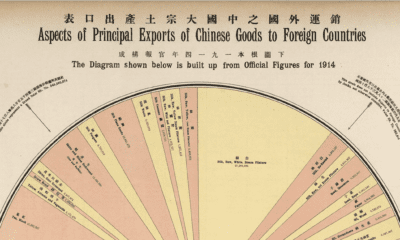

In late 2020, the Regional Comprehensive Economic Partnership (RCEP) was signed, officially creating the biggest trade bloc in history. Here, we break down everything you need to know about it, from who’s involved to its implications.

Who’s in the RCEP, and Why Was it Created?

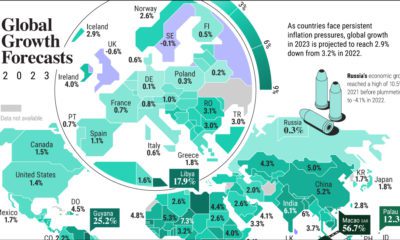

The RCEP is a free trade agreement between 15 nations in the Asia-Pacific region, and has been formalized after 28 rounds of discussion over eight years. Member nations who are a part of the RCEP will benefit from lowered or completely eliminated tariffs on imported goods and services within the region in the next 20 years. Here are the countries which have signed on to be member nations: Source: IMF But there is still some work to do to bring the trade agreement into full effect. Signing the agreement, the step taken in late 2020, is simply an initial show of support for the trade agreement, but now it needs to be ratified. That means these nations still have to give their consent to be legally bound to the terms within the RCEP. Once the RCEP is ratified by three-fifths of its signatories—a minimum of six ASEAN nations and three non-ASEAN nations—it will go ahead within 60 days. So far, it’s been ratified by China, Japan, Thailand, and Singapore as of April 30, 2021. At its current pace, the RCEP is set to come into effect in early 2022 as all member nations have agreed to complete the ratification process within the year. Interestingly, in the midst of negotiations in 2019, India pulled out of the agreement. This came after potential concerns about the trade bloc’s impacts on its industrial and agricultural sectors that affect the “lives and livelihoods of all Indians”. India retains the option to rejoin the RCEP in the future, if things change.

The Biggest Trading Blocs, Compared

When we say the Regional Comprehensive Economic Partnership is the biggest trade bloc in history, this statement is not hyperbole. The RCEP will not only surpass existing Asia-Pacific trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in size and scope, but also other key regional partnerships in advanced economies. This includes the European Union and the U.S.-Mexico-Canada Agreement (USMCA, formerly known as NAFTA). How does the trio stack up? With the combined might of its 15 signatories, the RCEP accounts for approximately 30% of global GDP and population. Interestingly, the total population covered within the RCEP is near or over five times that of the other trade blocs. Another regional agreement not covered here is the African Continental Free Trade Area (AfCFTA), which is now the largest in terms of participating countries (55 in total), but in the other metrics, the RCEP still emerges superior.

Implications of the Regional Comprehensive Economic Partnership

The potential effects of the RCEP are widespread. Among others, the agreement will establish rules for the region around:

Investment Competition E-commerce Intellectual property Telecommunications

However, there are some key exclusions that have raised critics’ eyebrows. These are:

Labor union provisions Environmental protection Government subsidies

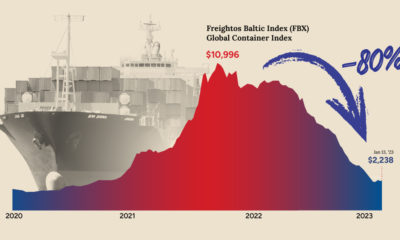

The RCEP could also help China gain even more ground in its economic race against the U.S. towards becoming a global superpower. Last, but most importantly, Brookings estimates that the potential gains from the RCEP are in the high billions: $209 billion could be added annually to world incomes, and $500 billion may be added to world trade by 2030. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.