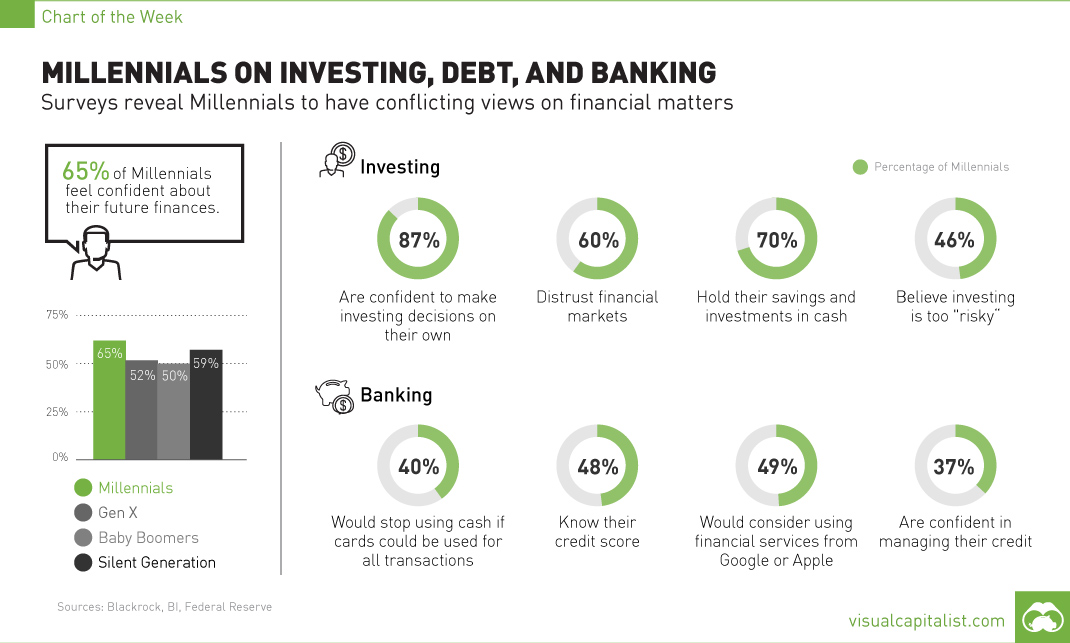

Millennials on Investing, Debt, and Banking [Chart]

Surveys reveal Millennials to have conflicting views on financial matters.

The Chart of the Week is a weekly Visual Capitalist feature on Fridays. Millennials are the most confident generation regarding their financial future. In fact, recent survey results show that 65% of Millennials feel confident about their future finances, compared to 52% of Gen X, 50% of Baby Boomers, and 59% of the Silent Generation. This is not a surprising find, as one of the defining traits of the Millennial group is high self-confidence. The problem is that this confidence seems to conflict with other survey findings. In reality, it looks like many Millennials could still have a steep learning curve ahead of them in the financial realm. Debt The first red flag is with debt. Only 48% of Millennials know their credit score, and just 37% are confident in their ability to manage their credit. Millennial student debt is at sky-high levels, and many are struggling to pay. Even the Federal Reserve noted that the delinquency rate for student loans in repayment is a staggering 27% in the United States. Investing Another potential concern arises with the generation’s attitudes towards investing and building wealth. Despite their confidence in their financial future, 46% of Millennials think investing is “risky”, 60% distrust financial markets, and a whopping 70% hold their savings and investments in cash. While there are some reasoning for these numbers individually, as a whole they seem to paint a broader picture that Millennials are afraid of entering the market in any capacity. As a result, it would appear that they hold onto their money in cash while interest rates are at their lowest in human history. Historically, the middle class has built much of their wealth through investing. While it is true that Millennials witnessed the failures of Wall Street first-hand during the Financial Crisis, it doesn’t change the fact that investing will likely play a key role in building their financial futures. Millennials do not have to only own stocks either, as there are plenty of market instruments, hedging strategies, and stores of value out there that can protect against market downside at any risk tolerance. Further, 87% of Millennials feel empowered to make investing decisions on their own. While we would agree that investing for yourself can be one of the most rewarding ways to build a strong financial future, not everyone can be an expert in personal finance. That’s why people hire brokers or investment advisors. When it comes to opinions on these types of professionals, Millennials have contradicting feelings. For example: 58% of Millennials are interested in robo-advisors, yet at the same time 64% say that a personal relationship with an advisor is important. Cash and Banking Millennials also have unorthodox views on cash and banking. As a generation of people that grew up in the digital age, 40% of Millennials would stop using cash altogether if cards could be used for all transactions. Further, 49% would consider using financial services from tech companies like Google or Facebook. In contrast, only 16% of people in older generations would consider a similar move. This disparity is part of the reason why bank executives today are unaware of the very technology startups gaining traction in the market, and that seek to unseat them.

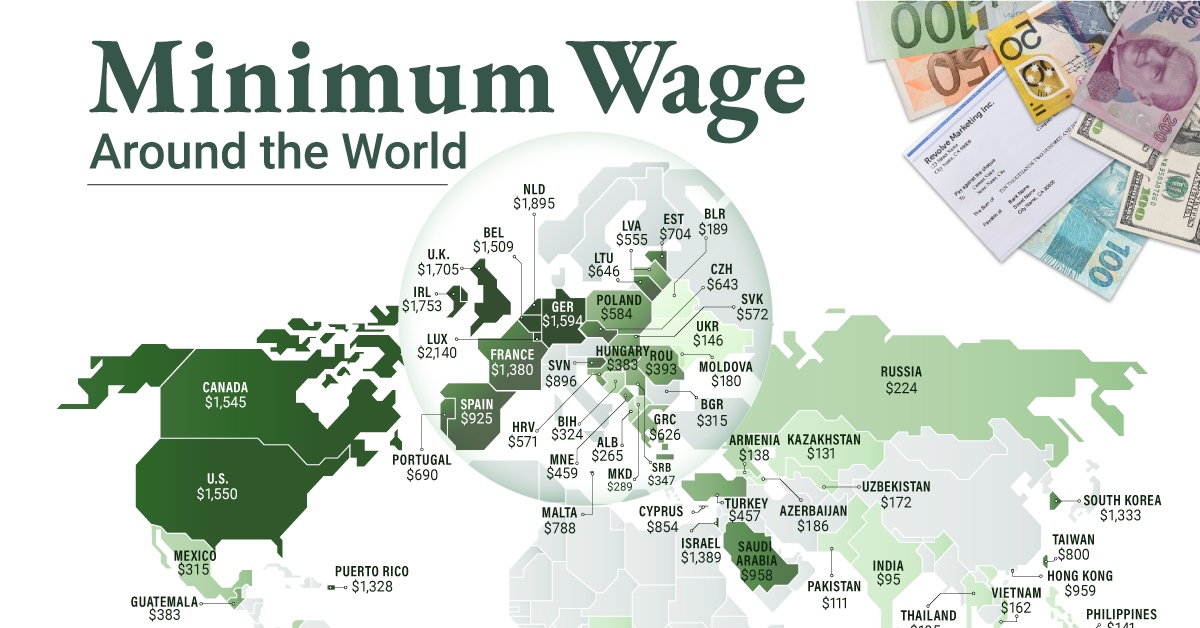

on To see how the minimum wage differs around the world, we’ve visualized data from Picodi, which includes values for 67 countries as of January 2023.

Monthly Minimum Wage, by Country

The following table includes all of the data used in this infographic. Each value represents the monthly minimum wage a full-time worker would receive in each country. Picodi states that these figures are net of taxes and have been converted to USD. Generally speaking, developed countries have a higher cost of living, and thus require a higher minimum wage. Two outliers in this dataset are Argentina and Turkey, which have increased their minimum wages by 100% or more from January 2022 levels. Turkey is suffering from an ongoing currency crisis, with the lira losing over 40% of its value in 2021. Prices of basic goods have increased considerably as the Turkish lira continues to plummet. In fact, a 2022 survey found that 70% of people in Turkey were struggling to pay for food. Argentina, South America’s second-biggest economy, is also suffering from very high inflation. In response, the country announced three minimum wage increases throughout 2022.

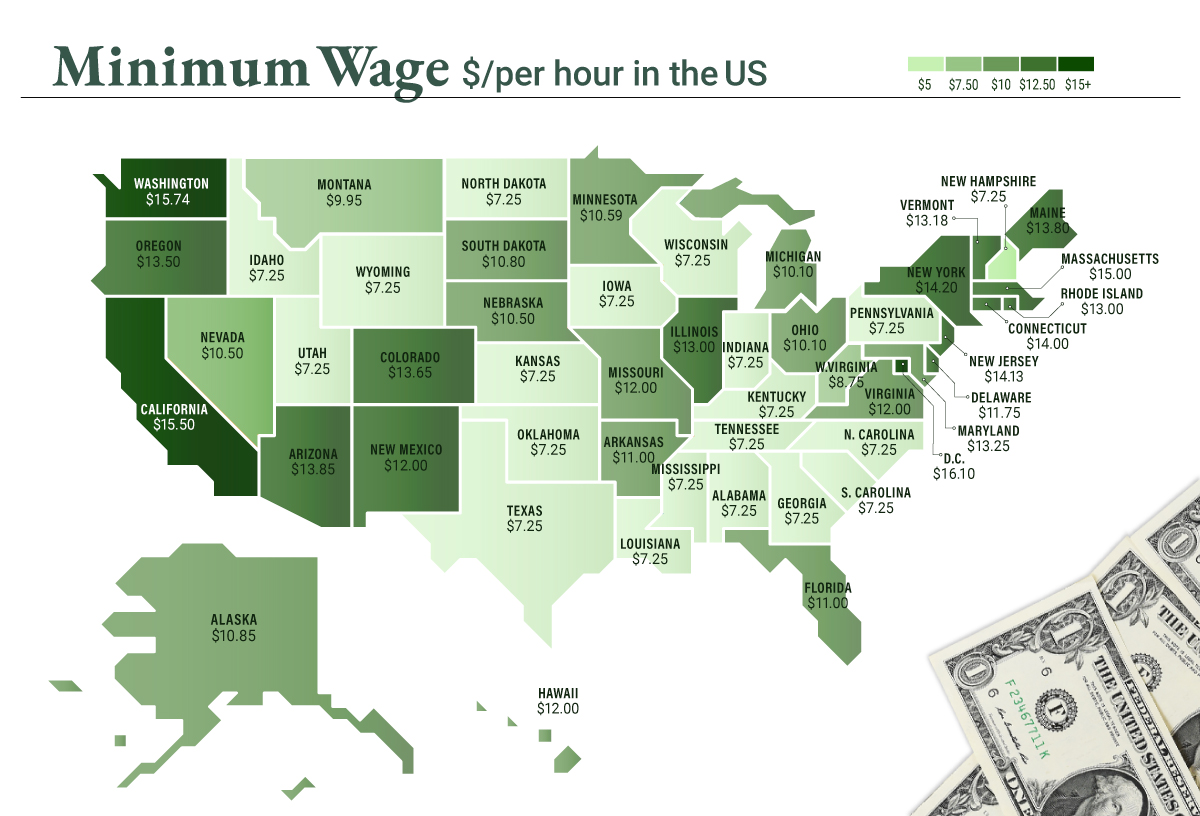

Minimum Wage in the U.S.

Within the U.S., minimum wage varies significantly by state. We’ve visualized each state’s basic minimum rate (hourly) using January 2023 data from the U.S. Department of Labor.

2023-03-17 Update: This map was updated to fix several incorrect values. We apologize for any confusion this may have caused. America’s federal minimum wage has remained unchanged since 2009 at $7.25 per hour. Each state is allowed to set their own minimum wage, as long as it’s higher than the federal minimum. In states that do not set their own minimum, the federal minimum applies. If we assume someone works 40 hours a week, the federal minimum wage of $7.25 translates to an annual figure of just $15,080 before taxes. California’s minimum wage of $15.50 translates to $32,240 before taxes. For further perspective, check out our 2022 infographic on the salary needed to buy a home across 50 U.S. cities.