But although more Americans are seeking advice on matters of personal finance, they are also less sure that the advice they are getting is trustworthy. Unfortunately, a growing amount of Americans see advisors as serving their companies’ best interests rather than their own best interests. According to a survey by The National Association of Retirement Plan Participants (NARPP), 60% of Americans now feel this way compared to just 25% of respondents in 2010.

Who Can Be Trusted?

Today’s infographic is from Tony Robbins, and it covers key points from his #1 Best Selling book Unshakeable: Your Financial Freedom Playbook, which is now available on paperback. The book dissects the investment advisor landscape to show the value of a relationship with an advisor, the legal distinctions between different advisor types, and how advisors are incentivized. Ultimately, it helps give you the ammo you need to find an investment advisor that will provide you with better service than the rest.

The Value of the Right Advisor

The right financial advisor can help you make better decisions, address your cognitive biases, and use their expertise to save you massive amounts of money. A recent Vanguard study helps quantify the value a good advisor can bring:

Lowering expense ratios: 0.45% Rebalancing portfolio: 0.35% Asset allocation: 0.75% Withdrawing the right investments in retirement: 0.70% Behavioral coaching: 1.50%

Total: 3.75% of added value! That’s more than 3x what a sophisticated advisor might charge, and doesn’t include the benefits of reducing taxes or other areas.

Advisors vs. Brokers

There are roughly 310,000 people in the U.S. who call themselves financial advisors – but they actually fall under two different legal frameworks. About 90% of this group are brokers, while 10% are registered investment advisors. Confusingly, there is also a significant portion who are dual-registered as both brokers and registered advisors, as well.

What’s the difference?

The two have different legal obligations, as well as differing ways of receiving compensation from clients: Investment Advisor (RIA)

RIAs are registered with the SEC and with the state they are working in Like doctors or lawyers, investment advisors have a fiduciary duty and legal obligation to their clients In other words, they must serve your best interest at all times They also must disclose any conflicts of interest They don’t accept commission from third-parties for their products

How they get paid: They charge a % based on assets managed, or a flat fee for financial advice Brokers

Brokers are usually employed by banks, brokerage houses, or insurance companies The products they recommend have to pass a suitability standard, based on your personal circumstances However, they do not have to necessarily recommend the best product for you

How they get paid: They get commissions for selling certain products to you. They may also charge based on assets under management, as well.

Picking the Right Advisor

Remember, the right advisor can add 3.75% of added value to a portfolio, and that’s before taxes and other areas! With the stakes so high, how can Americans pick the right advisor for them? Here are the 7 questions Tony Robbins would ask a potential advisor to work with:

- Are you a Registered Investment Advisor? If the answer is yes, he or she is required by law to be a fiduciary.

- Are you (or your firm) affiliated with a Broker-Dealer? If yes, he or she can act as a broker and receive commissions for guiding you into specific investments.

- Does your firm offer proprietary mutual funds or separately managed accounts? These products will likely compensate them with additional revenues, at your expense.

- Do you or your firm receive any third-party compensation for recommending particular investments? This is the ultimate question you want answered. You want products to be recommended because they are right for you, not because they give the best kickbacks.

- What’s your philosophy when it comes to investing? This will help you understand whether your advisor believes he/she can beat the market.

- What financial planning services do you offer beyond investment strategy and portfolio management? Financial planning is much bigger than just investing – it also involves planning for your child’s education, handling vested stock options, estate planning, and tax advice. You want someone that can help you in all stages of your life.

- Where will my money be held? Having your money held by a trusted third-party custodian will mean your money is in a secure environment. Like most financial endeavors, picking an advisor is an area lined with potential pitfalls. But choosing the right investment advisor can be a difference maker – it can even possibly even set you up with many years of extra retirement savings. on To see how the minimum wage differs around the world, we’ve visualized data from Picodi, which includes values for 67 countries as of January 2023.

Monthly Minimum Wage, by Country

The following table includes all of the data used in this infographic. Each value represents the monthly minimum wage a full-time worker would receive in each country. Picodi states that these figures are net of taxes and have been converted to USD. Generally speaking, developed countries have a higher cost of living, and thus require a higher minimum wage. Two outliers in this dataset are Argentina and Turkey, which have increased their minimum wages by 100% or more from January 2022 levels. Turkey is suffering from an ongoing currency crisis, with the lira losing over 40% of its value in 2021. Prices of basic goods have increased considerably as the Turkish lira continues to plummet. In fact, a 2022 survey found that 70% of people in Turkey were struggling to pay for food. Argentina, South America’s second-biggest economy, is also suffering from very high inflation. In response, the country announced three minimum wage increases throughout 2022.

Minimum Wage in the U.S.

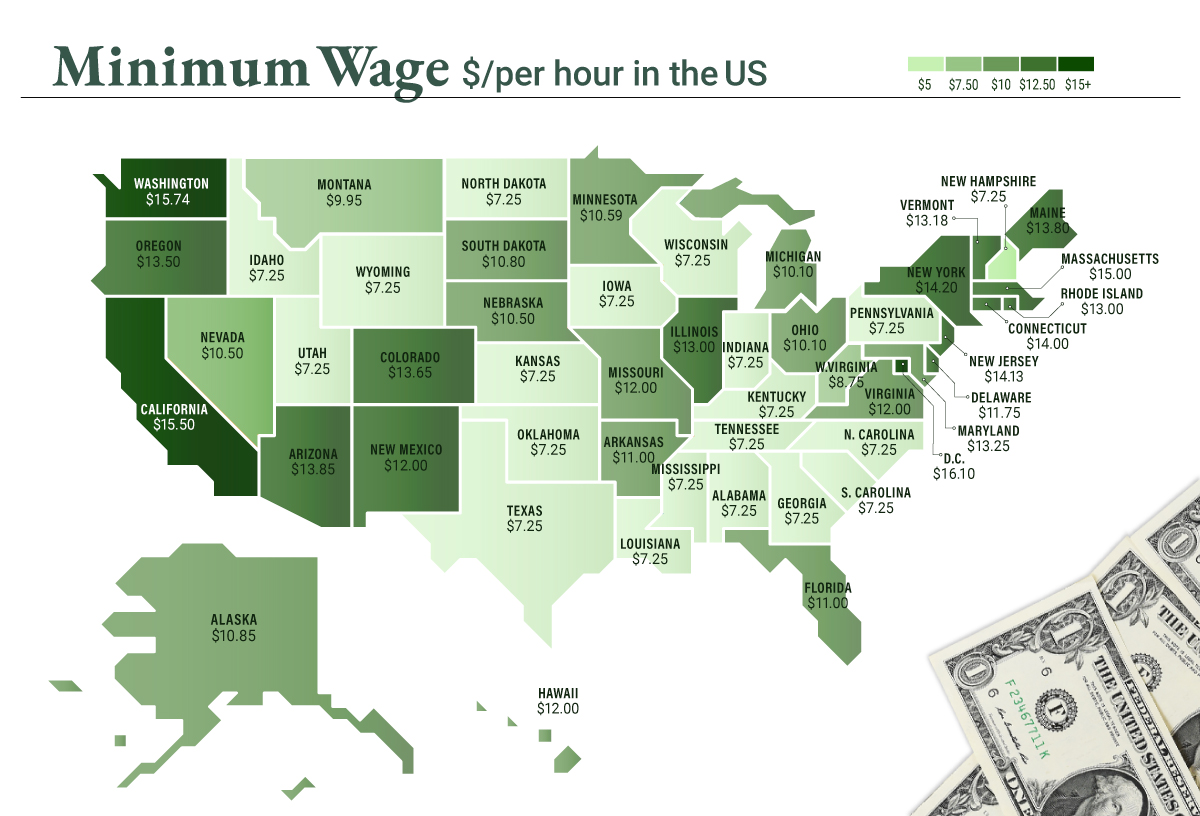

Within the U.S., minimum wage varies significantly by state. We’ve visualized each state’s basic minimum rate (hourly) using January 2023 data from the U.S. Department of Labor.

2023-03-17 Update: This map was updated to fix several incorrect values. We apologize for any confusion this may have caused. America’s federal minimum wage has remained unchanged since 2009 at $7.25 per hour. Each state is allowed to set their own minimum wage, as long as it’s higher than the federal minimum. In states that do not set their own minimum, the federal minimum applies. If we assume someone works 40 hours a week, the federal minimum wage of $7.25 translates to an annual figure of just $15,080 before taxes. California’s minimum wage of $15.50 translates to $32,240 before taxes. For further perspective, check out our 2022 infographic on the salary needed to buy a home across 50 U.S. cities.