Over the last five years, Bitcoin users and transactions have averaged a growth rate of nearly 60% per year. Similarly, private and public investors have deepened their commitment to cryptocurrencies including Ethereum, Ripple (XRP), and Stellar—and a number of others across the industry. Today’s infographic unpacks a cross-section of cryptocurrencies, stakeholders, and core applications across a sector that’s continuing to grow in importance.

The Evolution of Cryptocurrency

Cryptocurrency has erupted into a $200 billion industry, sparking a wave of global disruption. At the heart of cryptocurrency is a rich history of innovation. It extends back to the 1980s with advances in the field of cryptography—eventually leading to the technology that forms encryption techniques designed to protect the network. Since then, a series of key events have continued to shape the sector. Now, there are over 5,000 cryptocurrencies in circulation, with many built on innovative applications and use-cases as the ecosystem rapidly evolves.

The Value of Cryptocurrencies

Today, crypto offers cutting-edge advances that are diverse and transformative. In addition, it could also be considered an investment in tomorrow’s financial system—decentralized finance (DeFi). DeFi is an emerging alternative financial system that is built on a public blockchain, which enables greater accessibility because anyone has the ability to connect to it. Additionally, transactions are publicly visible, enabling greater transparency across the system. Here is a refresher on some of the practical advantages being applied across cryptocurrencies.

The Key Players in the Crypto Landscape

The cryptocurrency ecosystem is growing rapidly. Worldwide, private and public actors recognize its potential across many domains. Who are the primary participants in the field today?

Private Actors

Public Actors

The rising popularity of crypto is bolstering new policies and adoption, as evidenced by the many players trying to break into the space.

The Big Picture:

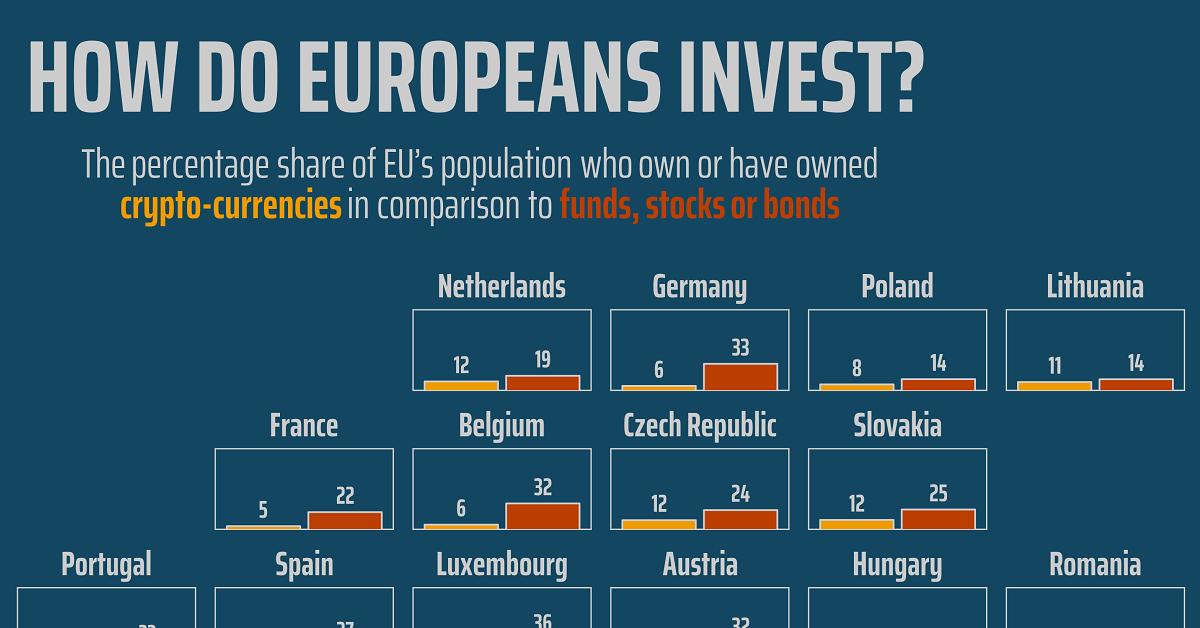

As crypto continues to gain momentum, its longer-term implications will come into focus. Crucially, its cryptographic foundation sets the stage for future advances in finance. Rooted in decentralized and autonomous systems, cryptocurrencies are creating second-order effects in the financial world. Ultimately, cryptocurrencies are helping to transform finance as we know it—unlocking countless investment opportunities across the global economy. on For a modern example, we can see how different countries (and regions) act when it comes to cryptocurrency. Within the European Union—one of the regions dealing with faster crypto adoption—attitudes towards investing can vary considerably. This graphic from Gilbert Fontana looks at crypto popularity amongst investors in the EU using data from the European Commission’s Eurobarometer. It compares exposure to cryptocurrencies relative to stocks, funds, and bonds.

Crypto Popularity in Europe in 2022

Given that crypto has experienced bubble-like asset rallies, including a dramatic rise to over a trillion dollars in value before crashing, it’s fair to say it’s well known by now. But even with a vast rise in awareness, there are still discrepancies between the level of investment crypto receives amongst European Union nations. Let’s see which countries have the highest proportion of citizens invested in crypto: Topping the list is Slovenia, considered by some the most crypto-friendly nation in the world. According to the survey, 18% of the country’s population has some sort of investment in it. Cyprus also ranks high in its crypto-friendly rank and hits an investment figure of 13%. Also notable is the Grand Duchy of Luxembourg, which despite having a small population of 640,000 also has a strong reputation as a global financial hub. When it comes to crypto, 14% of the population owns or has owned the asset, relative to 36% for stocks, bonds, or funds.

Crypto Unpopularity?

In regards to the countries with lower levels of crypto investment, one observation is that they tend to be wealthier and more developed EU nations. Here’s how the nations at or below the 10% crypto-investment threshold rank: At the “bottom” of crypto interest are France, Germany and Italy, also the EU’s largest economies. At a glance, this might suggest that citizens of stronger economies invest less in crypto. However, it’s important to note that the countries with higher levels of crypto investment tend to have lower levels of wealth on average. Though less of their investors seem to engage in crypto trading, countries like France and Germany might have more comparable levels of crypto investment on a pure dollar-basis.