Take this kind of spending power and combine it with the recent legalization of recreational cannabis, and it’s fair to say that the Golden State is primed to become the Holy Grail of cannabis opportunities. But while the market is home to immense potential, this doesn’t mean that the California cannabis business isn’t without its own unique challenges and obstacles to navigate.

Navigating California Cannabis

Today’s infographic comes to us from High Hampton Holdings and it helps set the stage for the boom in California, as well as listing the regulatory hurdles that companies must be prepared to deal with in the jurisdiction.

In the next year, it’s expected that recreational cannabis sales in California will surpass the existing total from the already established medical market. By 2025, those recreational sales could be $4 billion per year – that’s five times the size of the medical market!

Sticker Shock

The potential of the California cannabis market may be obvious, but navigating both the state’s notorious regulatory system and tax regime is a clear threat for companies aiming to succeed in the space. Since legalization, the price of cannabis in California has become an immediate hiccup that has initially angered consumers, reducing expected demand and state revenues. According to BDS Analytics, the effective sales tax on a gram of cannabis bought in San Jose works out to a hefty 38%. Add this to the higher cost of doing business in the state, and the sticker shock for consumers is real.

Complex Legislation

After high taxes, companies entering the California market must also navigate the state’s complex rules and regulations about growing, distributing, and selling cannabis. To give an idea of what this looks like for the average company, here is a brief snapshot of California’s regulatory environment:

There are three governing bodies for cannabis in the state: California Department of Food and Agriculture (CDFA), California Department of Public Health (CDPH), and the Bureau of Cannabis Control (BCC) There is a dual licensing requirement in the state, in which companies must be licensed both by the state as well as by local authorities Companies must get their local license before their state license – and this is complicated: there are 58 counties and 482 incorporated cities, each with their own specific set of rules and requirements Currently, many growers do not meet state or local standards The supply of zoned, permitted areas for cannabis cultivation are scarce and in high demand

Even further, the rules around cultivating, distributing, and retailing all involve specific and highly-specialized licenses. For example, only those with a full-service distribution license can coordinate required third-party testing, ensure packaging reviews of products, and collect and remit cultivation excise taxes.

Golden Potential

Despite the challenges that exist in the California cannabis market, it is still the undisputed jewel in the crown of the global legal cannabis space, offering access to 39 million consumers and large amounts of disposable income at play. Only companies that can navigate this uncharted territory will be able to take advantage of this lucrative opportunity.

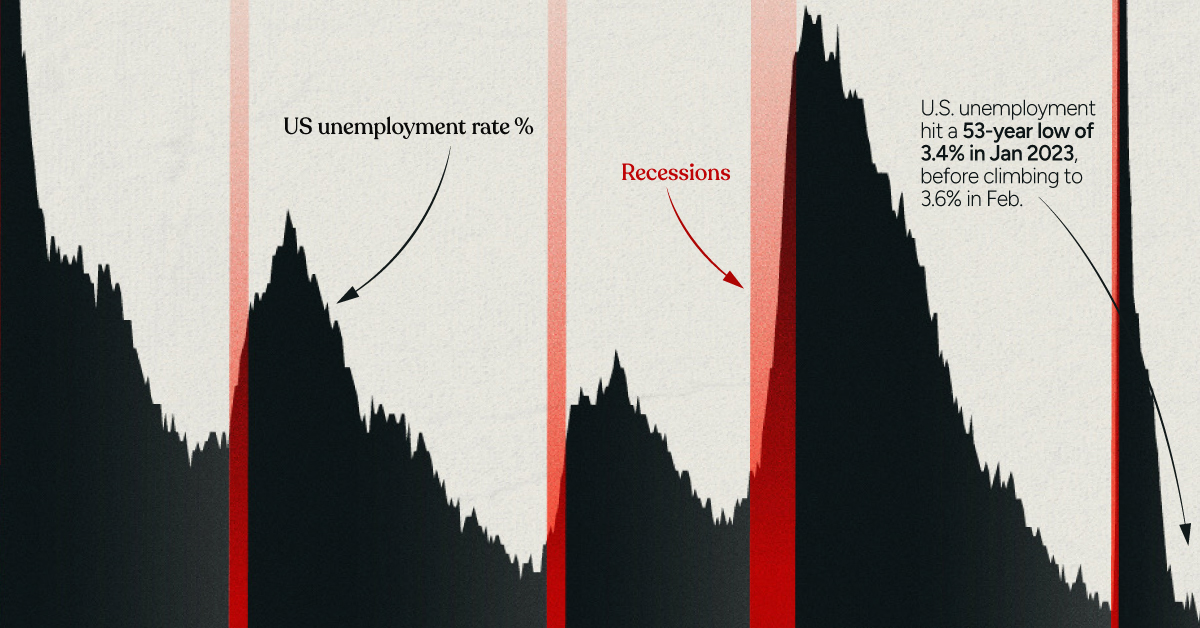

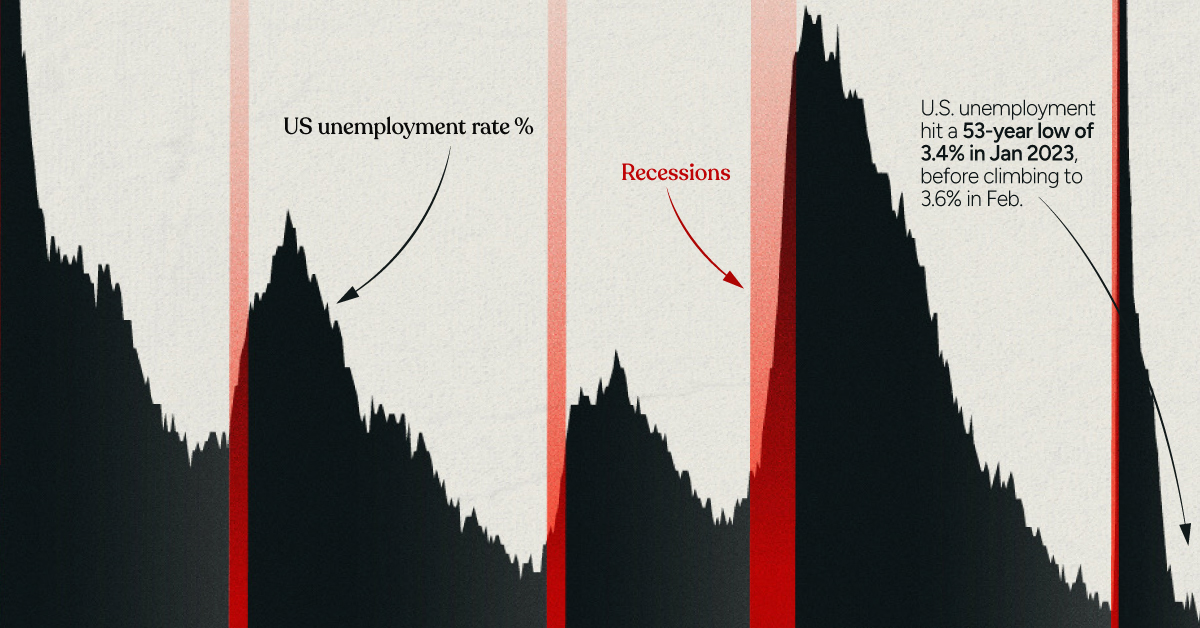

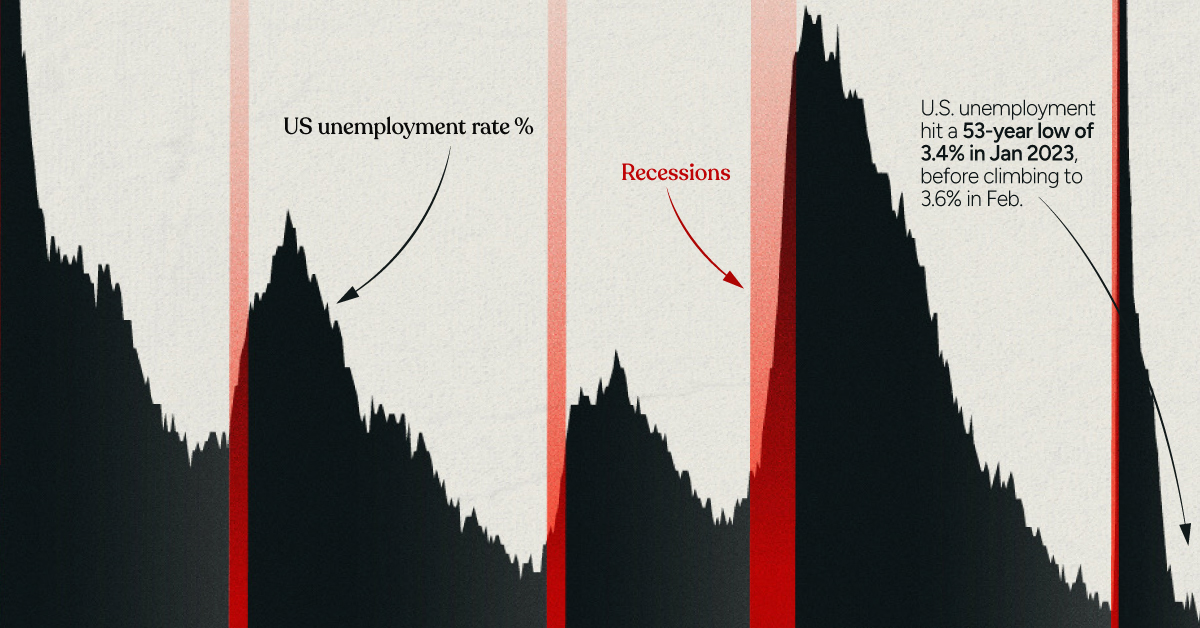

on Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%. A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement: While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession. This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter). With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation. For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022. The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make. Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation. More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession. Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes. Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.