And while people have always wanted electric cars and inexpensive solar power, the reality is that until recently, battery technology just wasn’t good enough to store energy on an economical or practical basis. Things have changed, and the green revolution has been kickstarted by battery power. The commercialization of the lithium-ion battery has solved a crucial green energy problem for two major reasons that can be related back to the properties of lithium:

- Lithium has extremely high electrochemical potential, and so do lithium-ion cells: This means one lithium-ion cell can do more – making it much more efficient to use in everything from electronics to energy storage.

- Lithium is also the lightest metal on the periodic table. Batteries need to be as light as possible, especially in electric cars.

How Lithium Gets Used

2001 Many years ago, lithium was used chiefly for a variety of industrial purposes. Major sources of lithium demand included ceramics, glass, aluminum production, lubricants, and as a catalyst for rubber production. 2015 In modern times, with the commercialization of the lithium-ion, batteries are now the major source of demand for lithium at 39%. 2025 According to a report by Deutsche Bank, in 2025 the battery market for lithium alone will be more than 2x bigger than the total lithium market today. About 70% of all lithium will go to electric vehicles, e-bikes, traditional batteries, and energy storage, making it the uncontested fuel of the green revolution.

Major Lithium Drivers

Lithium-ion battery demand is primarily driven by rapid growth in the electric vehicle market, which is expected to make up 35% of all vehicle demand by 2040. But renewable energy storage also plays a role in driving lithium demand. With solar and wind energy being installed at a rapid pace, that means more batteries must be procured to store this energy. This can be done for a home system with a product like Tesla’s Powerwall 2.0, and it is being done on a utility scale as well.

Two Types of Lithium

Prices for lithium have skyrocketed in the last two years – and it is worth knowing the two different types of lithium used by the market. Lithium carbonate: This is the first chemical in the production chain, and as a result, sells for less than lithium hydroxide. It can be used as cathode material in some batteries, such as the Nissan Leaf, where it is used in a LMO with NMC formulation (Lithium manganese oxide / nickel manganese cobalt oxide chemistries) Lithium hydroxide: This is a by-product of lithium carbonate, created by a metathesis reaction with calcium hydroxide. It can be used to produce cathode material more efficiently and is actually necessary for some types of cathodes. It’s used in the Tesla Powerwall and Model S, for example.

Lithium Mining

There are two basic ways to extract lithium: from brine or from hard rock. The latter mainly consists of spodumene production. Brine deposits represent about 66% of global lithium resources, and are found mainly in the salt flats of Chile, Argentina, Bolivia, China, and Tibet. The most famous area for lithium is known as the Lithium Triangle, located on the border between Chile, Argentina, and Bolivia. Salar de Atacama, the world’s third largest salt flat, resides on the Chilean side, and contains about 50% of global reserves. The largest lithium producers in 2015 were Chile (37%) and Australia (33%). Argentina is the only other double-digit producer at 11%.

Lithium is Fueling the Green Revolution

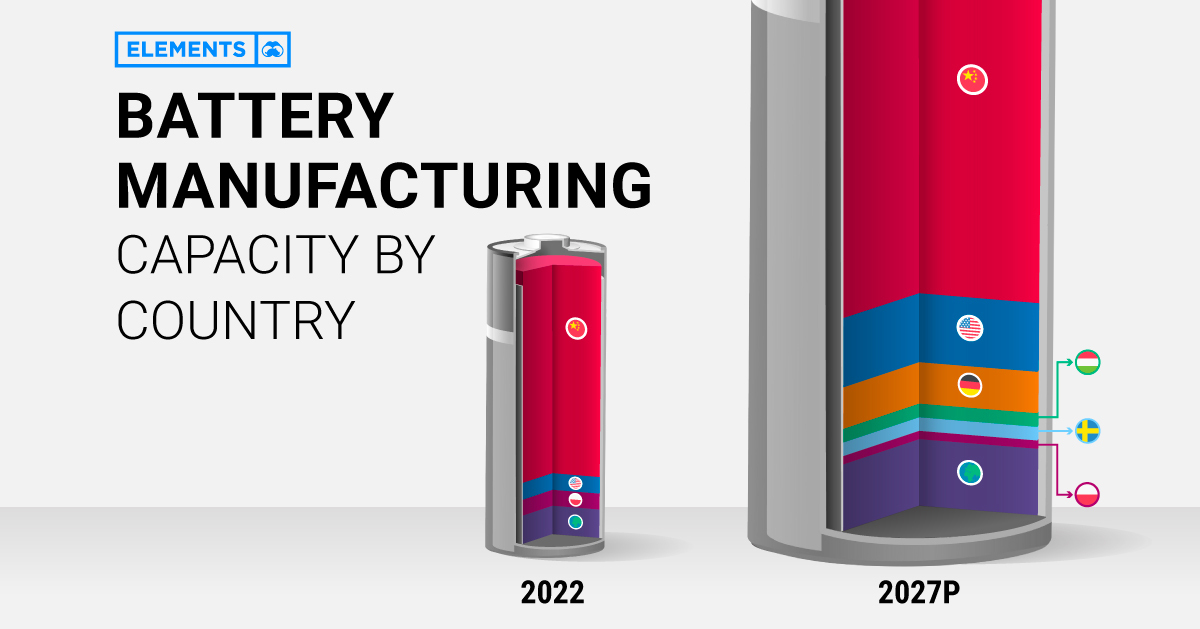

Here’s the estimated amount of lithium that can be found in everyday items using lithium-ion batteries: Tesla Model S: 51kg Electric Vehicles: 10-63kg Tesla Powerwall 2.0: 10kg Hybrids: 0.8kg to 2.0kg Power tool batteries: 40-60g Laptops: 30-40g Tablets: 20-30g Mobile phones: 2-3g on With the world gearing up for the electric vehicle era, battery manufacturing has become a priority for many nations, including the United States. However, having entered the race for batteries early, China is far and away in the lead. Using the data and projections behind BloombergNEF’s lithium-ion supply chain rankings, this infographic visualizes battery manufacturing capacity by country in 2022 and 2027p, highlighting the extent of China’s battery dominance.

Battery Manufacturing Capacity by Country in 2022

In 2022, China had more battery production capacity than the rest of the world combined. With nearly 900 gigawatt-hours of manufacturing capacity or 77% of the global total, China is home to six of the world’s 10 biggest battery makers. Behind China’s battery dominance is its vertical integration across the rest of the EV supply chain, from mining the metals to producing the EVs. It’s also the largest EV market, accounting for 52% of global sales in 2021. Poland ranks second with less than one-tenth of China’s capacity. In addition, it hosts LG Energy Solution’s Wroclaw gigafactory, the largest of its kind in Europe and one of the largest in the world. Overall, European countries (including non-EU members) made up just 14% of global battery manufacturing capacity in 2022. Although it lives in China’s shadow when it comes to batteries, the U.S. is also among the world’s lithium-ion powerhouses. As of 2022, it had eight major operational battery factories, concentrated in the Midwest and the South.

China’s Near-Monopoly Continues Through 2027

Global lithium-ion manufacturing capacity is projected to increase eightfold in the next five years. Here are the top 10 countries by projected battery production capacity in 2027: China’s well-established advantage is set to continue through 2027, with 69% of the world’s battery manufacturing capacity. Meanwhile, the U.S. is projected to increase its capacity by more than 10-fold in the next five years. EV tax credits in the Inflation Reduction Act are likely to incentivize battery manufacturing by rewarding EVs made with domestic materials. Alongside Ford and General Motors, Asian companies including Toyota, SK Innovation, and LG Energy Solution have all announced investments in U.S. battery manufacturing in recent months. Europe will host six of the projected top 10 countries for battery production in 2027. Europe’s current and future battery plants come from a mix of domestic and foreign firms, including Germany’s Volkswagen, China’s CATL, and South Korea’s SK Innovation.

Can Countries Cut Ties With China?

Regardless of the growth in North America and Europe, China’s dominance is unmatched. Battery manufacturing is just one piece of the puzzle, albeit a major one. Most of the parts and metals that make up a battery—like battery-grade lithium, electrolytes, separators, cathodes, and anodes—are primarily made in China. Therefore, combating China’s dominance will be expensive. According to Bloomberg, the U.S. and Europe will have to invest $87 billion and $102 billion, respectively, to meet domestic battery demand with fully local supply chains by 2030.