Outside of the mainstream world of stocks and bonds, there exists an interesting cross-section of alternative assets that only really gain appreciation from a relatively small group of elite investors. These luxury collectibles – things like fine wine, classic cars, rare stamps, colored diamonds, Chinese ceramics, and fine art – are unquestionably fun to hold as investments and even to talk about. But do these alternative assets also perform as investments over time?

Eye of the Beholder

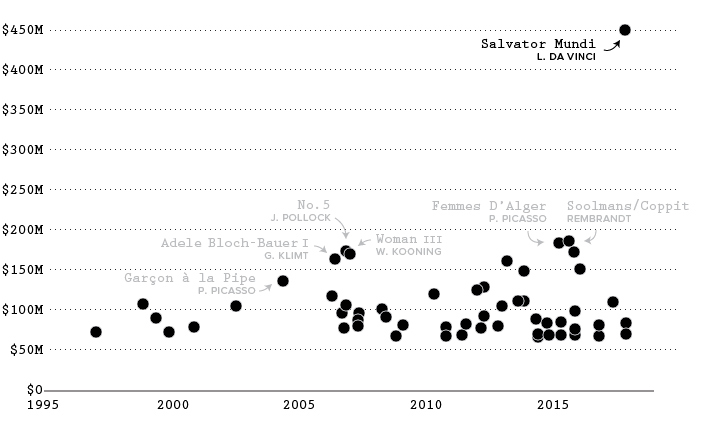

The obvious challenge with valuing an item like a prized Picasso painting is that beauty is in the eye of the beholder. Investors can rely on expert opinions, their own experience, historical evidence, and longstanding markets for these asset classes. However, at the end of the day, the price an investor is willing to pay is ultimately subjective, which can get compounded by the fact that these markets also tend to be illiquid. If you’re buying or selling one of these assets, this can either work in your favor – or you can be stuck with a classic car in your garage that never really panned out in terms of price. Here is a graph showing the sale dates of some of the most expensive paintings:

Recently, you may remember the sale of Leonardo da Vinci’s re-discovered masterpiece, Salvator Mundi, as an event that topped headlines in late-2017. The painting was bought for $450 million by Abu Dhabi’s department of culture and tourism, and it’s to be displayed in the Abu Dhabi Louvre.

Investments that Age Well

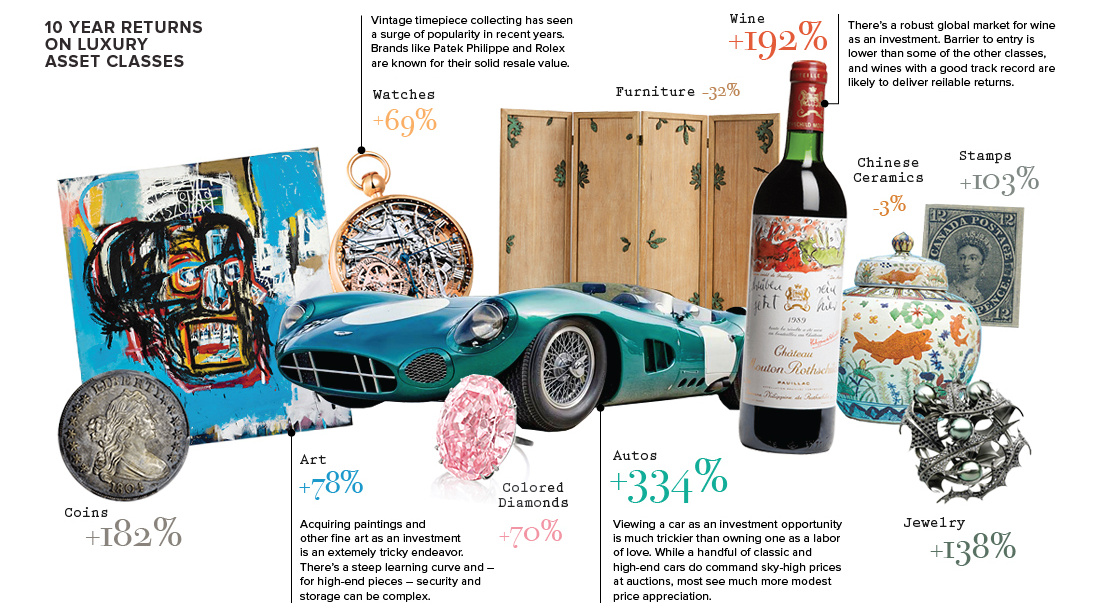

Despite the challenges involved in valuing these assets, as well as other costs such as setting up the storage and security systems needed to protect them, time has been kind to many of these luxury assets. Here are the returns of luxury items over the last decade, based on the 2018 Wealth Report by Knight Frank: Keep in mind these investment categories are pretty narrow – for example, a Toyota Corolla doesn’t count towards the auto category. Instead, we’re talking about cars like the Lancia Aurelia B24 “Spider”, of which only 761 models were made in the 1950s. In any case, as you can see from the above table, most of these assets have not only continued to hold their value, but they’ve also appreciated in price significantly. Autos topped the list, but fine wine and rare coins (two more accessible options for investors) also did quite well with 11.3% and 10.9% annual gains, respectively. Correction: A previous version of the graphic showed an incorrect Jean-Michel Basquiat painting. on These are in the form of Treasury securities, some of the most liquid assets worldwide. Central banks use them for foreign exchange reserves and private investors flock to them during flights to safety thanks to their perceived low default risk. Beyond these reasons, foreign investors may buy Treasuries as a store of value. They are often used as collateral during certain international trade transactions, or countries can use them to help manage exchange rate policy. For example, countries may buy Treasuries to protect their currency’s exchange rate from speculation. In the above graphic, we show the foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury.

Top Foreign Holders of U.S. Debt

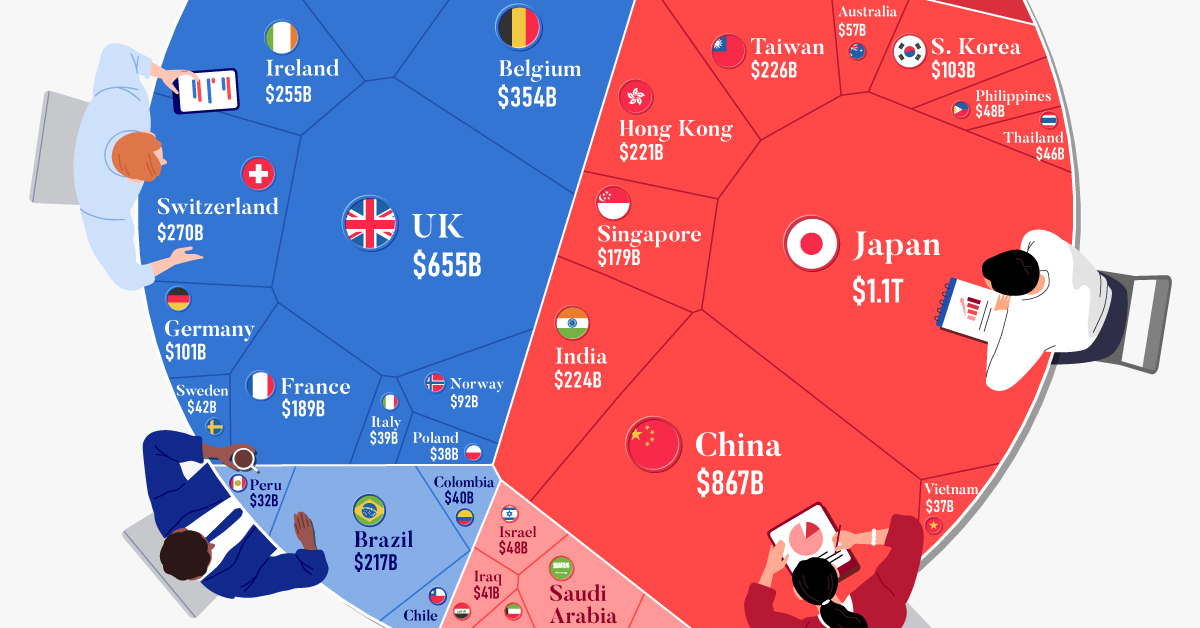

With $1.1 trillion in Treasury holdings, Japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. This bond offloading by China is the one way the country can manage the yuan’s exchange rate. This is because if it sells dollars, it can buy the yuan when the currency falls. At the same time, China doesn’t solely use the dollar to manage its currency—it now uses a basket of currencies. Here are the countries that hold the most U.S. debt: As the above table shows, the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries.

Interest Rates and Treasury Market Dynamics

Over 2022, foreign demand for Treasuries sank 6% as higher interest rates and a strong U.S. dollar made owning these bonds less profitable. This is because rising interest rates on U.S. debt makes the present value of their future income payments lower. Meanwhile, their prices also fall. As the chart below shows, this drop in demand is a sharp reversal from 2018-2020, when demand jumped as interest rates hovered at historic lows. A similar trend took place in the decade after the 2008-09 financial crisis when U.S. debt holdings effectively tripled from $2 to $6 trillion.

Driving this trend was China’s rapid purchase of Treasuries, which ballooned from $100 billion in 2002 to a peak of $1.3 trillion in 2013. As the country’s exports and output expanded, it sold yuan and bought dollars to help alleviate exchange rate pressure on its currency. Fast-forward to today, and global interest-rate uncertainty—which in turn can impact national currency valuations and therefore demand for Treasuries—continues to be a factor impacting the future direction of foreign U.S. debt holdings.