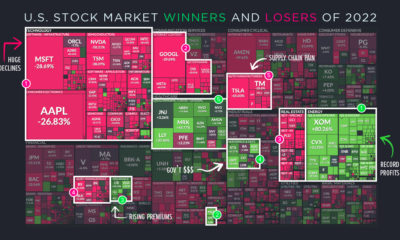

Although stocks see more volatility than other assets, they have also averaged a real return of 6.7% per year between 1925 and 2014, compared to just 2.7% for bonds and 0.5% for cash. And over long periods of time, the extraordinary power of compounding can turn this differential into a wealth generation machine.

But What is a Stock Market?

There is no denying the stock market’s unparalleled ability to create wealth, but that doesn’t mean it’s always an easy sell to newcomers. For most people, the very mention of the stock market conjures up images of a frantic floor at a busy stock exchange, people in suits yelling “Buy!” or “Sell!”, or even the sensational media coverage that can dominate the news cycle. Today’s animation provides an easier reference point for potential newcomers – it comes to us from TED-Ed and it highlights the basics of the stock market, as well as how it works.

By understanding the original purpose of the stock market and also its history, we can better understand how the modern market applies to wealth creation. In a nutshell, it provides a way for investors and companies to share the profit (and risks) of bold new endeavors, such as trying to invent a new cancer cure, discovering natural resource deposits, disrupting old business models, or innovating advanced technologies.

Basics of the Stock Market

Here are some other key questions that the animation helps to answer about the basics of the stock market: How does a company get on the market? A company needs to have an Initial Public Offering (IPO). This is traditionally done through big investment banks that help advise companies on the potential value of their company, and the market for their stock. More recently, companies like Slack and Spotify have IPO’d using a less traditional route. How does going public help a company grow? In the right scenario, listing on a stock market gives a company access to more capital. With more money, the company can make investments into new products and markets. How is a stock price determined by the market? By allowing millions of people to buy and sell shares of the company using the same set of information, it creates transparency and liquidity. Over time, this pushing and pulling creates a “fair” price for the stock. What else influences stock prices? Stock prices are not only influenced by what a company does – they are also influenced by external factors such as government regulations, market forces, competition, and changes in technology. Investor sentiment also plays a role. Why invest for the long term? Because short-term noise in the market can be hard to predict, most professionals promote long-term, reliable investment methods. Some examples of this in practice would include low-cost index funds, mutual funds, or simply building your own diverse portfolio of stocks, bonds, and other investments for the long haul.

Past and Future

The stock market is very different today than it was when the first shares of the Dutch East India Company started trading in the 17th century. Although the financial industry has increased in sophistication since those times, it still has the same general purpose – and it’s easier to get started investing than ever before. on To see how the minimum wage differs around the world, we’ve visualized data from Picodi, which includes values for 67 countries as of January 2023.

Monthly Minimum Wage, by Country

The following table includes all of the data used in this infographic. Each value represents the monthly minimum wage a full-time worker would receive in each country. Picodi states that these figures are net of taxes and have been converted to USD. Generally speaking, developed countries have a higher cost of living, and thus require a higher minimum wage. Two outliers in this dataset are Argentina and Turkey, which have increased their minimum wages by 100% or more from January 2022 levels. Turkey is suffering from an ongoing currency crisis, with the lira losing over 40% of its value in 2021. Prices of basic goods have increased considerably as the Turkish lira continues to plummet. In fact, a 2022 survey found that 70% of people in Turkey were struggling to pay for food. Argentina, South America’s second-biggest economy, is also suffering from very high inflation. In response, the country announced three minimum wage increases throughout 2022.

Minimum Wage in the U.S.

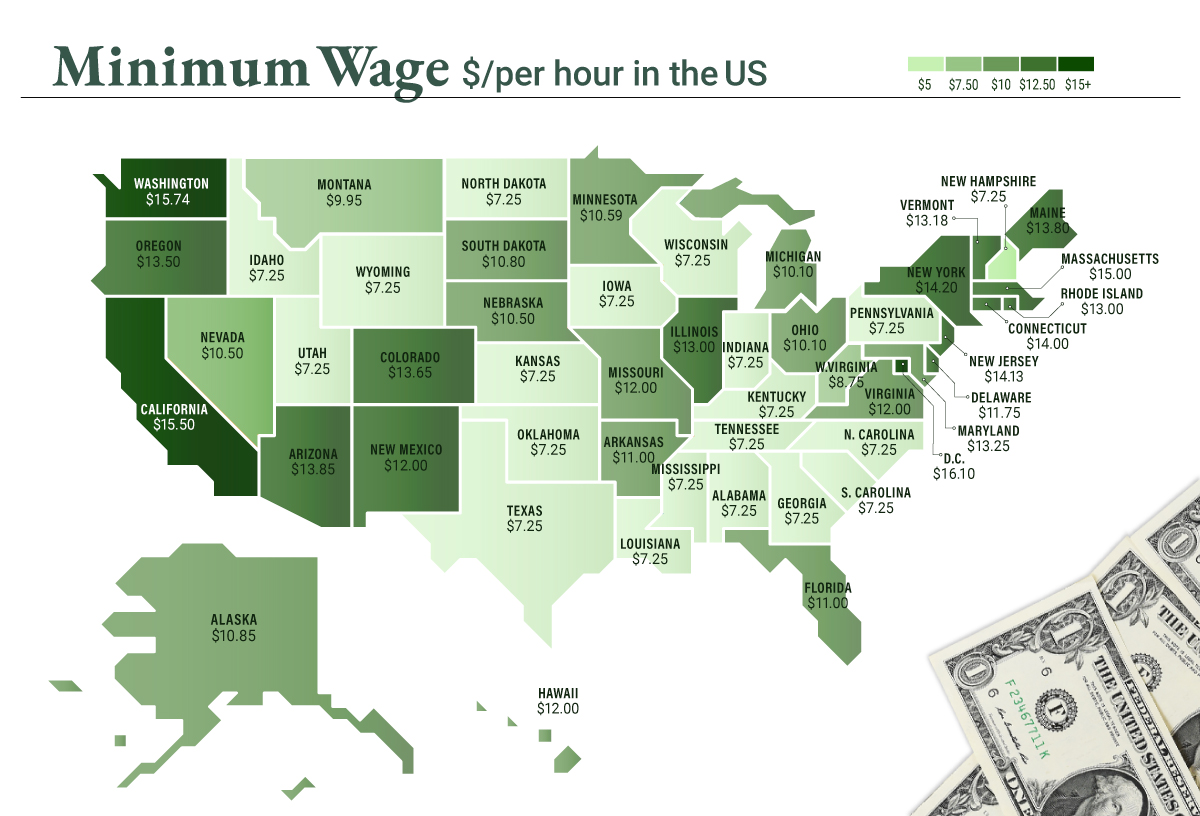

Within the U.S., minimum wage varies significantly by state. We’ve visualized each state’s basic minimum rate (hourly) using January 2023 data from the U.S. Department of Labor.

2023-03-17 Update: This map was updated to fix several incorrect values. We apologize for any confusion this may have caused. America’s federal minimum wage has remained unchanged since 2009 at $7.25 per hour. Each state is allowed to set their own minimum wage, as long as it’s higher than the federal minimum. In states that do not set their own minimum, the federal minimum applies. If we assume someone works 40 hours a week, the federal minimum wage of $7.25 translates to an annual figure of just $15,080 before taxes. California’s minimum wage of $15.50 translates to $32,240 before taxes. For further perspective, check out our 2022 infographic on the salary needed to buy a home across 50 U.S. cities.