The suits are pressed and the jets are gassed up, as global political and business leaders prepare to converge in Davos for the World Economic Forum. To prep the wide variety of world leaders attending the summit, the organization has just published its most recent edition of the Global Risks Report. The highly anticipated annual presentation puts the world’s most pressing issues into focus, giving a sense of what is top-of-mind for global decision-makers. Below are the top five risks highlighted in this year’s report.

The World’s Evolving Risk Landscape

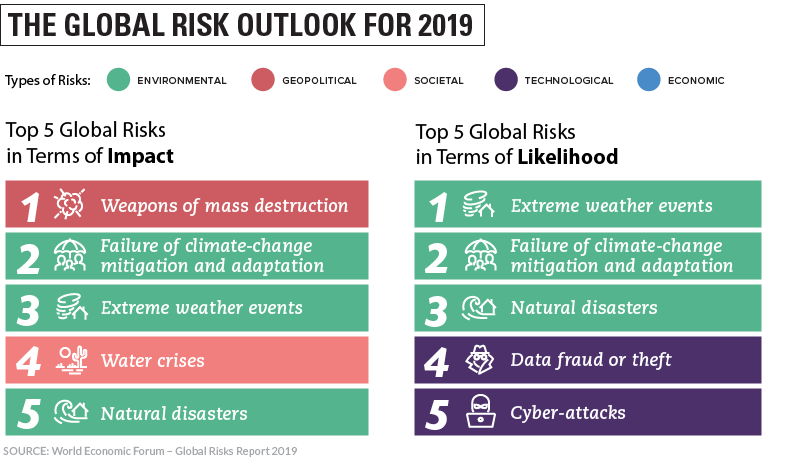

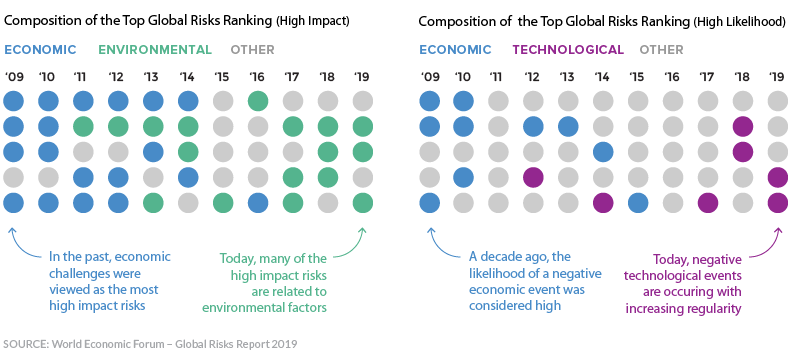

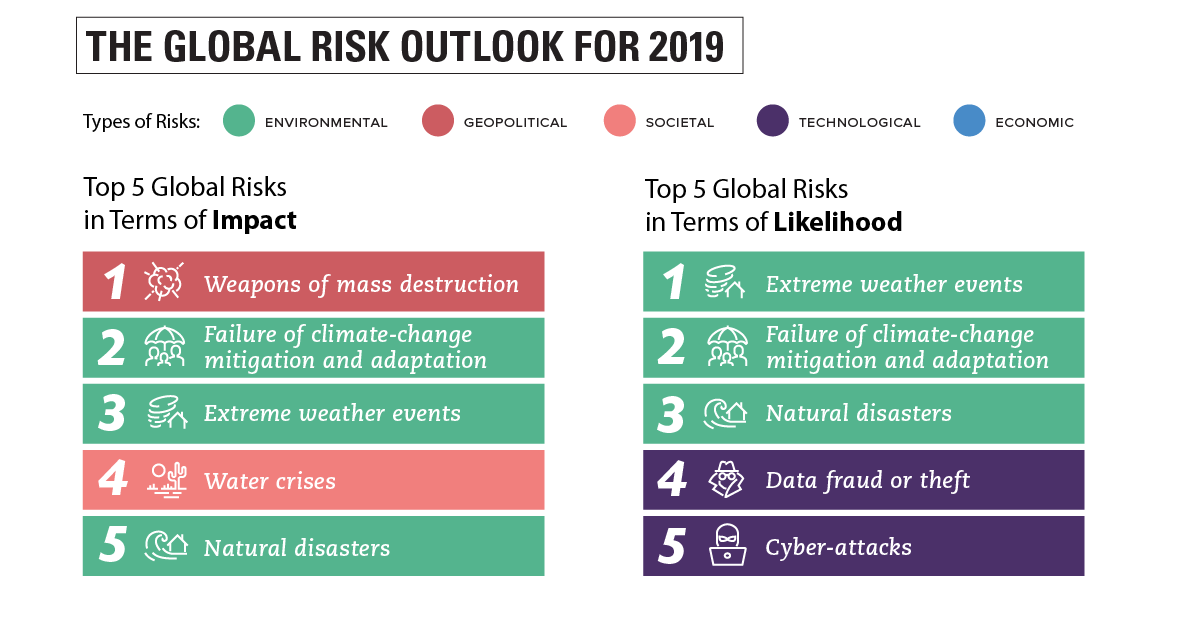

The report looks at two specific ways of evaluating global risks: And over recent years, it’s clear that the composition of these top threats has evolved.

In 2009, the world was still reeling from the global financial crisis, so economic concerns were naturally at the forefront of discussions. Today, the most likely scenarios to play out in the near future involve extreme weather events and natural disasters. Also trending upward are cyber-security threats and concerns over the security of personal data.

Risk Perception

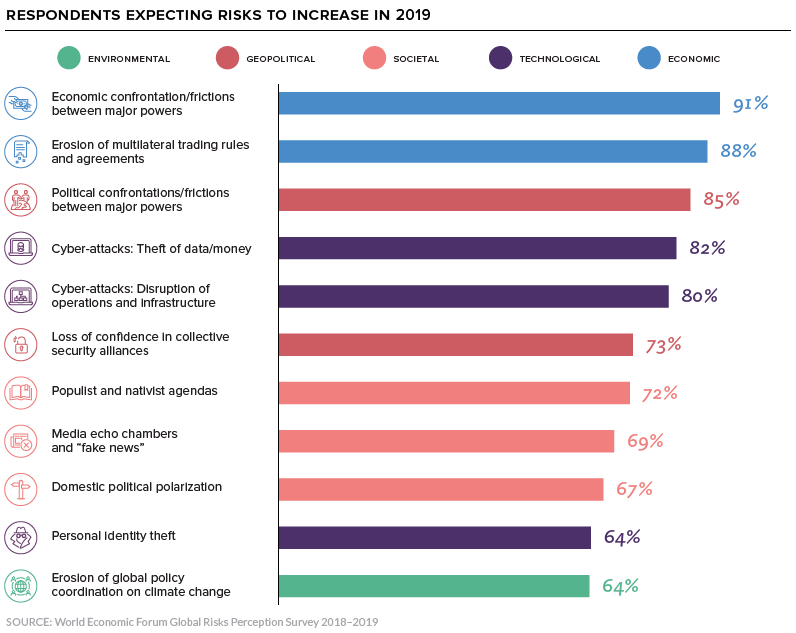

Each year, the Global Risks Perception Survey looks at which risks are viewed by global decision-makers as increasing in the coming year.

Some clear themes emerge from the responses: A Breakdown in Geopolitical Cooperation From trade wars to the dissolution of weapons treaties, cooperation between countries is on the decline. Leaders are concerned that this divergent geopolitical climate may continue to inhibit collective progress on important global challenges. Technological Instabilities As the influence of technology creeps into more aspects of everyday life, cyber-attacks and lax cybersecurity protocols are becoming more of a concern. In one dramatic example information theft, multiple breaches of India’s government ID database reportedly left the information of over 1 billion registered citizens exposed. Technology is influencing society in other ways too, such as the pervasive issue of “fake news”. Polarization of Government and Society One of the major themes of this year’s forum will be addressing increasing polarization in many countries. – Global Risks Report 2019

Gauging the National Sentiment

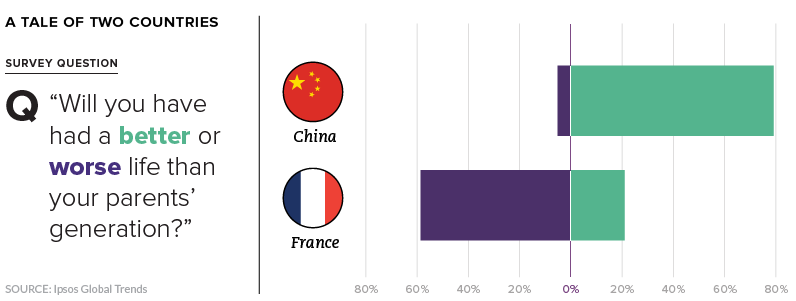

The report also looks at questions related to human happiness too. One might ask, “Is the world becoming a better or worse place?” That, of course, is a complicated question, and one that is influenced by geography and socioeconomic standing.

Survey data also shows that when people are asked to compare their lives to their parents’ generation, the answers vary greatly from country to country. The prevailing opinion in China is that things are improving, whereas nearly 60% of French respondents had a pessimistic view of the realities facing their generation. While France has a uniquely gloomy outlook on the future, this uncertainty is reflected in the opinion of citizens in many other developed democracies as well. In Davos, global leaders will be pondering a similar question: How do we move towards a brighter future for the next generation when the collective will for tackling global problems appears to be weakening? on Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%. A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement: While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession. This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter). With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation. For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022. The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make. Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation. More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession. Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes. Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.