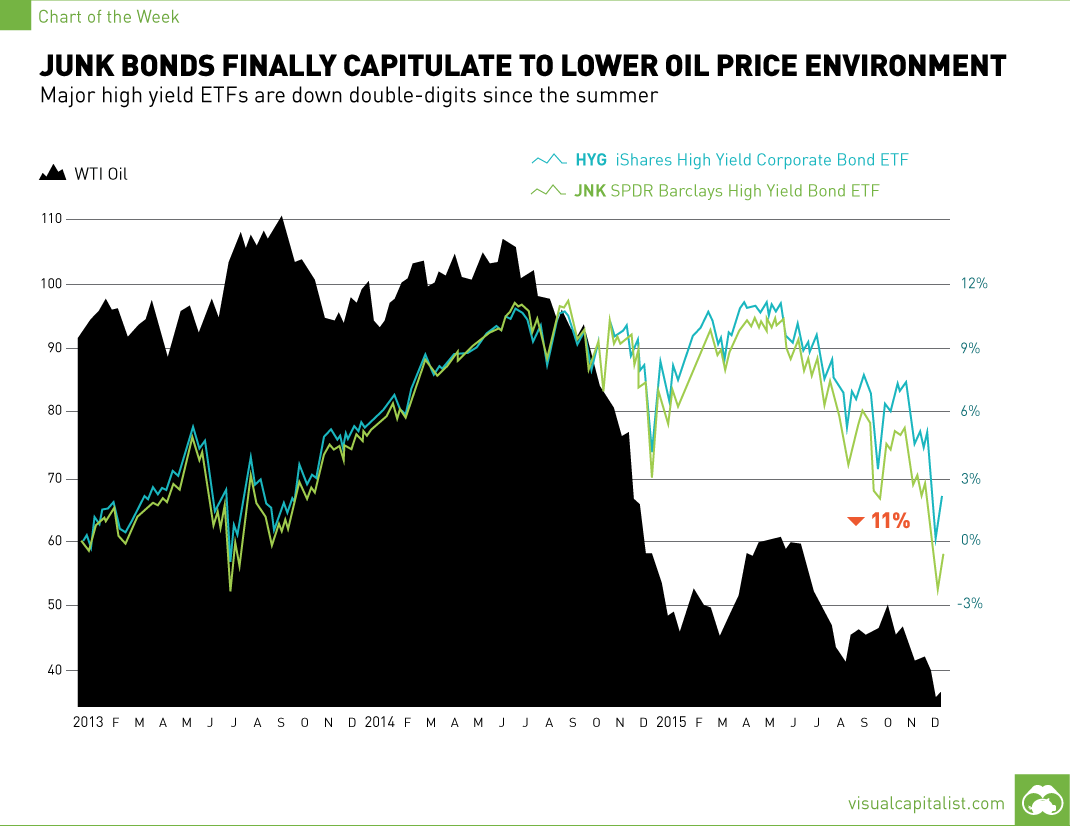

Junk Bonds Finally Capitulate to Lower Oil Price Environment [Chart]

High-yield bond ETFs are down double-digits since the summer.

The Chart of the Week is a weekly Visual Capitalist feature on Fridays. Over the month of December, the market for high-yield bonds (also known as junk bonds) had a mini-meltdown that’s raised some eyebrows. Junk bonds, which are non-investment grade debt instruments that are issued by companies with poor credit ratings, are both high-risk and high-reward. If the companies don’t default on their payments, the bonds pay a nice premium to the investor. In fact, the risk and return on junk bonds is generally comparable with that of stocks. However, sometimes these companies can and will default on their debt obligations, and here’s where the risk comes in. This time, it is the energy sector that is the culprit. When low oil prices hit last year, many fringe oil and gas producers believed that it would be possible to wait out the market for better prices. Some of these companies even issued risky junk bonds to raise capital to sustain operations until better times. The recent action in oil and commodity markets have made it clear that oil prices could be low for a long time. Now, these fringe shale producers that have been holding on for better times may get a different type of medicine. Standard & Poor’s recently warned that a stunning 50% of energy junk bonds are “distressed,” meaning they are at risk of default. That’s about a total of $180 billion distressed debt, which is the highest level since the Financial Crisis. Investors began pulling money out of the credit markets fast. Last week, investors pulled a record $5.1 billion out of mutual funds and ETFs investing in junk bonds. Investment-grade bond and junk bond yields are now at their highest since 2012. On top of that, several funds announced they would be locking out investors from withdrawing their funds. Third Avenue has blocked investors from retrieving money from its credit fund, Stone Lion suspended redemptions in its credit hedge funds, and Lucidus Capital Partners liquidated its holdings to try and get money back to investors. What does this mean for ordinary investors? Jeffrey Gundlach, the “Bond King”, talked about this in his latest presentation for DoubleLine Capital: In 2016 we will be sailing into some uncharted territory.

on

#1: High Reliability

Nuclear power plants run 24/7 and are the most reliable source of sustainable energy. Nuclear electricity generation remains steady around the clock throughout the day, week, and year. Meanwhile, daily solar generation peaks in the afternoon when electricity demand is usually lower, and wind generation depends on wind speeds.As the use of variable solar and wind power increases globally, nuclear offers a stable and reliable backbone for a clean electricity grid.

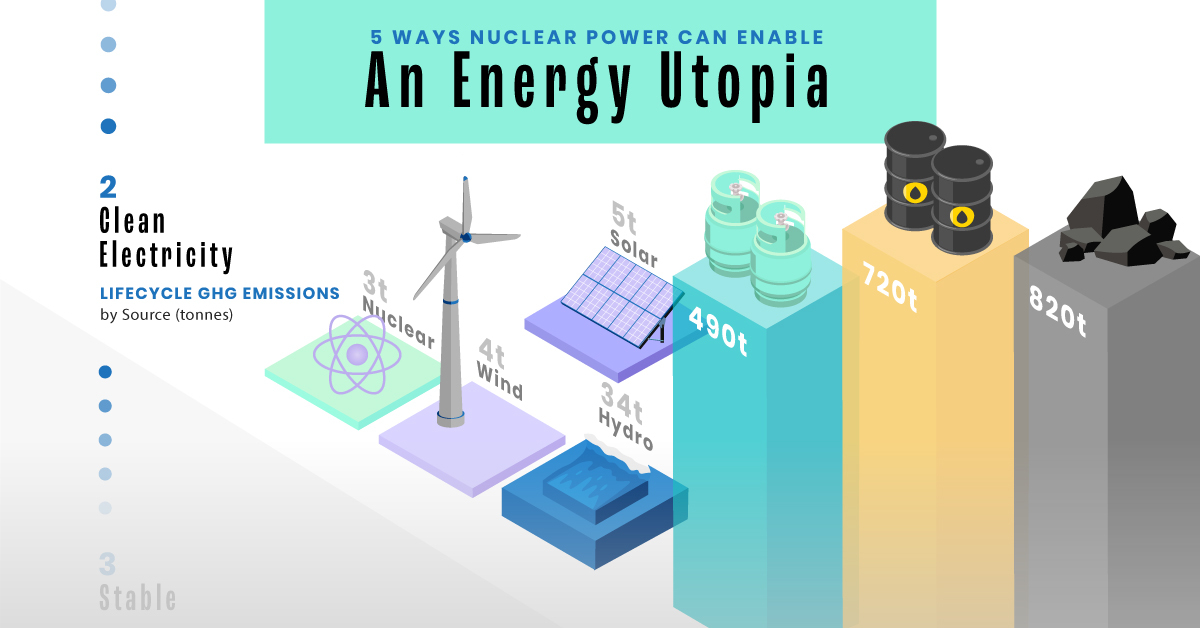

#2: Clean Electricity

Nuclear reactors use fission to generate electricity without any greenhouse gas (GHG) emissions.Consequently, nuclear power is the cleanest energy source on a lifecycle basis, measured in CO2-equivalent emissions per gigawatt-hour (GWh) of electricity produced by a power plant over its lifetime. The lifecycle emissions from a typical nuclear power plant are 273 times lower than coal and 163 times lower than natural gas. Furthermore, nuclear is relatively less resource-intensive, allowing for lower supply chain emissions than wind and solar plants.

#3: Stable Affordability

Although nuclear plants can be expensive to build, they are cost-competitive in the long run. Most nuclear plants have an initial lifetime of around 40 years, after which they can continue operating with approved lifetime extensions. Nuclear plants with lifetime extensions are the cheapest sources of electricity in the United States, and 88 of the country’s 92 reactors have received approvals for 20-year extensions. Additionally, according to the World Nuclear Association, nuclear plants are relatively less susceptible to fuel price volatility than natural gas plants, allowing for stable costs of electricity generation.

#4: Energy Efficiency

Nuclear’s high energy return on investment (EROI) exemplifies its exceptional efficiency. EROI measures how many units of energy are returned for every unit invested in building and running a power plant, over its lifetime. According to a 2018 study by Weissbach et al., nuclear’s EROI is 75 units, making it the most efficient energy source by some distance, with hydropower ranking second at 35 units.

#5: Sustainable Innovation

New, advanced reactor designs are bypassing many of the difficulties faced by traditional nuclear plants, making nuclear power more accessible.

Small Modular Reactors (SMRs) are much smaller than conventional reactors and are modular—meaning that their components can be transported and assembled in different locations. Microreactors are smaller than SMRs and are designed to provide electricity in remote and small market areas. They can also serve as backup power sources during emergencies.

These reactor designs offer several advantages, including lower initial capital costs, portability, and increased scalability.

A Nuclear-Powered Future

Nuclear power is making a remarkable comeback as countries work to achieve climate goals and ultimately, a state of energy utopia. Besides the 423 reactors in operation worldwide, another 56 reactors are under construction, and at least 69 more are planned for construction. Some nations, like Japan, have also reversed their attitudes toward nuclear power, embracing it as a clean and reliable energy source for the future. CanAlaska is a leading exploration company in the Athabasca Basin, the Earth’s richest uranium depository. Click here to learn more now. In part 3 of the Road to Energy Utopia series, we explore the unique properties of uranium, the fuel that powers nuclear reactors.