From mass job losses to not seeing family and friends for months on end, the COVID-19 pandemic has pushed people to their limits in 2020. As an incredibly difficult year draws to a close, people are starting to accept that this festive season will be anything but typical. But while a portion of consumers have reined in their spending due to financial uncertainty, others are spreading Christmas cheer by indulging in gifts for their loved ones. The graphic above from Raconteur explores how consumers’ festive spending in the U.S. and UK has changed as a result of the ongoing pandemic. Will the shift trigger permanent changes in the retail industry?

Festive Budget Breakdown

According creative agency Kinetic, half of all UK adults surveyed believe this Christmas is more important than ever before, with that figure rising to three quarters for 18-34 year olds.

However, given consumers’ concerns over the future of the economy, they are expected to reduce spending during the festive season. In the U.S. for example, spending will decline by 7% to $1,387 per household.

When it comes to how consumers plan to spend their hard-earned cash, some interesting insights emerge. As many have saved significantly on socializing and travel—which is down 34% year-on-year—they plan to put this money towards items for themselves instead of gifts and gift cards for others. These items include clothes, at-home entertainment, and home furnishings.

It therefore comes as little surprise that the global online home decor market is estimated to grow at a compound annual growth rate (CAGR) of almost 13% between 2020-2024 with revenue of over $80 billion.

Dampening the Christmas Spirit?

Unsurprisingly, over half of all U.S. consumers are anxious about shopping in-store this holiday season. The vast majority have health and safety concerns, with 71% being the most worried about dealing with others who aren’t taking the virus seriously. This is closely followed by being around, or too close to others in stores. Therefore, when it comes to physical shopping, people feel more comfortable in local stores or at outdoor markets and much less so in shopping malls.

Safety in Online Shopping

Considering this change in mindset, almost 60% of UK consumers said that they will be shopping online more this Christmas. Here’s a closer look at how they plan to shop differently during the 2020 holiday season: But while ecommerce sales are expected to spike over Christmas, delivery speeds and shipping delays are also major concerns for consumers. As a result, many of them started their shopping much earlier this year to avoid disappointment. In fact, over half of all UK shoppers had started their Christmas shopping before November had even arrived.

Bidding Adieu to 2020

The end to a painful year for many can’t come soon enough. But boarded-up storefronts, and “for sale” signs serve as a harsh reminder of the fragility of the retail sector and its reliance on consumer sentiment. Even as we march forward guided by the hope of an effective vaccine, the future of retail remains uncertain. For consumers, their confidence will build once more, but how they choose to spend their money following the festive season will be more important for businesses and the economy than ever before. on A lagging stock market dented these fortunes against high interest rates, energy shocks, and economic uncertainty. But some of the world’s billionaires have flourished in this environment, posting sky-high revenues in spite of inflationary pressures. With data from Forbes Real-Time Billionaires List, we feature a snapshot of the richest people in the world in 2023.

Luxury Mogul Takes Top Spot

The world’s richest person is France’s Bernard Arnault, the chief executive of LVMH.

With 75 brands, the luxury conglomerate owns Louis Vuitton, Christian Dior, and Tiffany. LVMH traces back to 1985, when Arnault cut his first major deal with the company by acquiring Christian Dior, a firm that was struggling with bankruptcy.

Fast-forward to today, and the company is seeing record profits despite challenging market conditions. Louis Vuitton, for instance, has doubled its sales in four years.

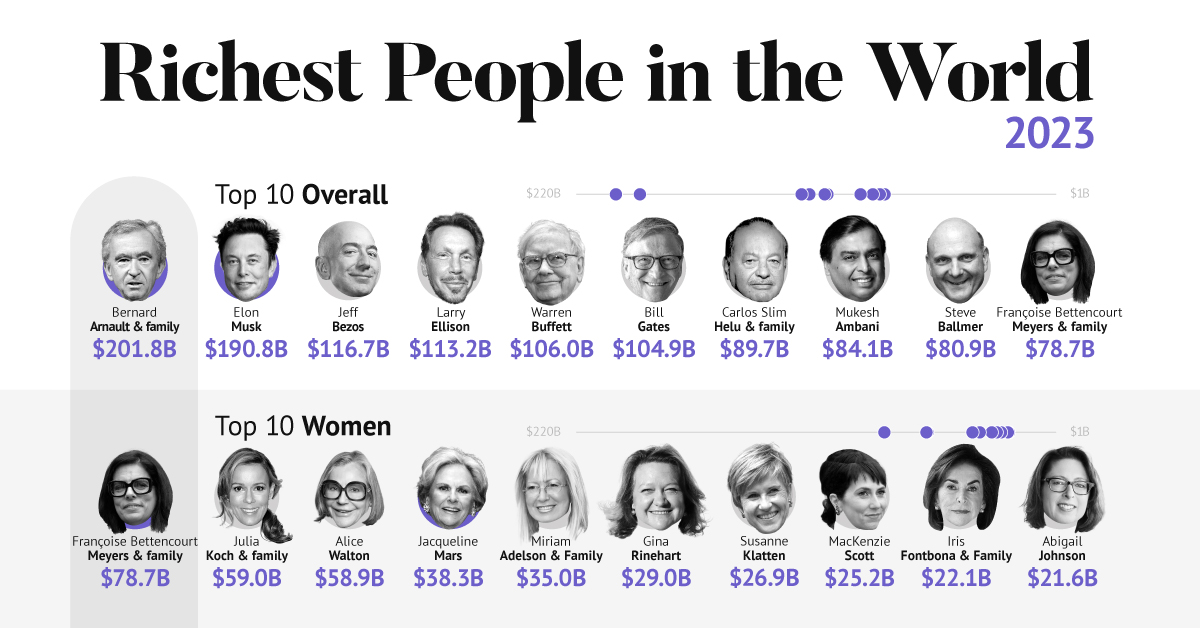

In the table below, we show the world’s 10 richest people with data as of February 27, 2023:

Elon Musk, the second-wealthiest person in the world has a net worth of $191 billion. In October, Musk took over Twitter in a $44 billion dollar deal, which has drawn criticism from investors. Many say it’s a distraction from Musk’s work with Tesla.

While Tesla shares have rebounded—after falling roughly 70% in 2022—Musk’s wealth still sits about 13% lower than in March of last year.

Third on the list is Jeff Bezos, followed by Larry Ellison. The latter of the two, who founded Oracle, owns 98% of the Hawaiian island of Lanai which he bought in 2012 for $300 million.

Fifth on the list is Warren Buffett. In his annual letter to shareholders, he discussed how Berkshire Hathaway reported record operating profits despite economic headwinds. The company outperformed the S&P 500 Index by about 22% in 2022.

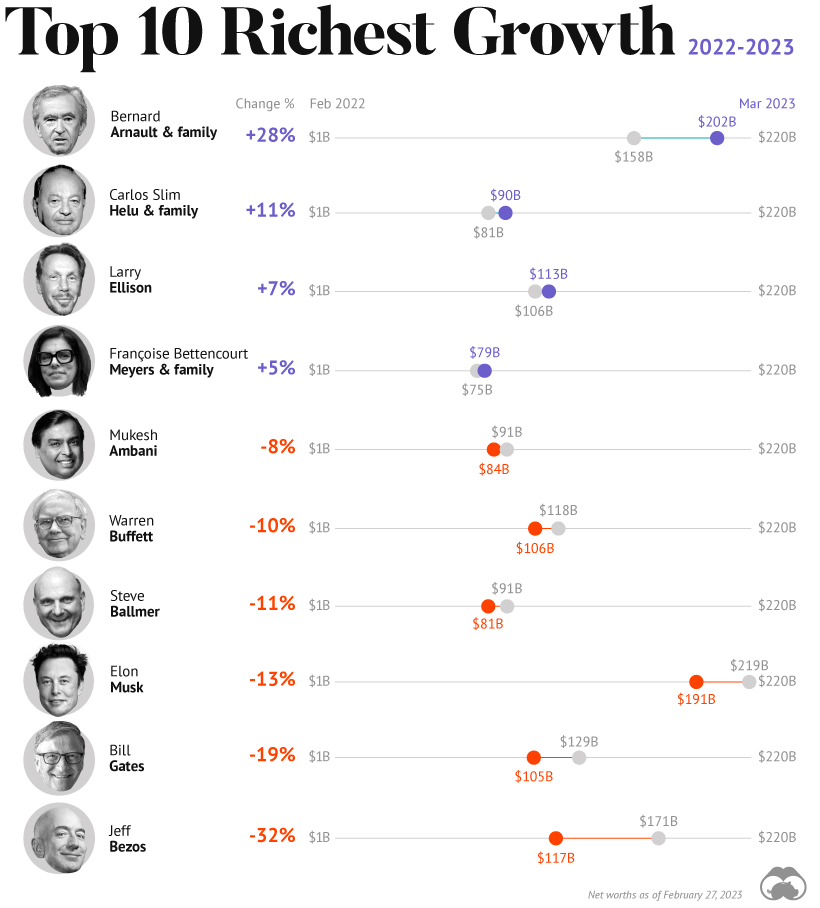

How Fortunes Have Changed

Given multiple economic crosscurrents, billionaire wealth has diverged over the last year. Since March 2022, just four of the top 10 richest in the world have seen their wealth increase. Two of these are European magnates, while Carlos Slim Helu runs the largest telecom firm in Latin America. In fact, a decade ago Slim was the richest person on the planet. Overall, as the tech sector saw dismal returns over the year, the top 10 tech billionaires lost almost $500 billion in combined wealth.

Recent Shakeups in Asia

Perhaps the most striking news for the world’s richest centers around Gautam Adani, formerly the richest person in Asia. In January, Hindenburg Research, a short-selling firm, released a report claiming that the Adani Group engaged in stock manipulation and fraud. Specifically, the alleged the firm used offshore accounts to launder money, artificially boost share prices, and hide losses. The Adani Group, which owns India’s largest ports—along with ports in Australia, Sri Lanka, and Israel—lost $100 billion in value in the span of a few weeks. Interestingly, very few Indian mutual funds hold significant shares in Adani Group, signaling a lack of confidence across India’s market, which was also cited in Hindenburg’s report. As a result, Mukesh Ambani has climbed to Asia’s top spot, controlling a $84 billion empire that spans from oil and gas and renewable energy to telecom. His conglomerate, Reliance Industries is the largest company by market cap in India.