From public CCTV cameras to biometric identification systems in airports, facial recognition technology is now common in a growing number of places around the world. In its most benign form, facial recognition technology is a convenient way to unlock your smartphone. At the state level though, facial recognition is a key component of mass surveillance, and it already touches half the global population on a regular basis. Today’s visualizations from SurfShark classify 194 countries and regions based on the extent of surveillance. Click here to explore the full research methodology. Let’s dive into the ways facial recognition technology is used across every region.

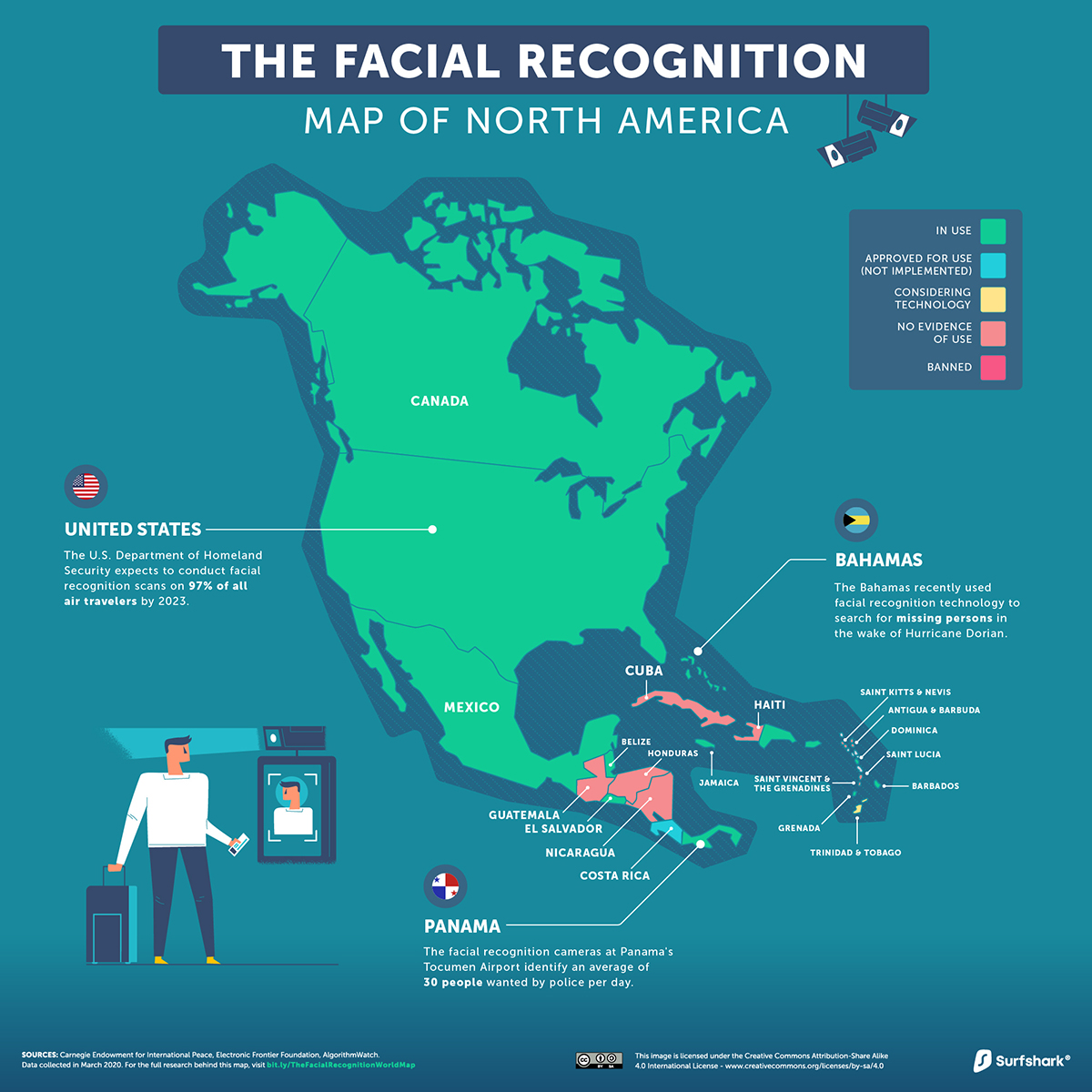

North America, Central America, and Caribbean

In the U.S., a 2016 study showed that already half of American adults were captured in some kind of facial recognition network. More recently, the Department of Homeland Security unveiled its “Biometric Exit” plan, which aims to use facial recognition technology on nearly all air travel passengers by 2023, to identify compliance with visa status.

Perhaps surprisingly, 59% of Americans are actually in favor of implementing facial recognition technology, considering it acceptable for use in law enforcement according to a Pew Research survey. Yet, some cities such as San Francisco have pushed to ban surveillance, citing a stand against its potential abuse by the government. Facial recognition technology can potentially come in handy after a natural disaster. After Hurricane Dorian hit in late summer of 2019, the Bahamas launched a blockchain-based missing persons database “FindMeBahamas” to identify thousands of displaced people.

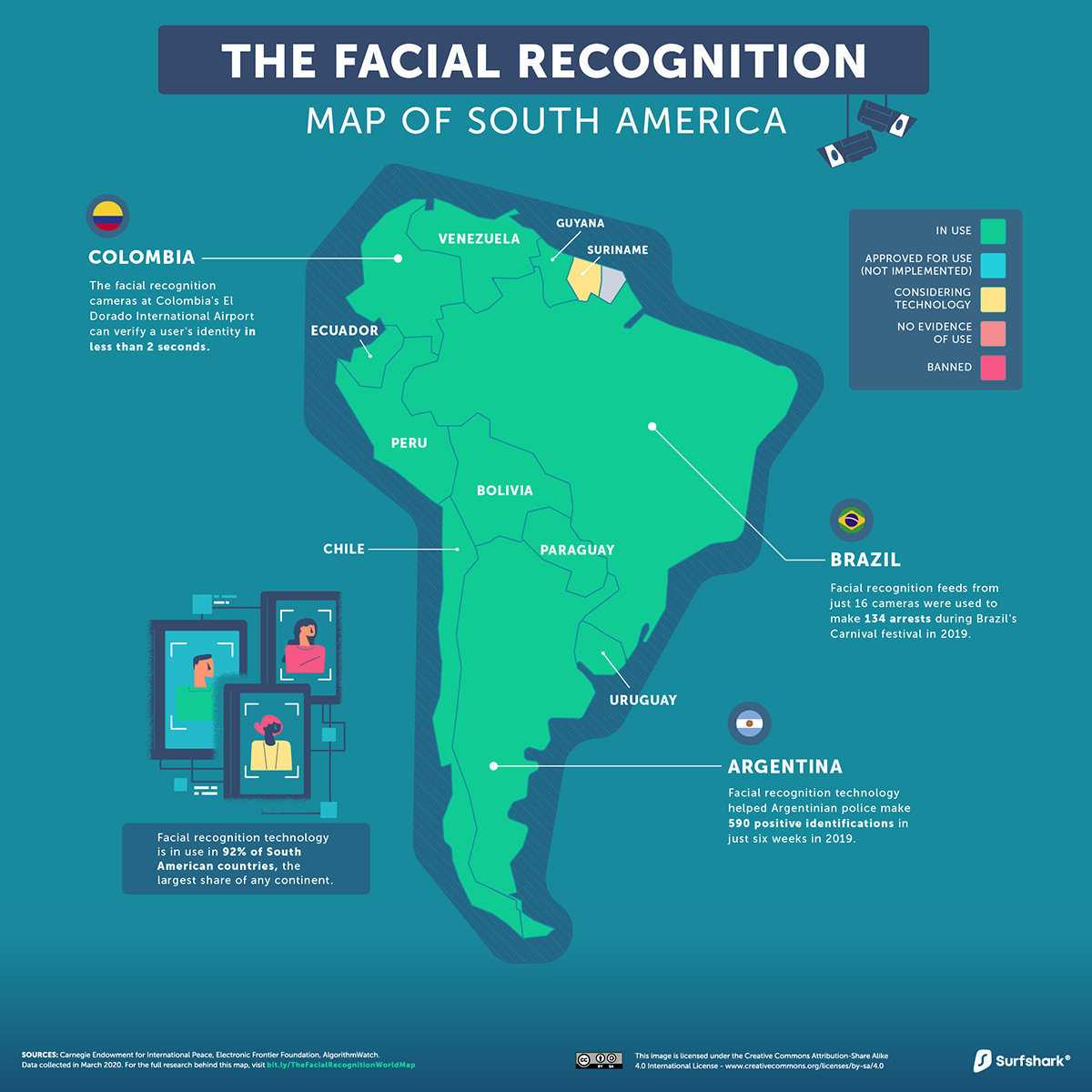

South America

The majority of facial recognition technology in South America is aimed at cracking down on crime. In fact, it worked in Brazil to capture Interpol’s second-most wanted criminal.

Home to over 209 million, Brazil soon plans to create a biometric database of its citizens. However, some are nervous that this could also serve as a means to prevent dissent against the current political order.

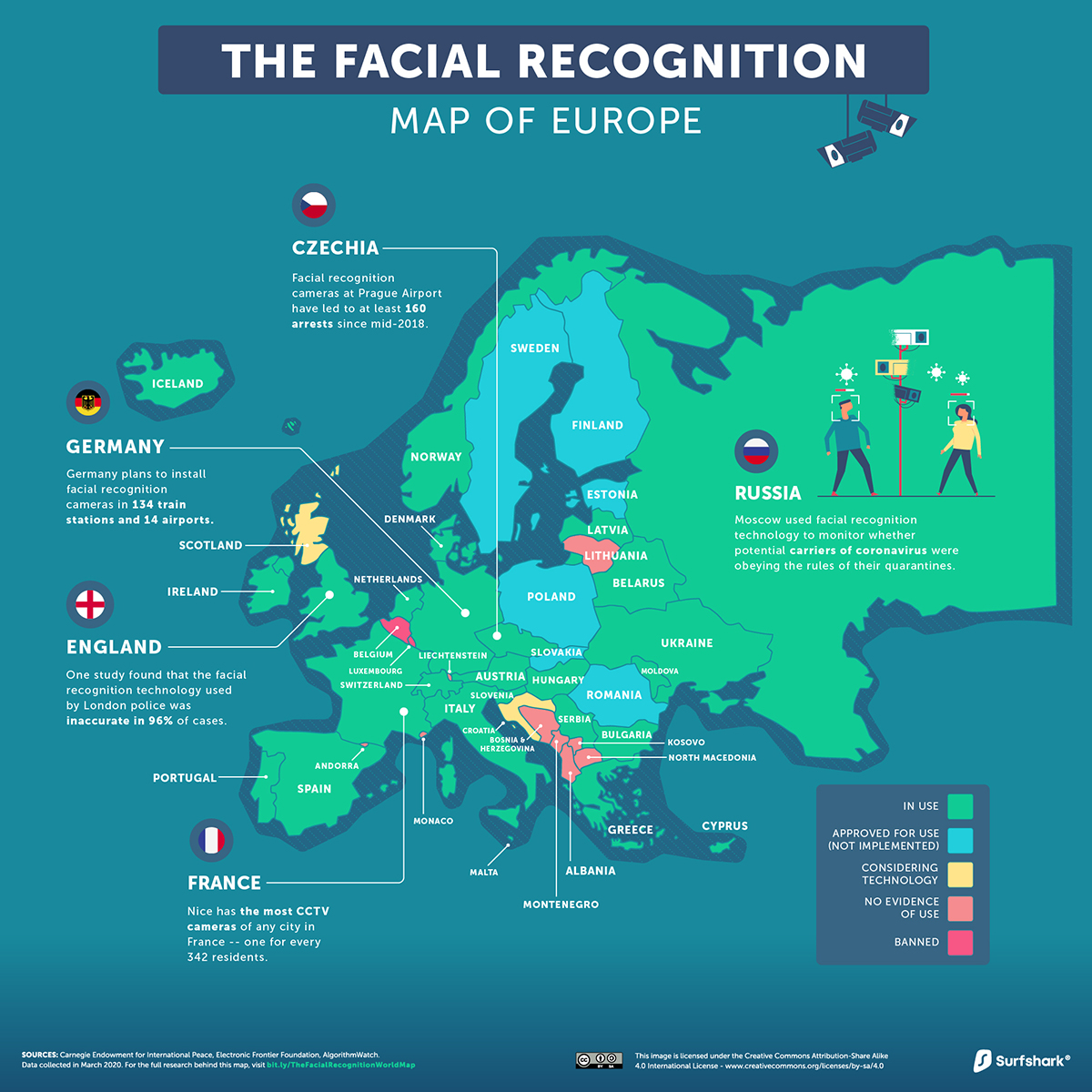

Europe

Belgium and Luxembourg are two of only three governments in the world to officially oppose the use of facial recognition technology.

Further, 80% of Europeans are not keen on sharing facial data with authorities. Despite such negative sentiment, it’s still in use across 26 European countries to date. —European Digital Rights (EDRi) In Russia, authorities have relied on facial recognition technology to check for breaches of quarantine rules by potential COVID-19 carriers. In Moscow alone, there are reportedly over 100,000 facial recognition enabled cameras in operation.

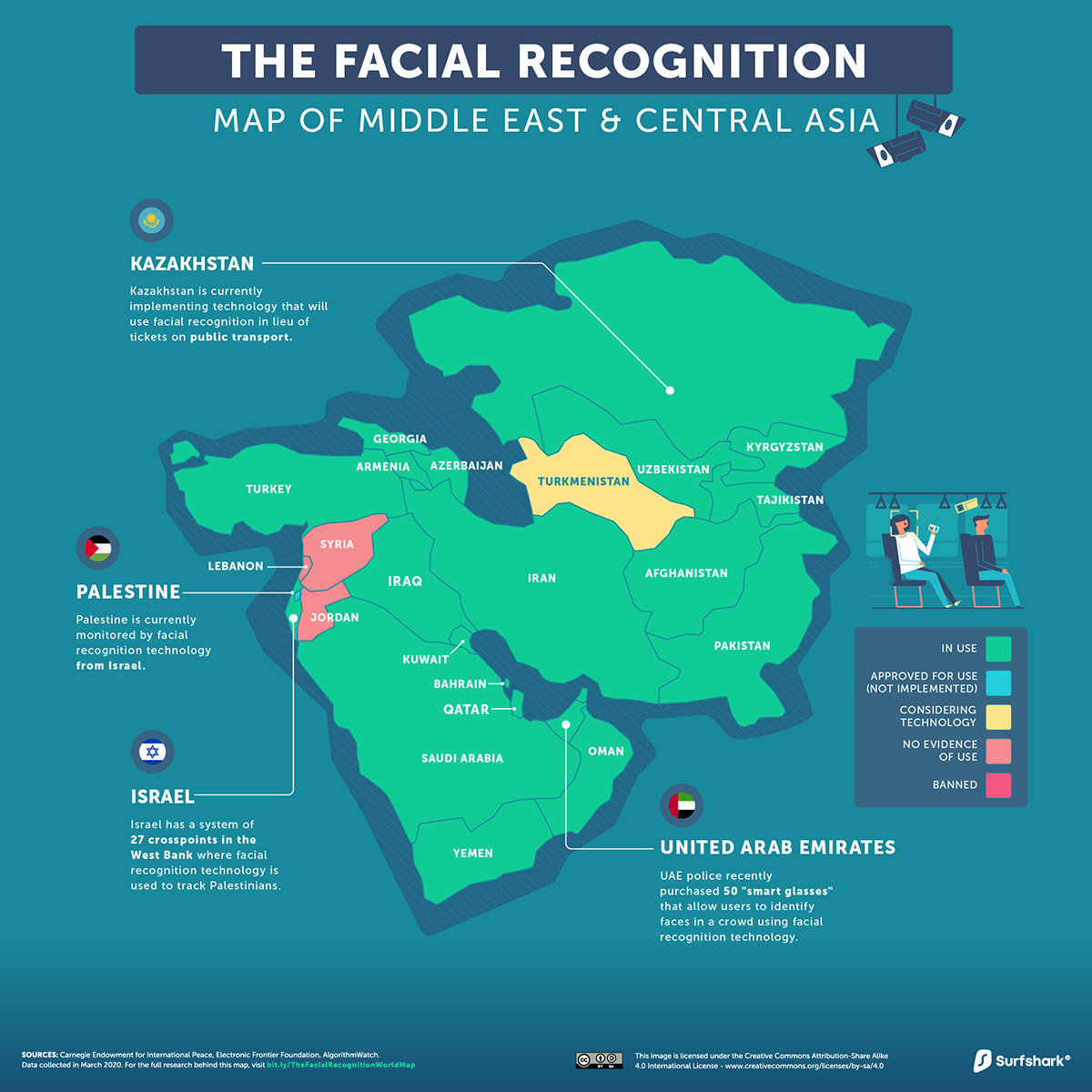

Middle East and Central Asia

Facial recognition technology is widespread in this region, notably for military purposes.

In Turkey, 30 domestically-developed kamikaze drones will use AI and facial recognition for border security. Similarly, Israel has a close eye on Palestinian citizens across 27 West Bank checkpoints. In other parts of the region, police in the UAE have purchased discreet smart glasses that can be used to scan crowds, where positive matches show up on an embedded lens display. Over in Kazakhstan, facial recognition technology could replace public transportation passes entirely.

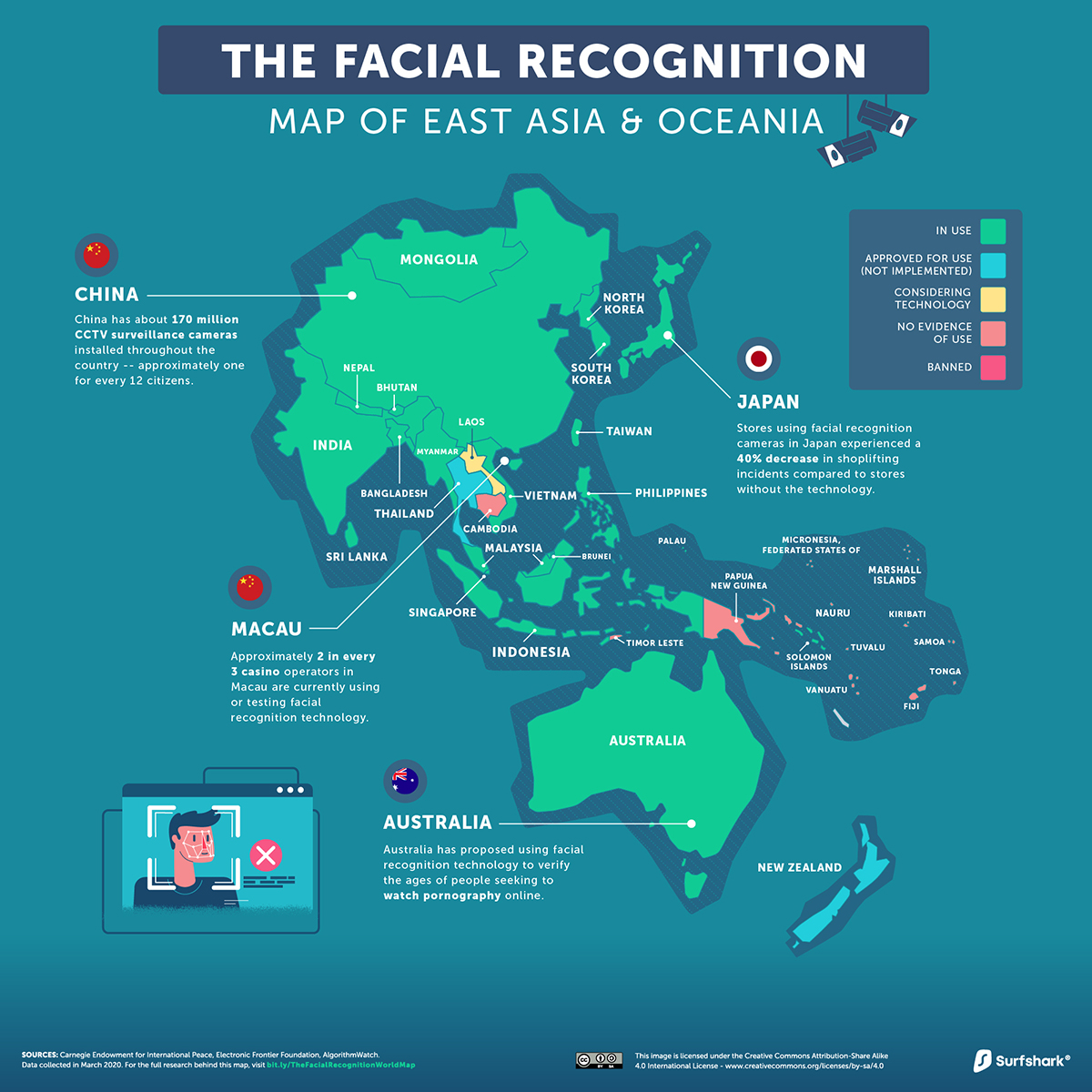

East Asia and Oceania

In the COVID-19 battle, contact tracing through biometric identification became a common tool to slow the infection rates in countries such as China, South Korea, Taiwan, and Singapore. In some instances, this included the use of facial recognition technology to monitor temperatures as well as spot those without a mask.

That said, questions remain about whether the pandemic panopticon will stop there. China is often cited as a notorious use case of mass surveillance, and the country has the highest ratio of CCTV cameras to citizens in the world—one for every 12 people. By 2023, China will be the single biggest player in the global facial recognition market. And it’s not just implementing the technology at home–it’s exporting too.

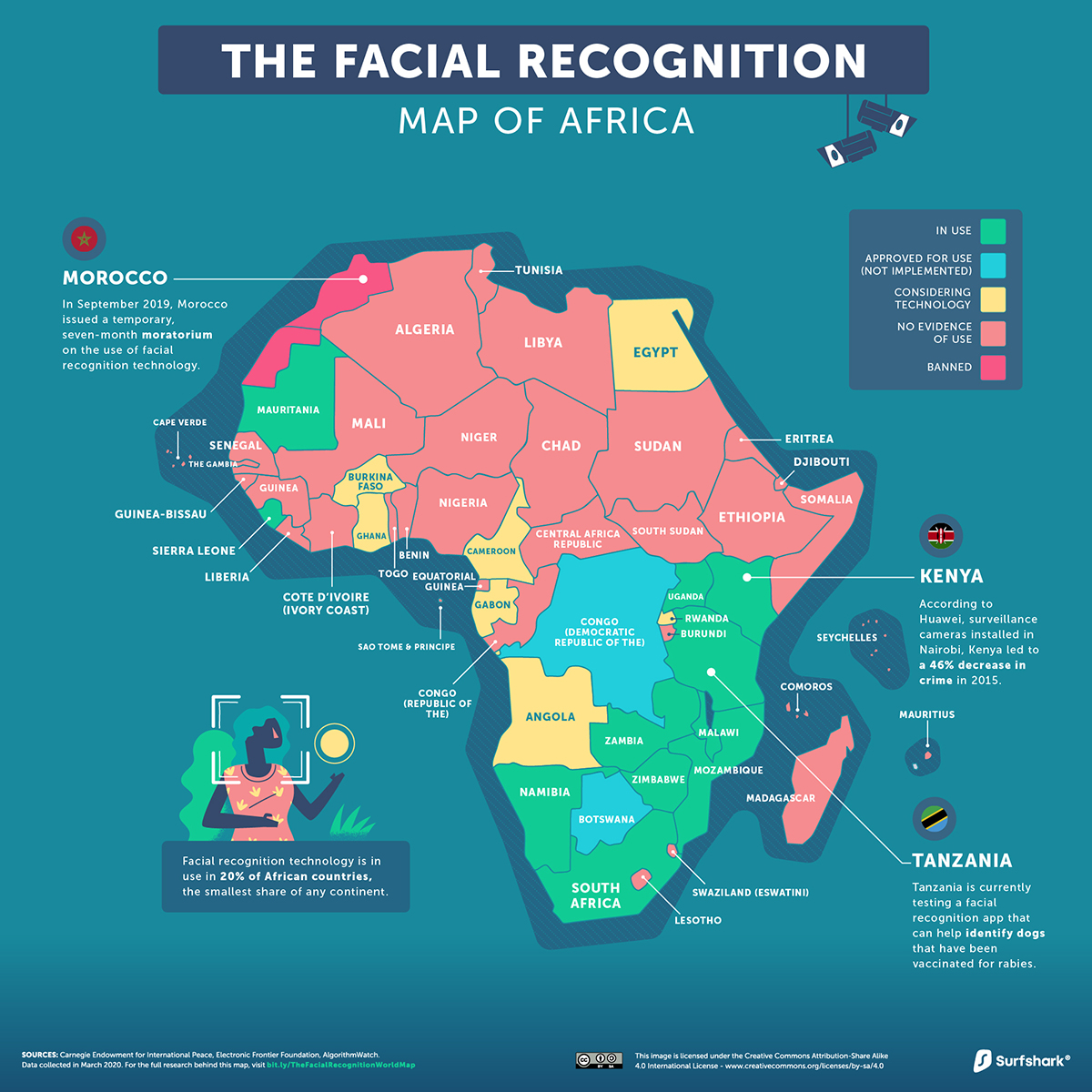

Africa

While the African continent currently has the lowest concentration of facial recognition technology in use, this deficit may not last for long.

Several African countries, such as Kenya and Uganda, have received telecommunications and surveillance financing and infrastructure from Chinese companies—Huawei in particular. While the company claims this has enabled regional crime rates to plummet, some activists are wary of the partnership. Whether you approach facial recognition technology from public and national security lens or from an individual liberty perspective, it’s clear that this kind of surveillance is here to stay. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.