Businesses, too, face rapidly changing environments and associated risks that they need to adapt to—or risk falling behind. These can range from supply chain issues due to shipping blockages, to disruptions from natural catastrophes. As countries and companies continue to grapple with the effects of the pandemic, nearly 3,000 risk management experts were surveyed for the Allianz Risk Barometer, uncovering the top 10 business risks that leaders must watch out for in 2021.

The Top 10 Business Risks: The Pandemic Trio Emerges

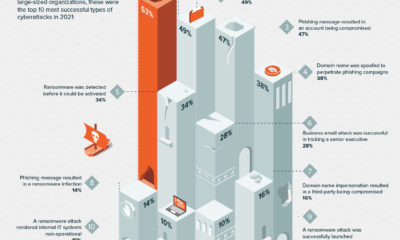

Business Interruption tops the charts consistently as the biggest business risk. This risk has slotted into the #1 spot seven times in the last decade of the survey, showing it has been on the minds of business leaders well before the pandemic began. However, that is not to say that the pandemic hasn’t made awareness of this risk more acute. In fact, 94% of surveyed companies reported a COVID-19 related supply chain disruption in 2020. Note: Figures do not add to 100% as respondents could select up to three risks per industry. Pandemic Outbreak, naturally, has climbed 15 spots to become the second-most significant business risk. Even with vaccine roll-outs, the uncontrollable spread of the virus and new variants remain a concern. The third most prominent business risk, Cyber Incidents, are also on the rise. Global cybercrime already causes a $1 trillion drag on the economy—a 50% jump from just two years ago. In addition, the pandemic-induced rush towards digitalization leaves businesses increasingly susceptible to cyber incidents.

Other Socio-Economic Business Risks

The top three risks mentioned above are considered the “pandemic trio”, owing to their inextricable and intertwined effects on the business world. However, these next few notable business risks are also not far behind. Globally, GDP is expected to recover by +4.4% in 2021, compared to the -4.5% contraction from 2020. These Market Developments may also see a short-term 2 percentage point increase in GDP growth estimates in the event of rapid and successful vaccination campaigns. In the long term, however, the world will need to contend with a record of $277 trillion worth of debt, which may potentially affect these economic growth projections. Rising insolvency rates also remain a key post-COVID concern. Persisting traditional risks such as Fires and Explosions are especially damaging for manufacturing and industry. For example, the August 2020 Beirut explosion caused $15 billion in damages. What’s more, Political Risks And Violence have escalated in number, scale, and duration worldwide in the form of civil unrest and protests. Such disruption is often underestimated, but insured losses can add up into the billions.

No Such Thing as a Risk-Free Life

The risks that businesses face depend on a multitude of factors, from political (in)stability and growing regulations to climate change and macroeconomic shifts. Will a post-pandemic world accentuate these global business risks even further, or will something entirely new rear its head? on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.