Cryptocurrencies have now evolved past simple digital currencies, offering solutions to meet the complex needs of modern financial markets. Today’s graphic from Abra visualizes the complex, ever-evolving cryptocurrency ecosystem and its real-world applications.

Characteristics of Cryptocurrencies

Why are cryptocurrencies important for the future of digital finance?

Borderless Drastically reduces fees and processing times due to a lack of cross-border restrictions Censorship-free Prevents governments or major institutions from blocking financial activities at whim Greater financial control Individuals can have total control of their funds Greater security Prevents fraudulent alterations from third parties Lower costs Lower transaction fees thanks to fewer third parties Greater Accessibility Reduces or eliminates traditional barriers to capital markets

Much like the internet has forever altered how we live and work, cryptocurrencies have the potential to change how people participate in global financial markets.

Categorizing the New Crypto Economy

Today’s cryptocurrencies go beyond replacing cash. This new token-based economy is evolving─with unique solutions emerging in finance, security, identification, social engagement, and ownership. Cryptocurrencies are generally categorized by their primary application within the ecosystem:

Payments Digital cash can be used for both ecommerce and brick-and-mortar retailers Store of value New form of scarce native currency and a means of settlement Programmable money Borderless money that enables easy conversion between currencies Stablecoins Crypto version of fiat which is tied to the value of resources like gold or the U.S. dollar Privacy Private digital transactions, with some offering anonymity Digital ownership Digital handling, storage, and monetization of data Decentralized utilities Crypto-enabled networks, products, and services that exchange between assets Alternative finance Digital assets such as collectibles, commodities, and tokenized securities

Cryptocurrencies are adding both value and utility to the digital economy, and to the global financial market as a whole.

Applications of Cryptocurrencies

Because cryptocurrencies are programmable, customizable computer code, developers can design and adapt them for many use cases within the digital economy. How are these various cryptocurrencies being used in everyday applications?

Current Projects

SPEDN auto-converts crypto to fiat for merchants, reducing exchange rate risk while offering convenient customer payment options. Slice offers real estate investing to anyone for as low as $10,000 through fractional investment.

Near-future Projects

CyClean plans to launch a blockchain-enabled electric vehicle (EV) fleet that mines crypto as users travel—reducing emissions and rewarding users for doing so. Digital construction platform Builderium connects contractors to clients around the world through blockchain, opening up a global marketplace of potential deals.

These are just a few of the ways cryptocurrencies are breaking down barriers for people and companies worldwide—allowing them to grow personal wealth and enter the global market.

The Growth of the Crypto Economy

Worldwide, the numbers show that blockchain-based technology and cryptocurrency use is growing. Blockchain wallet users rose from nearly 9 million in 2016 to over 42 million in 2019.

Developers produced a mere 100 decentralized apps (DApps) in 2015─with that number skyrocketing to over 3,100 by 2019.

Overall, cryptocurrencies are helping to create an innovative and accessible financial system around the world.

—Adena Friedman, President & CEO of NASDAQ

While the future of the new cryptocurrency economy is still taking shape, one thing is certain─cryptos are forever altering the way we view and measure the value of money.

on

For a modern example, we can see how different countries (and regions) act when it comes to cryptocurrency. Within the European Union—one of the regions dealing with faster crypto adoption—attitudes towards investing can vary considerably.

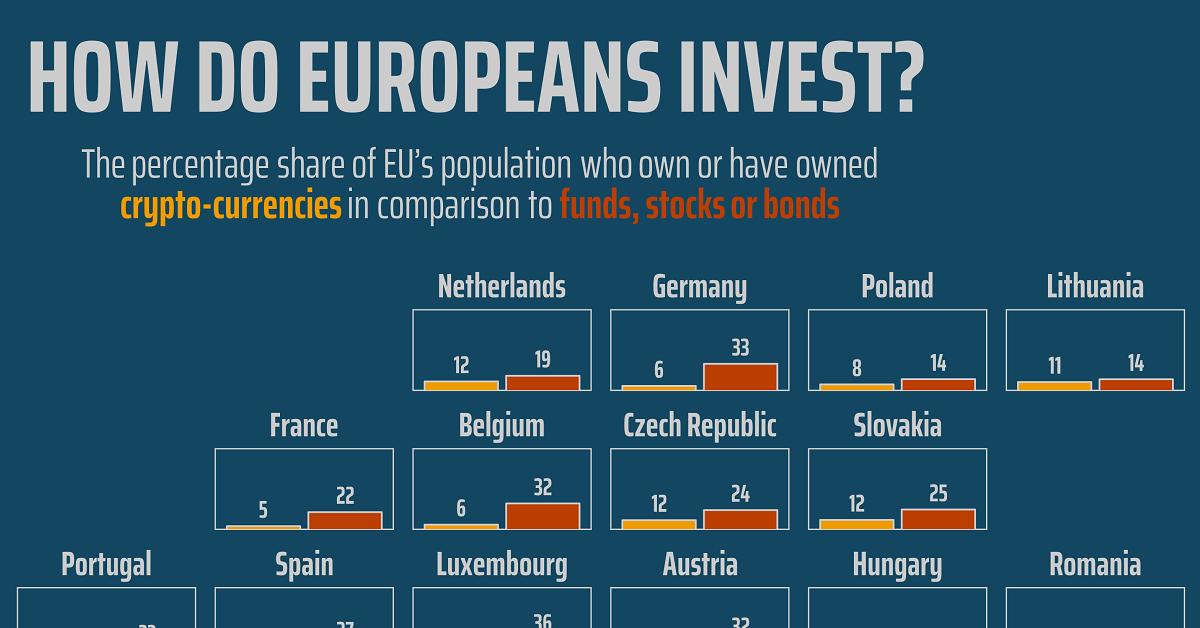

This graphic from Gilbert Fontana looks at crypto popularity amongst investors in the EU using data from the European Commission’s Eurobarometer. It compares exposure to cryptocurrencies relative to stocks, funds, and bonds.

Crypto Popularity in Europe in 2022

Given that crypto has experienced bubble-like asset rallies, including a dramatic rise to over a trillion dollars in value before crashing, it’s fair to say it’s well known by now. But even with a vast rise in awareness, there are still discrepancies between the level of investment crypto receives amongst European Union nations. Let’s see which countries have the highest proportion of citizens invested in crypto: Topping the list is Slovenia, considered by some the most crypto-friendly nation in the world. According to the survey, 18% of the country’s population has some sort of investment in it. Cyprus also ranks high in its crypto-friendly rank and hits an investment figure of 13%. Also notable is the Grand Duchy of Luxembourg, which despite having a small population of 640,000 also has a strong reputation as a global financial hub. When it comes to crypto, 14% of the population owns or has owned the asset, relative to 36% for stocks, bonds, or funds.

Crypto Unpopularity?

In regards to the countries with lower levels of crypto investment, one observation is that they tend to be wealthier and more developed EU nations. Here’s how the nations at or below the 10% crypto-investment threshold rank: At the “bottom” of crypto interest are France, Germany and Italy, also the EU’s largest economies. At a glance, this might suggest that citizens of stronger economies invest less in crypto. However, it’s important to note that the countries with higher levels of crypto investment tend to have lower levels of wealth on average. Though less of their investors seem to engage in crypto trading, countries like France and Germany might have more comparable levels of crypto investment on a pure dollar-basis.