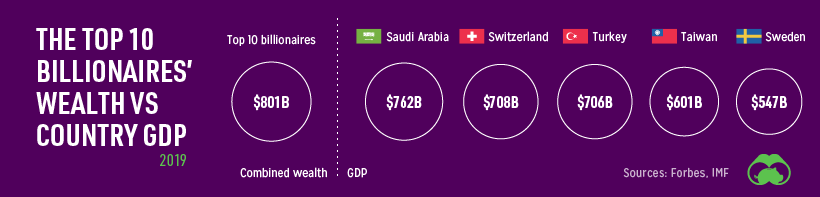

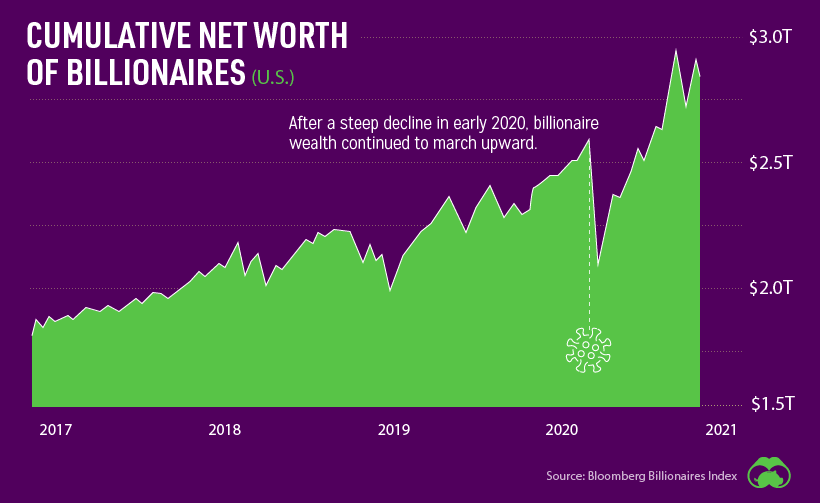

On the high end of the wealth spectrum, billionaires are worth more than ever.

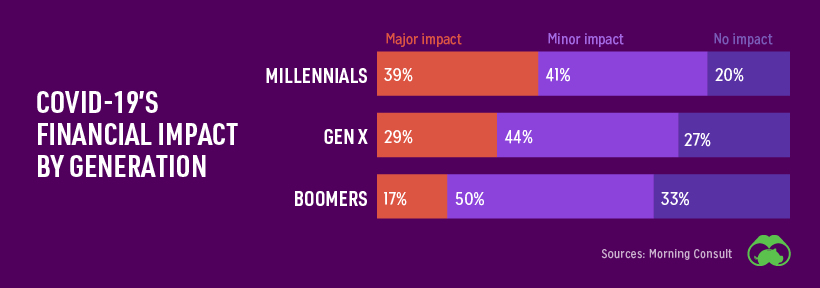

Meanwhile, in the broader economy, inequality has grown over the last few decades. Those in the top 50% wealth bracket have seen increasing gains, while the bottom 50% have seen stagnation. This issue is sure to be compounded by economic turmoil brought on by COVID-19. Younger generations face the dual challenges of being more likely to be negatively impacted by the pandemic, while also being the least likely to have savings to cover an interruption in income. In fact, nearly half of people in the 18–24 year old age group have nothing saved at all.

The longer the economy is affected by COVID-19 measures, the more of a wedge will be driven between people who have continued working and those who are employed in impacted industries (e.g. tourism, events). Acceleration signal: Growth in the net worth of billionaires has been largely unaffected by COVID-19.

#5: The Flexible Workplace

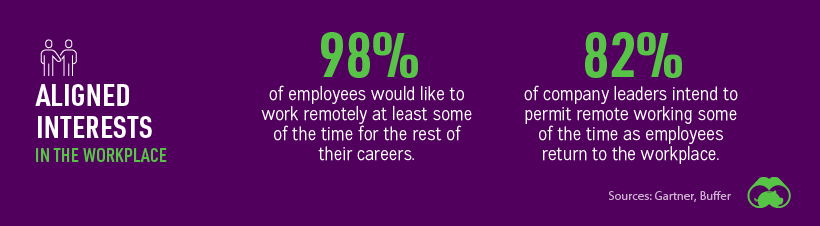

As of 2019, over half of companies that didn’t have a flexible or remote workplace policy cited “longstanding company policy” as the reason. In other words, that is just the way things have always worked. Of course, the pandemic has forced many companies to rethink these policies.

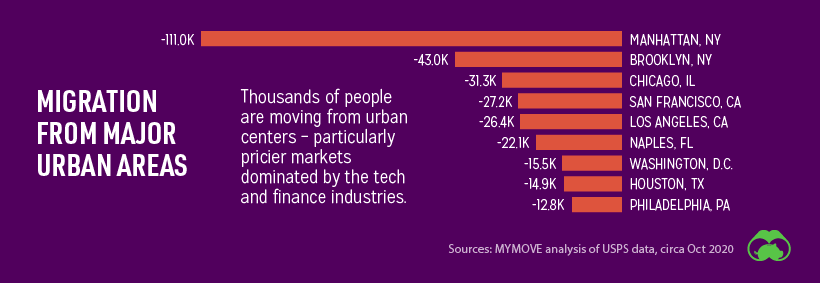

This grand experiment in remote work and distributed teams will have an impact on office life as we know it, potentially reshaping the entire “office economy”. The impact is already being felt, with global commercial property investment volume falling by 48% in Q3 2020. Acceleration signal: Thousands of people are moving out of pricey urban areas, presumably because they are able to work remotely from a cheaper location.

If you like this post, find hundreds of charts like this in our new book “Signals”:

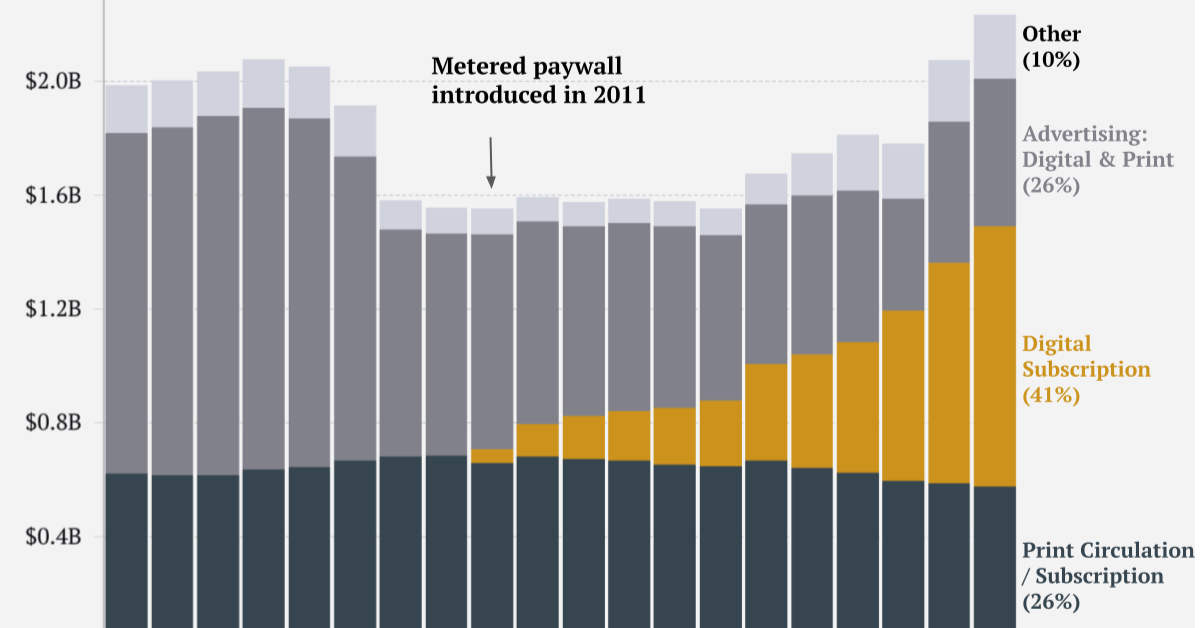

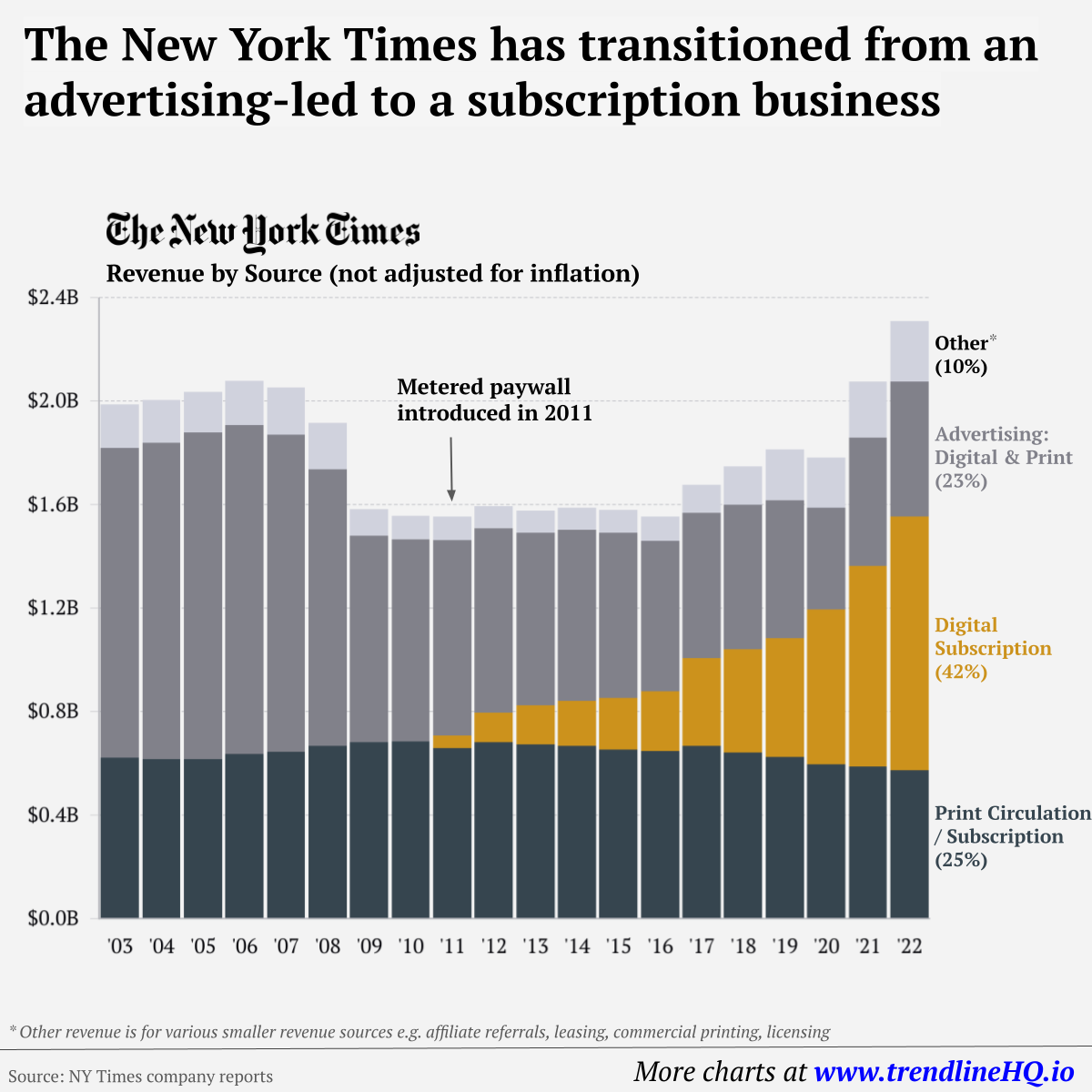

on Similar to the the precedent set by the music industry, many news outlets have also been figuring out how to transition into a paid digital monetization model. Over the past decade or so, The New York Times (NY Times)—one of the world’s most iconic and widely read news organizations—has been transforming its revenue model to fit this trend. This chart from creator Trendline uses annual reports from the The New York Times Company to visualize how this seemingly simple transition helped the organization adapt to the digital era.

The New York Times’ Revenue Transition

The NY Times has always been one of the world’s most-widely circulated papers. Before the launch of its digital subscription model, it earned half its revenue from print and online advertisements. The rest of its income came in through circulation and other avenues including licensing, referrals, commercial printing, events, and so on. But after annual revenues dropped by more than $500 million from 2006 to 2010, something had to change. In 2011, the NY Times launched its new digital subscription model and put some of its online articles behind a paywall. It bet that consumers would be willing to pay for quality content. And while it faced a rocky start, with revenue through print circulation and advertising slowly dwindling and some consumers frustrated that once-available content was now paywalled, its income through digital subscriptions began to climb. After digital subscription revenues first launched in 2011, they totaled to $47 million of revenue in their first year. By 2022 they had climbed to $979 million and accounted for 42% of total revenue.

Why Are Readers Paying for News?

More than half of U.S. adults subscribe to the news in some format. That (perhaps surprisingly) includes around four out of 10 adults under the age of 35. One of the main reasons cited for this was the consistency of publications in covering a variety of news topics. And given the NY Times’ popularity, it’s no surprise that it recently ranked as the most popular news subscription.