Yet, even as changing regulations unlock new opportunities, it seems as though the cannabis stock bubble has already burst — at least temporarily. Today’s visualization dives into the roller coaster of cannabis company stock valuations over the past few years, and which companies remain standing in this hazy market.

A Wild Ride for Cannabis Stocks

The North American Marijuana Index tracks the equally-weighted stocks of leading companies operating in the legal cannabis industry in U.S. and Canada. Companies listed on the index must have at least 50% of their business strategy focused on the legal industry, including ancillary operations that support companies and consumers. At the tail-end of 2017, the promise of upcoming legalization in two immense markets—California state and Canada—had investors all fired up. The index’s low (105.31 on June 27th, 2017) shot up almost three times to 358.93 by January 8th, 2018. Things took a sharp turn in the second quarter of 2019, as the expectations for cannabis company stocks encountered a harsh reality post-legalization. Note: 52-week period data captures Dec 9th 2018-Dec 9th 2019. What are the reasons behind such a nosedive? Could the cannabis industry still make a comeback in 2020? We look at some opposing perspectives to answer these questions.

So Much For the Green Rush

The cannabis industry is experiencing significant challenges. In the U.S., legal cannabis faces high taxes—come the new year, consumers in California will see an 80% mark-up on their cannabis at checkout, up from 60%. North of the border, federal legalization led to immense consumer demand for Canadian cannabis—but supply can’t keep up. To make matters worse, retail stores are slow to roll out, which means Canada is feeling the crunch. Steep prices, and difficulty purchasing products post-legalization, allow the black market to thrive. It’s clear many cannabis companies have taken a big hit as a result. According to the Marijuana Index, here are the 10 biggest companies in the space now: Only one company outside of North America—and even the cannabis sector—lands on this list. The UK-based Big Pharma company GW Pharmaceuticals is steadily growing its industry presence, as it currently holds 41 cannabis patents in the U.S. and Canada combined. Still, even these big players have seen their valuations drop since the industry was at its peak. Unless the aforementioned issues are ironed out, investors may continue to pull their dollars from the cannabis industry.

—Chris Kerlow, portfolio manager at Richardson GMP

On the flip side, some investors aren’t calling it quits quite yet.

Long-Term Prospects Are High

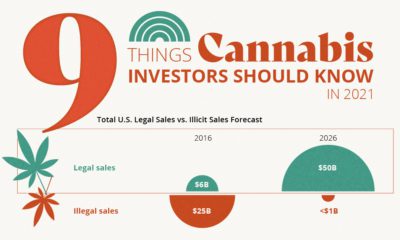

While cannabis seems plagued with issues, some argue that these are simply short-term growing pains and will be solved as the industry matures. Particularly in the U.S., experts predict that cannabis sales could reach immense heights in the next decade: Compared to a benchmark of $13.6 billion today, these numbers may seem ambitious—but they’re backed by major industry trends. 2020 could well be the year the market stabilizes, as consumers explore an array of retail options and vote with their wallets. What’s more, key players in consumer industries—from alcohol and tobacco to beauty and fitness—are making big bets in cannabis and CBD-infused products. A higher number of partnerships could spark the next uptick for the industry’s potential.

——Mark Zekulin, CEO of Canopy Growth Corp.

An Eye on What’s to Come

It’s clear there are differing viewpoints on the future of cannabis companies and their respective investors. As this snapshot of cannabis stocks unfolds and transforms in 2020 and beyond, could companies potentially buck the current trend and bounce back? Or will stocks continue to go up in smoke? on Humans have a storied and complicated relationship with drugs. Defined as chemical substances that cause a change in our physiology or psychology, many drugs are taken medicinally or accepted culturally, like caffeine, nicotine, and alcohol. But many drugs—including medicines and non-medicinal substances taken as drugs—are taken recreationally and can be abused. Each country and people have their own relationship to drugs, with some embracing the use of specific substances while others shun them outright. What are the most common drugs that are considered generally illicit in different parts of the world? Today’s graphics use data from the UN’s World Drug Report 2021 to highlight the most prevalent drug used in each country.

What Types of Common Drugs Are Tracked?

The World Drug Report looks explicitly at the supply and demand of the international illegal drug market, not including commonly legal substances like caffeine and alcohol. Drugs are grouped by class and type, with six main types of drugs found as the most prevalent drugs worldwide.

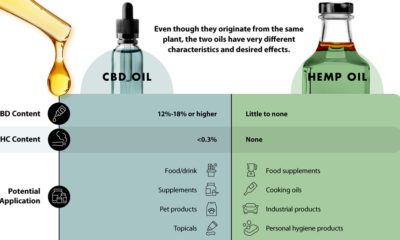

Cannabis*: Drugs derived from cannabis, including hemp. This category includes marijuana (dried flowers), hashish (resin), and other for various other parts of the plant or derived oils. Cocaine: Drugs derived from the leaves of coca plants. Labeled as either cocaine salts for powder form or crack for cocaine processed with baking soda and water into rock form. Opioids: Includes opiates which are derived directly from the opium poppy plant, including morphine, codeine, and heroin, as well as synthetic alkaloids. Amphetamine-type Stimulants (ATS): Amphetamine and drugs derived from amphetamine, including meth (also known as speed), MDMA, and ecstasy. Sedatives and Tranquilizers: Includes other drugs whose main purpose is to reduce energy, excitement, or anxiety, as well as drugs used primarily to initiate or help with sleep (also called hypnotics). Solvents and Inhalants: Gases or chemicals that can cause intoxication but are not intended to be drugs, including fuels, glues, and other industrial substances.

The report also tracked the prevalence of hallucinogens—psychoactive drugs which strongly affect the mind and cause a “trip”—but no hallucinogens ranked as the most prevalent drug in any one country. *Editor’s note: Recreational cannabis is legal in five countries, and some non-federal jurisdictions (i.e. states). However, in the context of this report, it was included because it is still widely illicit in most countries globally.

The Most Prevalent Drug in Each Country

According to the report, 275 million people used drugs worldwide in 2020. Between the ages of 15–64, around 5.5% of the global population used drugs at least once. Many countries grouped different types of the same drug class together, and a few like Saudi Arabia and North Macedonia had multiple different drug types listed as the most prevalent. But across the board, cannabis was the most commonly prevalent drug used in 107 listed countries and territories: How prevalent is cannabis worldwide? 72 locations or more than two-thirds of those reporting listed cannabis as the most prevalent drug. Unsurprisingly these include countries that have legalized recreational cannabis: Canada, Georgia, Mexico, South Africa, and Uruguay.

How Common Are Opioids and Other Drugs?

Though the global prevalence of cannabis is unsurprising, especially as it becomes legalized and accepted in more countries, other drugs also have strong footholds. Opioids (14 locations) were the most prevalent drugs in the Middle-East, South and Central Asia, including in India and Iran. Notably, Afghanistan is the world’s largest producer of opium, supplying more than 90% of illicit heroin globally. Amphetamine-type drugs (9 locations) were the third-most common drugs overall, mainly in East Asia. Methamphetamine was the reported most prevalent drug in China, South Korea, and Japan, while amphetamine was only the most common drug in Bangladesh. However, it’s important to note that illicit drug usage is tough to track. Asian countries where cannabis is less frequently found (or reported) might understate its usage. At the same time, the opioid epidemic in the U.S. and Canada reflects high opioid usage in the West. As some drugs become more widespread and others face a renewed “war,” the landscape is certain to shift over the next few years.