Unfortunately, a familiar property of helium prevents this from happening. Helium gas is lighter than air and literally rises into space, depleting the Earth of almost all valuable helium resources over time.

Where do we get helium?

So how do we actually obtain new helium gas, which is necessary for important technological applications such as MRI machines, superconductors, and even the Large Hadron Collider? Today’s infographic from Helium One shows everything you need to know on helium, including where we can find it on Earth, as well as the most important uses of the gas.

Although helium is plentiful in the universe, on Earth it is quite rare and difficult to obtain.

Why Do We Need Helium?

Helium has several properties that make it invaluable to modern humans, particularly for technological uses:

Helium Demand

Helium demand has risen consistently since 2009, and the market has been increasing at a CAGR of 10.1% since 2010. With that in mind, here are the specific constituents of helium demand today: Helium’s melting point, which is the lowest found in nature, allows it to remain as a liquid at the coolest possible temperature. This makes helium ideal for uses in superconductors, including MRI machines – one of the fastest growing components of helium demand.

Helium Supply

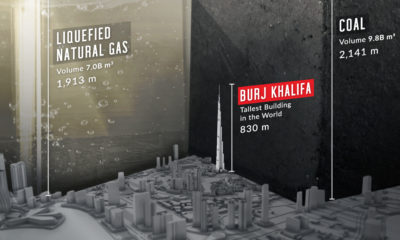

But where do we obtain this elusive gas? It turns out that new helium is actually created every day in very tiny amounts within the Earth’s crust as a by-product of radioactive decay. And like other gases below the Earth’s surface (i.e. natural gas), helium gets trapped in geological formations in economical amounts. Today, much of helium is either produced as a by-product of natural gas deposits, or from helium-primary gas deposits with concentrations up to 7% He. Here’s helium production by country: USA (from Cliffside Field) The USA government has a helium stockpile at the Cliffside Field in Texas, developed as part of a WWI initiative. It is in the process of being phased out, and by as late as 2021 it will no longer contribute to supply. Qatar In December 2013, the Qatar Helium 2 project was opened. This new facility combined with the first helium project makes the country the 2nd largest source of helium globally. Russia Russia is looking to become a player in helium as well. Gazprom’s Amur LNG project will be one of the biggest gas facilities in the world, and it will include a helium processing plant. This won’t be online until 2024, though. Tanzania Though not a helium player yet, scientists have recently uncovered a major helium find in the Rift Valley of Tanzania which contains an estimated 99 billion cubic feet of gas.

The Future of the Helium Market?

Because of inflated demand, especially for cryogenics in MRI machines, helium prices have risen significantly over the years. And with these market dynamics in mind, it’s clear that the future of helium is not full of hot air.

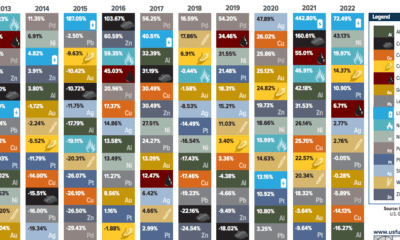

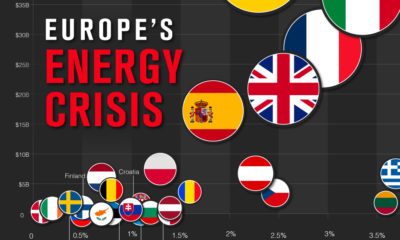

on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.