The world’s most populous country has been the primary engine of economic growth for decades, but recently investor optimism around China has diminished significantly. With a sliding manufacturing sector and lower GDP growth, most mainstream pundits have shifted focus to whether the country will have a “soft” or a “hard” landing. Ever the contrarian, investor and author Gianni Kovacevic is not one to buy into this Kool Aid. In his new book “My Electrician Drives a Porsche?”, Kovacevic examines the fundamentals around China and other emerging markets to create perspective on the newest and fastest-growing generation of consumers. Using an allegorical conversation between a doctor and his Porsche-driving electrician, the impact and ripple effects of this new “spending class” are described, affecting everything from the economy to the environment. We thought the book had some great statistics on emerging markets, and that the easy-to-follow conversation was an effective way at introducing the contrarian way of thinking. Further, the book also outlines an interesting track on how to invest in green energy specifically.

Key Themes

Today’s infographic pulls some of the themes from this book to show who makes up the new spending class, and why their inevitable rise will translate to a blossoming green energy sector. There is much more meat to the book and to avoid spoilers, we’ve left out Kovacevic’s ultimate investment conclusion. However, here are some of the points that we thought were most compelling: Millennials Millennials get a lot of media coverage in the United States. There’s 87 million of them and they have already had a profound impact on the economy. That said, it is incredible to think that the same generation in China is nearly 5x as big with 415 million people. This cohort of millennials (16-35 years old) in China is larger than the entire working populations of the U.S., Canada, and Western Europe combined. Millennials in China and other emerging markets are nothing like previous generations. For example, in China, millennials have already earned 107 million college degrees, while all other previous generations have combined for a grand total of only 14 million. Newly educated and aware of the modern world through technology, China’s millennials do not want to work in factories or fields. Spending Class Potential China’s spectacular growth isn’t coming to an end anytime soon. The country is in 74th place worldwide in GDP per capita with $8,280. This is compared to neighboring countries such as Japan and South Korea, which have amounts closer to $30,000 per capita. Only 22% of the Chinese population has drivers licenses, yet the country is already the largest auto market in the world with close to 25 million cars sold per year. Imagine how many refrigerators, air conditioners, and other basic comfort products the spending class will be buying over the coming years as their disposable income rises. Energy The common denominator of these goods is that they all take significant amounts of raw materials and energy to manufacture. Most of these goods, such as refrigerators or air conditions, require great amounts of energy to constantly power as well. Today, the average person in China uses less than 30% of the energy used each year by an American. As 400 million people buy these essential goods of human progress and comfort, the energy draw will rise rapidly. Where will this energy come from? Certainly all power sources will be a part of this energy mix going forward, but China is leaning green the most. Air pollution is so bad in China that it is commonly referred to as the “Airpocalypse”. It’s estimated that pollution kills 4,000 people per day in China, and green energy will help combat this problem. That’s why China is building 1,000 GW of green energy capacity between 2014 and 2030, which is the equivalent of 90% of the entire current U.S. energy grid.

Tesla Tour

To amplify the message of the book, Gianni Kovacevic is embarking on “The Realistic Environmentalist Tesla Tour” to 32 official cities in North America. This one-of-a-kind, zero emissions book tour will be facilitated by driving a Tesla Model S from Toronto to California. The objective is to enlighten millions of people by illustrating what makes green energy and human progress factually possible while debunking common myths from the validity of electric cars to the future of energy. Here’s more on the Tesla Tour in his own words:

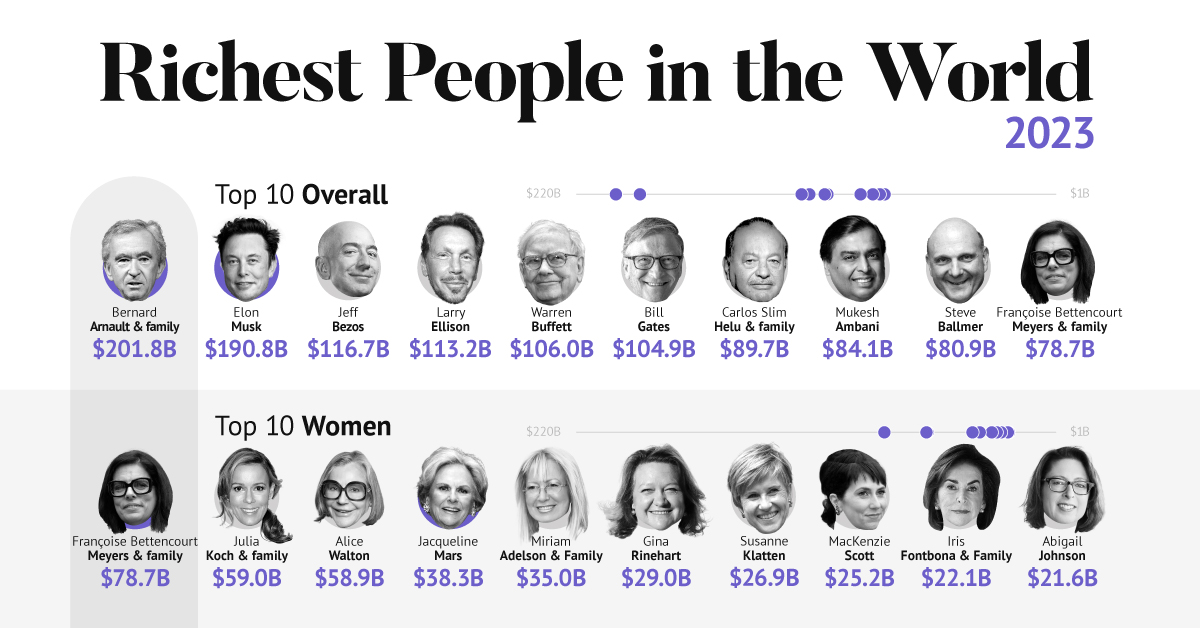

on A lagging stock market dented these fortunes against high interest rates, energy shocks, and economic uncertainty. But some of the world’s billionaires have flourished in this environment, posting sky-high revenues in spite of inflationary pressures. With data from Forbes Real-Time Billionaires List, we feature a snapshot of the richest people in the world in 2023.

Luxury Mogul Takes Top Spot

The world’s richest person is France’s Bernard Arnault, the chief executive of LVMH.

With 75 brands, the luxury conglomerate owns Louis Vuitton, Christian Dior, and Tiffany. LVMH traces back to 1985, when Arnault cut his first major deal with the company by acquiring Christian Dior, a firm that was struggling with bankruptcy.

Fast-forward to today, and the company is seeing record profits despite challenging market conditions. Louis Vuitton, for instance, has doubled its sales in four years.

In the table below, we show the world’s 10 richest people with data as of February 27, 2023:

Elon Musk, the second-wealthiest person in the world has a net worth of $191 billion. In October, Musk took over Twitter in a $44 billion dollar deal, which has drawn criticism from investors. Many say it’s a distraction from Musk’s work with Tesla.

While Tesla shares have rebounded—after falling roughly 70% in 2022—Musk’s wealth still sits about 13% lower than in March of last year.

Third on the list is Jeff Bezos, followed by Larry Ellison. The latter of the two, who founded Oracle, owns 98% of the Hawaiian island of Lanai which he bought in 2012 for $300 million.

Fifth on the list is Warren Buffett. In his annual letter to shareholders, he discussed how Berkshire Hathaway reported record operating profits despite economic headwinds. The company outperformed the S&P 500 Index by about 22% in 2022.

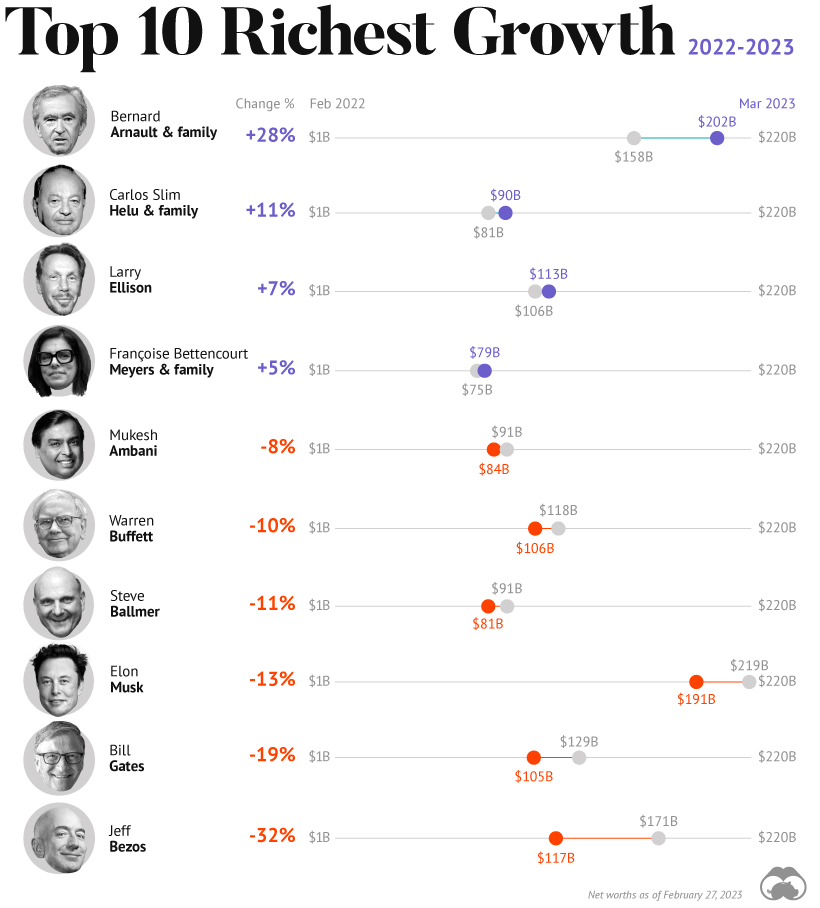

How Fortunes Have Changed

Given multiple economic crosscurrents, billionaire wealth has diverged over the last year. Since March 2022, just four of the top 10 richest in the world have seen their wealth increase. Two of these are European magnates, while Carlos Slim Helu runs the largest telecom firm in Latin America. In fact, a decade ago Slim was the richest person on the planet. Overall, as the tech sector saw dismal returns over the year, the top 10 tech billionaires lost almost $500 billion in combined wealth.

Recent Shakeups in Asia

Perhaps the most striking news for the world’s richest centers around Gautam Adani, formerly the richest person in Asia. In January, Hindenburg Research, a short-selling firm, released a report claiming that the Adani Group engaged in stock manipulation and fraud. Specifically, the alleged the firm used offshore accounts to launder money, artificially boost share prices, and hide losses. The Adani Group, which owns India’s largest ports—along with ports in Australia, Sri Lanka, and Israel—lost $100 billion in value in the span of a few weeks. Interestingly, very few Indian mutual funds hold significant shares in Adani Group, signaling a lack of confidence across India’s market, which was also cited in Hindenburg’s report. As a result, Mukesh Ambani has climbed to Asia’s top spot, controlling a $84 billion empire that spans from oil and gas and renewable energy to telecom. His conglomerate, Reliance Industries is the largest company by market cap in India.