Created in 1913, Henry Ford’s assembly line greatly reduced the time it took to build a car. This also made cars more affordable, and America’s automotive industry quickly became the largest in the world. As we can see in the chart above, this dominance wouldn’t last forever. From a high of nearly 10 million cars per month in the 1970s, the U.S. produced just 1.4 million in June 2021. Here are some reasons for why the country produces a fraction of the cars it used to.

Global Competition

America’s Big Three (Ford, GM, and Chrysler*) have been unable to defend their market share from overseas competitors. The following table shows how Honda and Toyota were able to break into the U.S. market over a span of just five decades. *Chrysler is now a part of Stellantis N.V., a multinational corporation. Source: WardsAuto The 1970s presented an incredible opportunity for Honda and Toyota, which at the time were known for producing smaller, more fuel-efficient cars. First was the Clean Air Act of 1970, which imposed limits on the amount of emissions a car could produce. Then came the 1973 oil crisis, which caused a massive spike in gasoline prices. As consumers switched to smaller cars, American brands struggled to compete. For example, the flawed design of the Ford Pinto (Ford’s first subcompact car) was exposed in 1972 after one exploded in a rear-end collision. The ensuing lawsuit, Grimshaw v. Ford Motor Company, undoubtedly left a stain on the automaker’s reputation.

Production Moves to Mexico

2018 was a controversial year for GM as it came under fire by the Trump administration for closing four of its U.S. plants. That same year, GM became Mexico’s biggest automaker. The decision to outsource is well-founded from a business standpoint. Mexico offers cheaper labor, lower taxes, and close proximity for logistics. Altogether, these benefits add up to roughly $1,200 in savings per car. It’s important to note that GM isn’t alone in this decision. BMW, Ford, and many others have also invested in Mexico to produce cars destined for the United States.

Shifts in the Market

There are other, less obvious factors to consider too. Modern cars are much more reliable, meaning Americans don’t need to purchase a new one as often. 2020 marks four consecutive years of increase for the average vehicle age in the U.S., which now sits at 12 years old. Rising car prices could also be playing a part. The average price of a new car was $41,000 as of July 2021, up from around $35,700 in May 2018.

Can U.S. Car Production Make a Comeback?

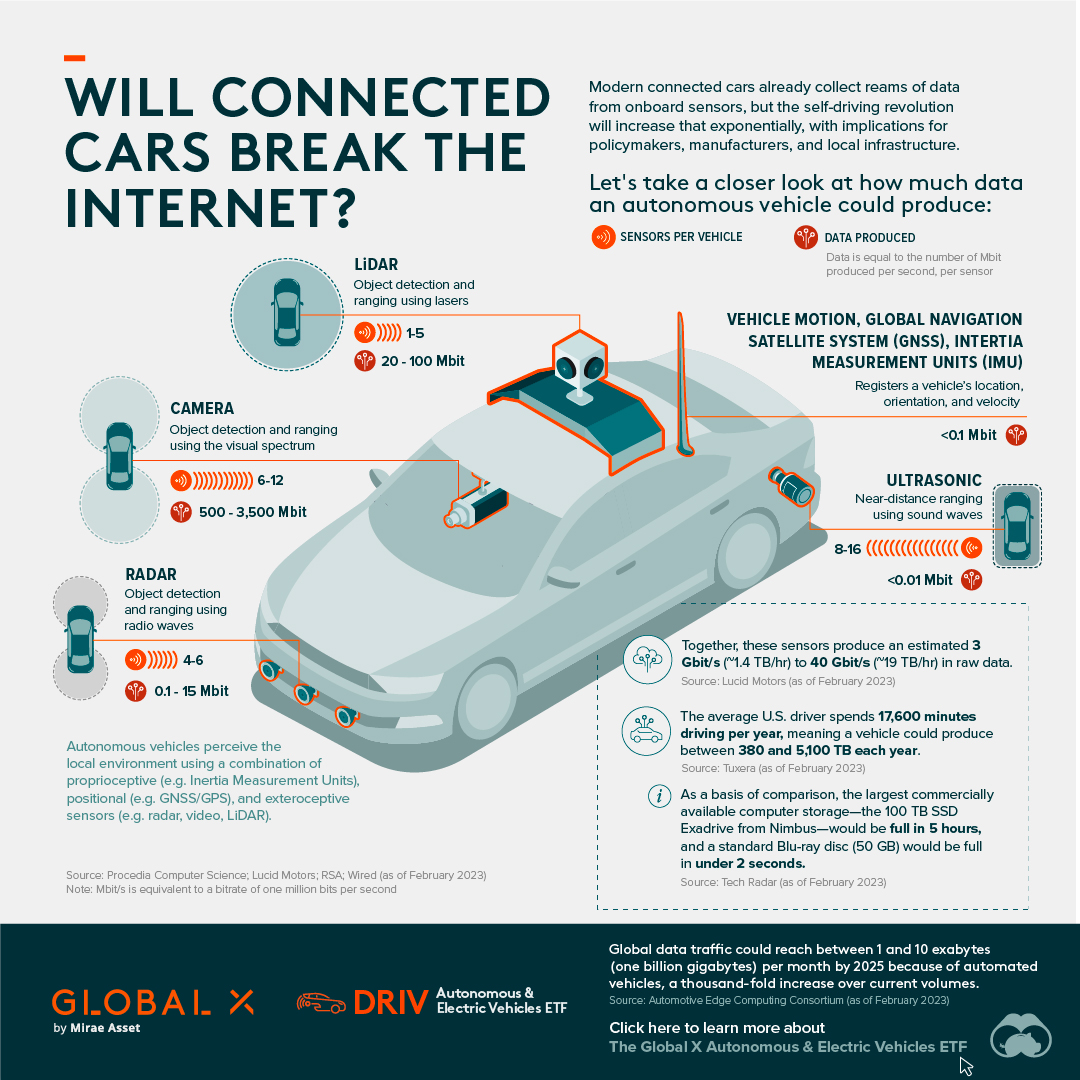

Recent events are a grim reminder of the direction U.S. car production is heading. As part of its plant closures, GM shuttered its Lordstown facility in 2019. This broke a 2008 agreement in which GM pledged to keep 3,700 employees at the location through 2028. The company had received over $60 million in tax credits as part of this deal, and $28 million was ordered to be paid back. COVID-19 has presented further issues, such as the ongoing chip shortage which has impacted the production of more than 1 million U.S.-made vehicles. Not all hope is lost, however. Tesla now employs over 70,000 Americans across its production facilities in California, Nevada, New York, and soon, Texas. The company is joined by Lucid Motors and Rivian, two entrants into the EV industry that have both opened U.S. plants in 2021. on Today’s connected cars come stocked with as many as 200 onboard sensors, tracking everything from engine temperature to seatbelt status. And all those sensors create reams of data, which will increase exponentially as the autonomous driving revolution gathers pace. With carmakers planning on uploading 50-70% of that data, this has serious implications for policymakers, manufacturers, and local network infrastructure. In this visualization from our sponsor Global X ETFs, we ask the question: will connected cars break the internet?

Data is a Plural Noun

Just how much data could it possibly be? There are lots of estimates out there, from as much as 450 TB per day for robotaxis, to as little as 0.383 TB per hour for a minimally connected car. This visualization adds up the outputs from sensors found in a typical connected car of the future, with at least some self-driving capabilities. The focus is on the kinds of sensors that an automated vehicle might use, because these are the data hogs. Sensors like the one that turns on your check-oil-light probably doesn’t produce that much data. But a 4K camera at 30 frames a second, on the other hand, produces 5.4 TB per hour. All together, you could have somewhere between 1.4 TB and 19 TB per hour. Given that U.S. drivers spend 17,600 minutes driving per year, a vehicle could produce between 380 and 5,100 TB every year. To put that upper range into perspective, the largest commercially available computer storage—the 100 TB SSD Exadrive from Nimbus—would be full in 5 hours. A standard Blu-ray disc (50 GB) would be full in under 2 seconds.

Lag is a Drag

The problem is twofold. In the first place, the internet is better at downloading than uploading. And this makes sense when you think about it. How often are you uploading a video, versus downloading or streaming one? Average global mobile download speeds were 30.78 MB/s in July 2022, against 8.55 MB/s for uploads. Fixed broadband is much higher of course, but no one is suggesting that you connect really, really long network cables to moving vehicles.

Ultimately, there isn’t enough bandwidth to go around. Consider the types of data traffic that a connected car could produce:

Vehicle-to-vehicle (V2V) Vehicle-to-grid (V2G) Vehicles-to-people (V2P) Vehicles-to-infrastructure (V2I) Vehicles-to-everything (V2E)

The network just won’t be able to handle it.

Moreover, lag needs to be relatively non-existent for roads to be safe. If a traffic camera detects that another car has run a red light and is about to t-bone you, that message needs to get to you right now, not in a few seconds.

Full to the Gunwales

The second problem is storage. Just where is all this data supposed to go? In 2021, total global data storage capacity was 8 zettabytes (ZB) and is set to double to 16 ZB by 2025.

One study predicted that connected cars could be producing up to 10 exabytes per month, a thousand-fold increase over current data volumes.

At that rate, 8 ZB will be full in 2.2 years, which seems like a long time until you consider that we still need a place to put the rest of our data too.

At the Bleeding Edge

Fortunately, not all of that data needs to be uploaded. As already noted, automakers are only interested in uploading some of that. Also, privacy legislation in some jurisdictions may not allow highly personal data, like a car’s exact location, to be shared with manufacturers.

Uploading could also move to off-peak hours to even out demand on network infrastructure. Plug in your EV at the end of the day to charge, and upload data in the evening, when network traffic is down. This would be good for maintenance logs, but less useful for the kind of real-time data discussed above.

For that, Edge Computing could hold the answer. The Automotive Edge Computing Consortium has a plan for a next generation network based on distributed computing on localized networks. Storage and computing resources stay closer to the data source—the connected car—to improve response times and reduce bandwidth loads.

Invest in the Future of Road Transport

By 2030, 95% of new vehicles sold will be connected vehicles, up from 50% today, and companies are racing to meet the challenge, creating investing opportunities.

Learn more about the Global X Autonomous & Electric Vehicles ETF (DRIV). It provides exposure to companies involved in the development of autonomous vehicles, EVs, and EV components and materials.

And be sure to read about how experiential technologies like Edge Computing are driving change in road transport in Charting Disruption. This joint report by Global X ETFs and the Wall Street Journal is also available as a downloadable PDF.