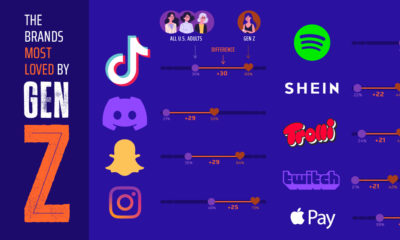

The Axios Harris Poll polled a nationally representative sample of nearly 43,000 Americans to find out which 100 companies emerge as top of mind—for better or for worse.

How is Brand Reputation Measured?

The polling process started by asking respondents which two companies they felt excelled or faltered in the U.S.—in other words, which companies were the most “visible” in their eyes. The top 100 brands that emerged from this framework were then judged by poll respondents across seven dimensions, over three key pillars:

Character Includes a company’s culture, ethics, and citizenship (whether a consumer shares a company’s values or the company supports good causes) Trajectory Includes a company’s growth prospects, vision for the future, and product and service offerings (whether they are innovative, and of high quality) Trust Does a consumer trust the brand in the first place?

Once these dimensions are taken into account, the final scores portray how these “visible brands” rank in terms of their reputation among a representative sample of Americans:

Score range: 80.0 and above Reputation: Excellent Score range: 75.0-79.9 Reputation: Very Good Score range: 70.0-74.9 Reputation: Good Score range: 65.0-69.9 Reputation: Fair Score range: 64.9 and below Reputation: Poor

Companies with a Very Poor reputation (a score below 50) didn’t make it into the list. Here’s how the 100 most visible companies stack up in terms of brand reputation: While the ranking itself highlights well-respected and poorly-viewed brands overall, another perspective is to look at which brands shot up in the list, and which ones plummeted.

Fastest Risers in Brand Reputation

Unwavering and bold commitments to the environment has helped Patagonia to top the charts as the #1 brand, rising 31 ranks since 2020. From funneling 1% of sales into environmental donations to ensuring ethical supply chains, Patagonia’s culture, ethics, and citizenship all align with its business model in consumers’ eyes. With over 33 million COVID-19 vaccine doses administered daily around the world, Pfizer’s contribution to the ongoing immunization progress is undeniable. As a result, its overall ranking has swelled by 54 places since 2020. Dollar General might seem like a surprising addition to this table, but in terms of sheer growth, discount stores are thriving. Across America, dollar stores are opening at a rate of three per day, faster than any Starbucks or McDonalds. There’s a crucial reason for this: in many rural areas, millions rely on dollar stores for food and other essentials, as the nearest grocery store can be nearly an hour’s drive away.

Biggest Decliners in Brand Reputation

Despite steady revenue growth, Google is among a handful of Big Tech companies whose reputations are backsliding, dropping 36 places in the past year. The outsize power and influence these companies hold is increasingly coming under regulatory scrutiny.

Building a Brand Reputation Doesn’t Come Easy

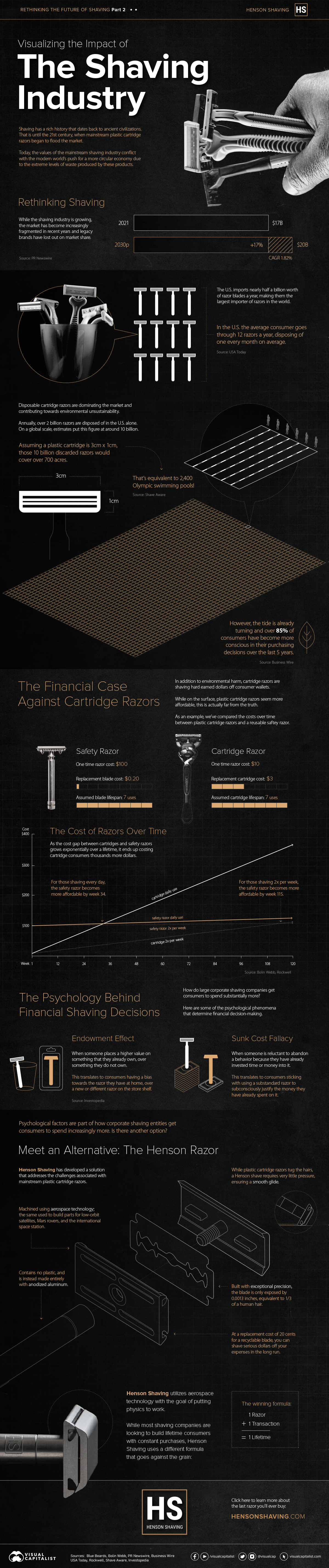

Near the bottom of the 100 companies leaderboard, the struggles of mainstream media and modern information dissemination are strongly reflected. Despite their diverse audiences and established histories, brand reputations of both Facebook and Fox News have eroded in recent years. This example highlights how the nature of a brand’s reputation can evolve over time. Building a strong and reputable brand may be subjective, but its effects on consumer loyalty are powerful. on This graphic from Henson Shaving shows how mainstream plastic cartridge razors conflict with expectations of the modern world by being huge contributors to pollution. The data also suggests that consumers could significantly benefit from switching over to using a safety razor. Let’s dive in.

Rethinking Shaving

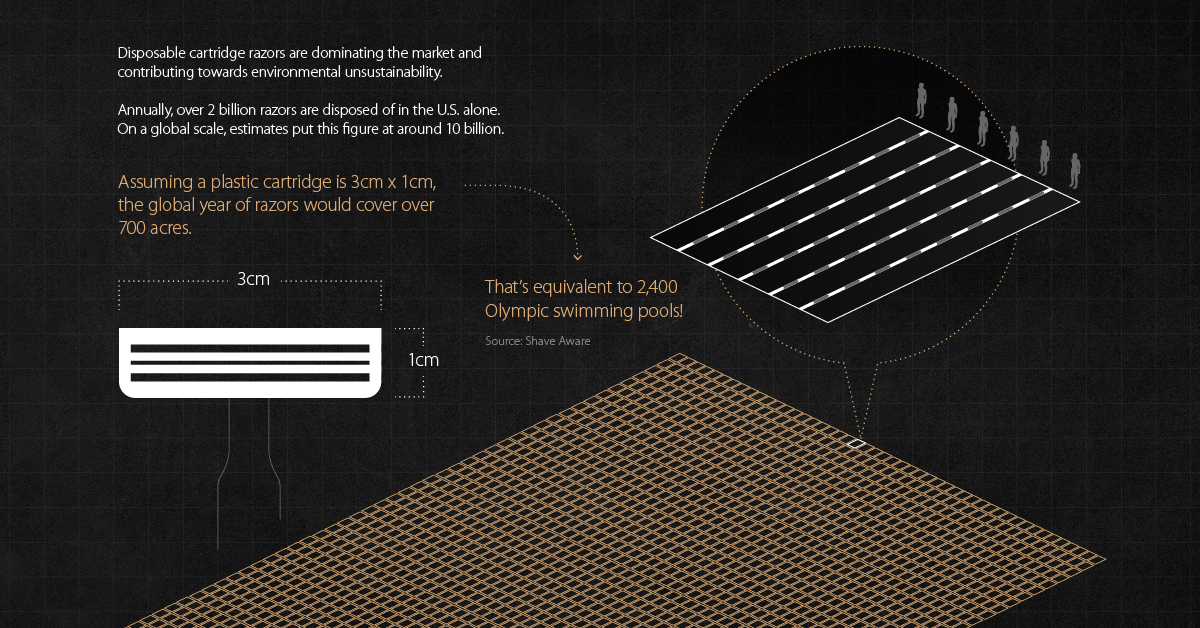

The shaving industry is dominated by several corporate entities that rake in billions of dollars every year. In fact, the majority of razors on the market today are optimized for profit rather than sustainability and affordability. The industry was worth $17 billion in 2021 and is poised to grow by 17%, reaching $20 billion by 2030. Within this large market, the U.S. is a key player. The country imports over half a billion razors a year—more than any other country. Overall, U.S. shavers go through 2 billion razors a year, which is roughly 12 per consumer on average. How much waste does this create? As it turns out, quite a lot. The 2 billion razors discarded annually cover an area of 700 acres—assuming the average disposable cartridge razor (without a handle) has a dimension of about 3 cm by 1 cm. To put that into context, that’s 2,400 Olympic sized swimming pools.

The Financial Case Against Cartridge Razors

The other inefficiency involves consumer wallets. While on the surface disposable cartridge razors seem more affordable, this is far from the truth. While cartridge razors have a cheaper cost up front, they become more expensive incrementally over time. In fact, most consumers do not detect this, but they may actually end up paying 5-10 times more than safety razors over their lifetime. On the other hand, safety razors require a larger upfront investment, but become progressively cheaper over the months and years. How is this possible? A cartridge razor costs between $2-4 in most markets, while a safety razor blade is a fraction of that at around 10-20 cents. What’s more, both typically last last for an average of 7 shaves. We can better understand the total cost of ownership associated with shaving by looking at the costs over a few years. Eventually, daily shavers see safety razors become cheaper at the 35th week, while those who shave twice a week recognize the savings around week 115. But given people spend an average of 3,000 hours in a lifetime shaving, the compounding effect translates into huge cost savings for the consumer no matter how often they shave.

The Psychology Behind Financial Shaving Decisions

There are several psychological phenomena at play that shape the financial decision making behind shaving. First the endowment effect, which is when consumers place a higher perceived value on an item they own, over something they don’t. The endowment effect states that we assign a positive psychological bias to our possessions. For shaving, this means consumers are more likely to have a positive view towards their own razor over alternatives. Next, is the sunk cost fallacy, which suggests that people are reluctant to abandon a behavior if they have already invested time or money into it. For shavers, this may mean sticking to a substandard shaving method or product because time or money has been spent acquiring the item, thus making us reluctant to change and accept potentially better ways. These psychological factors are part of how the large corporate shaving companies build profitable lifetime consumers—but it’s time for change.

Meet an Alternative: The Henson Razor

There’s evidence to suggest the modern day cartridge razors can lead to suboptimal outcomes for your wallet and the environment at large. The Henson razor addresses these challenges head on.

Made with anodized aluminum, contains zero plastic.Machined using aerospace technology.Exceptional precision, blades exposed to .0013 inches, equivalent to 1/3 of a human hair.Affordably priced, replacement blades cost 10-20 cents.

Henson Shaving is going against the grain by selling one razor for one consumer to last a lifetime.

Learn more about the last razor you’ll ever buy with Henson Shaving.