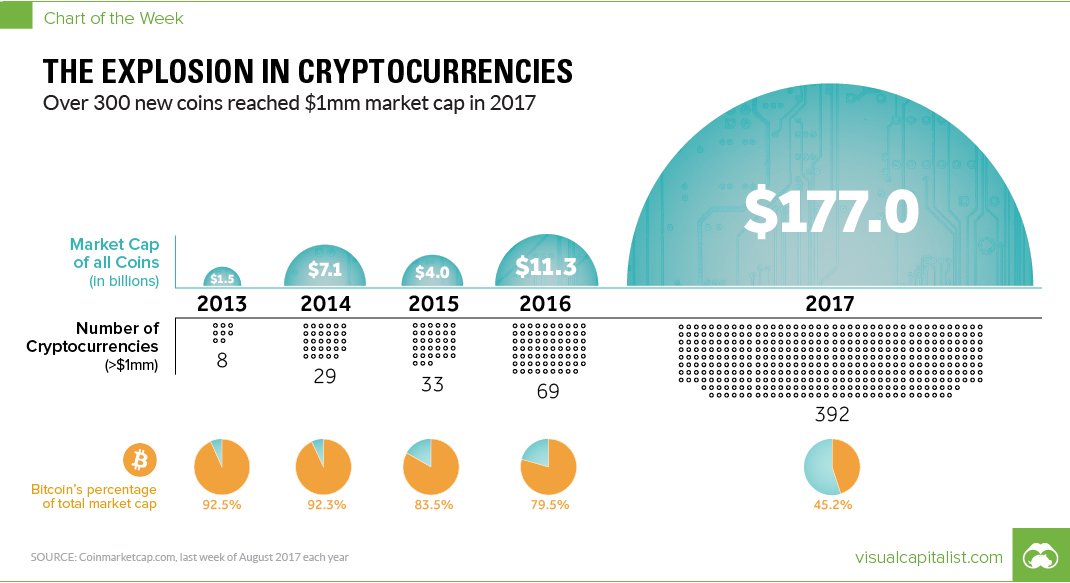

After the massive Bitcoin price surge in November 2013, the popularity of launching new cryptocurrencies took off along with it. In fact, if you go back at historical snapshots around that time, you’ll see that there were literally hundreds of new coins available to mine and buy. Here’s one from November 2014 – a time when there were only 32 coins that were worth more than $1 million in market cap, and 354 coins that were worth less than $50,000, usually trading for tiny fractions of a cent. It seems like everyone and their dog were launching cryptocurrencies back then, even if they were a longshot to materialize into anything.

Then vs. Now

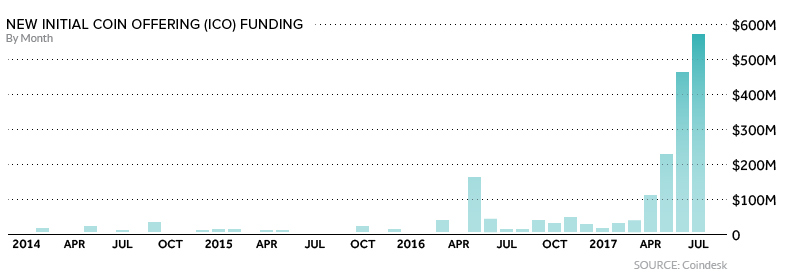

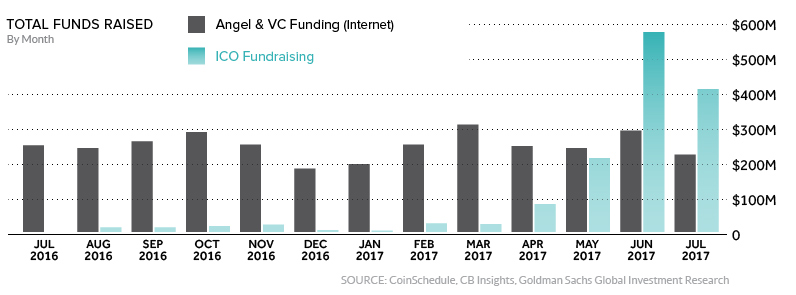

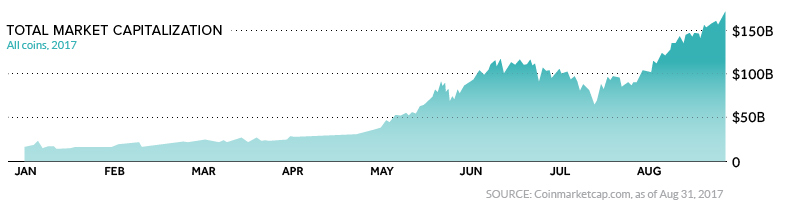

Fast forward to today, and things haven’t changed much – many people and companies are still launching new cryptocurrencies through a mechanism known as an ICO (Initial Coin Offering). The only difference? Today, there is real money at play, and in 12 months the number of cryptocurrencies worth >$1 million has soared by 468%. Meanwhile, the total value of all currencies together has skyrocketed by 1,466%. Cryptocurrency is so hot, in fact, that raising money through ICOs has become more effective than traditional early-stage angel and VC funding.

For the long-time advocates of Bitcoin and other cryptocurrencies, it is now their moment in the sun. And with this ICO activity and a wealth of opportunities emerging, a new breed of Bitcoin millionaire has been born. Like the wealthy tech founders that exit and give back to their local startup ecosystems, these new digital tycoons are using their newfound wealth to invest in upstart crypto projects that show potential – ultimately, further enhancing the ecosystem.

Out of the Woodwork

Of course, whenever there is a massive surge in prices and speculation, there are two other players that tend to come out of the woodwork. One is of the scammer and shyster variety, and certainly crypto-fueled scams are a concern for everyone else in the broader ecosystem. Perhaps even a bigger threat, however, are the regulators – and in recent weeks the SEC has voiced concerns about ICO “pump and dump” schemes, while Canadian authorities have clearly stated that “most ICOs need oversight”.

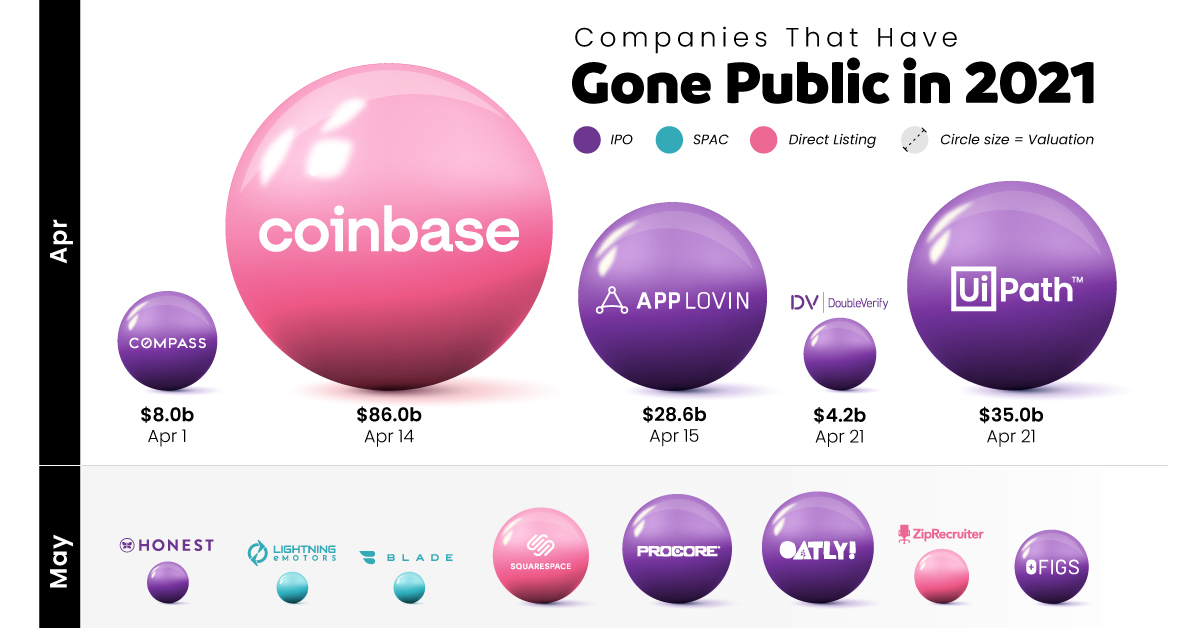

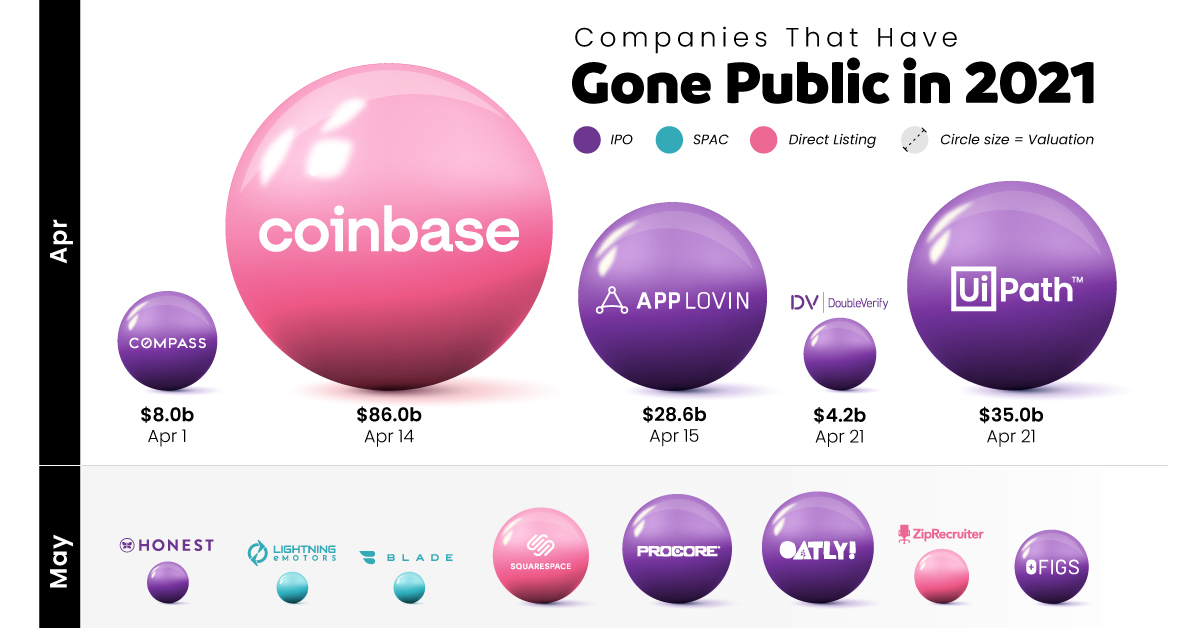

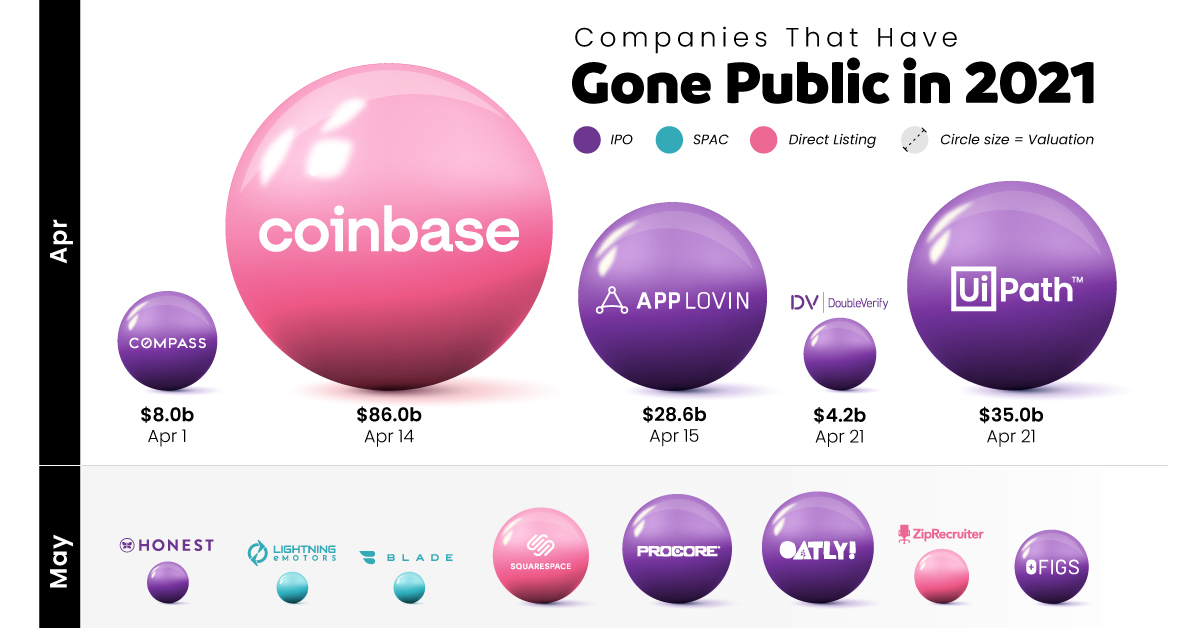

With the market exploding with hundreds of new cryptocurrencies and the total value reaching $177 billion, a new series of questions has emerged: what risk do ICO scams ultimately have on market? And, could misguided regulation disrupt the momentum of the crypto boom? on From much-hyped tech initial public offerings (IPOs) to food and healthcare services, many companies with already large followings have gone public this year. Some were supposed to go public in 2020 but got delayed due to the pandemic, and others saw the opportunity to take advantage of a strong current market. This graphic measures 68 companies that have gone public in 2021 — including IPOs, SPACs, and Direct Listings—as well as their subsequent valuations after listing.

Who’s Gone Public in 2021?

Historically, companies that wanted to go public employed one main method above others: the initial public offering (IPO). But companies going public today readily choose from one of three different options, depending on market situations, associated costs, and shareholder preference:

Initial Public Offering (IPO): A private company creates new shares which are underwritten by a financial organization and sold to the public. Special Purpose Acquisition Company (SPAC): A separate company with no operations is created strictly to raise capital to acquire the company going public. SPACs are the fastest method of going public, and have become popular in recent years. Direct Listing: A private company enters a market with only existing, outstanding shares being traded and no new shares created. The cost is lower than that of an IPO, since no fees need to be paid for underwriting.

The majority of companies going public in 2021 chose the IPO route, but some of the biggest valuations resulted from direct listings. Though there are many well-known names in the list, one of the biggest through lines continues to be the importance of tech. A majority of 2021’s newly public companies have been in tech, including multiple mobile apps, websites, and online services. The two biggest IPOs so far were South Korea’s Coupang, an online marketplace valued at $60 billion after going public, and China’s ride-hailing app Didi Chuxing, the year’s largest post-IPO valuation at $73 billion. And there were many apps and services going public through other means as well. Gaming company Roblox went public through a direct listing, earning a valuation of $30 billion, and cryptocurrency platform Coinbase has earned the year’s largest valuation so far, with an $86 billion valuation following its direct listing.

Big Companies Going Public in 2022

As with every year, some of the biggest companies going public were lined up for the later half. Tech will continue to be the talk of the markets. Payment processing firm Stripe was setting up to be the year’s biggest IPO with an estimated valuation of $95 billion, but got delayed. Likewise, online grocery delivery platform InstaCart, which saw a big upswing in traction due to the pandemic, has been looking to go public at a valuation of at least $39 billion. Of course, it’s common that potential public listings and offerings fall through. Whether they get delayed due to weak market conditions or cancelled at the last minute, anything can happen when it comes to public markets. This post has been updated as of January 1, 2022.