The size of the bitcoin market may still be microscopic when contrasted with other global markets, but that hasn’t stopped the eight-year-old cryptocurrency, as well as the surrounding blockchain ecosystem, from evolving. As Bitcoin Magazine points out in its article accompanying this infographic: The blockchain, which is the technological infrastructure behind how Bitcoin transactions work, is now much more heralded in many circles than the original cryptocurrency itself. That’s because it is now clear how the blockchain can be further applied to many other disciplines, including payments, trading assets digitally, identity management, data verification, and smart contracts. Venture capital has continued to pour into the sector to untap this potential. In 2015 alone, companies focused on Bitcoin or the blockchain raised over $1 billion. Meanwhile, 2016 has already seen notable investments in companies like Augur, a decentralized prediction market, or Ethereum, a smart contract and publishing platform. As of today, than 65 banks and financial institutions have made investments in the industry in a wide range of businesses and ideas. We pointed out in last week’s chart that mentions of “Bitcoin” have decreased by 61% in Y Combinator applications, which does raise a potential concern for the development of future Bitcoin and blockchain technology. Less startups focusing on the applications of the blockchain could be a sign of a slowdown, but it could also be temporary. Any significant breakthrough, like the anticipated success of OpenBazaar, could tip the scales back in favor again. Even despite this potential setback, Bitcoin has always done well in the face of adversity. It was the top performing currency of 2015, and recently the bitcoin price has soared to 21-month highs after a recent four-day rally of 21%. Based on this, it would seem that the blockchain ecosystem, including Bitcoin, is still alive and well. on It takes an estimated 1,449 kilowatt hours (kWh) of energy to mine a single bitcoin. That’s the same amount of energy an average U.S. household consumes in approximately 13 years. Given the high amount of energy needed to mine bitcoin, it can be a costly venture to get into. But exact prices fluctuate, depending on the location and the cost of electricity in the area. Where are the cheapest and most expensive places to mine this popular cryptocurrency? This graphic by 911 Metallurgist provides a snapshot of the estimated cost of mining bitcoin around the world, using pricing and relative costs from March 23, 2022.

How Does Bitcoin Mining Work?

Before diving in, it’s worth briefly explaining the basics of bitcoin mining, and why it requires so much energy. When someone mines for bitcoin, what they’re really doing is adding and verifying a new transaction record to the blockchain—the decentralized bank ledger where bitcoin is traded and distributed. To create this new record, crypto miners need to crack a complex equation that’s been generated by the blockchain system. Potentially tens of thousands of miners are racing to crack the same code at any given time. Only the first person to solve the equation gets rewarded (unless you’re part of a mining pool, which is essentially a group of miners who agree to combine efforts to increase their chances of solving the equation). The faster your computing power is, the better your chances are of winning, so solving the equation first requires powerful equipment that takes up a lot of energy.

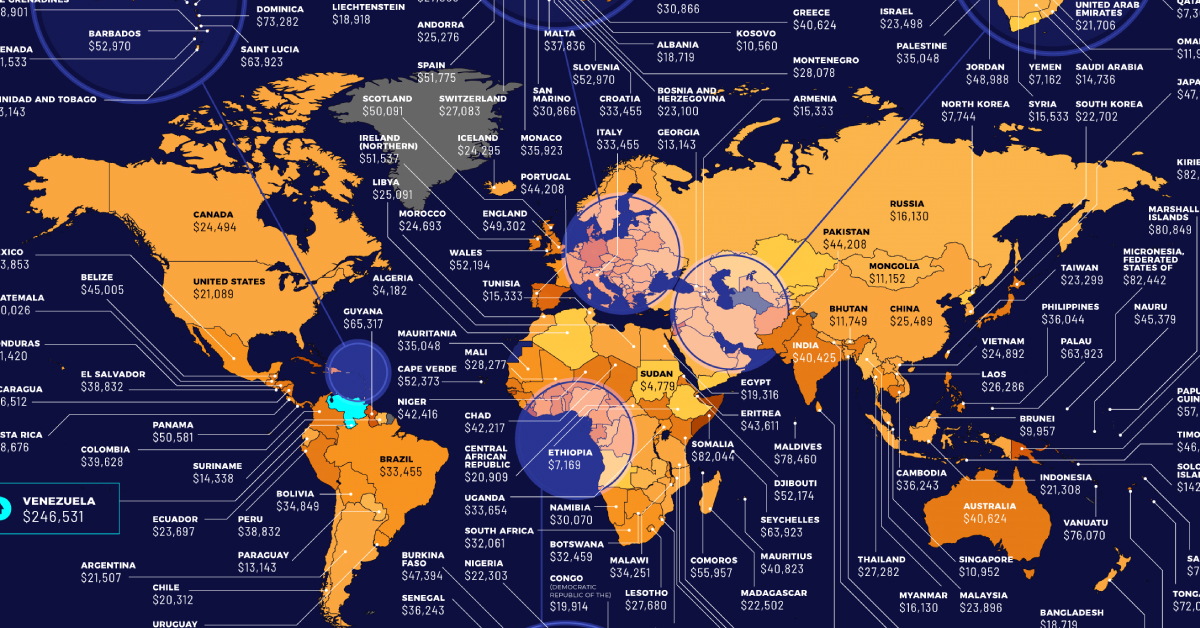

The Costs and Profits of Mining Bitcoin in 198 Countries

Across the 198 countries included in the dataset, the average cost to mine bitcoin sat at $35,404.03, more than bitcoin’s value of $20,863.69 on July 15, 2022. Though it’s important to note that fluctuating energy prices, and more or less miners on the bitcoin network, constantly change the necessary energy and final cost.

Here’s a breakdown of what the cost to mine one bitcoin in each country was in March 23, 2022, along with the potential profit after accounting for mining costs:

Venezuela ranks as the number one most expensive country to mine bitcoin. It costs a whooping $246,530.74 to mine a single bitcoin in the South American country, meaning the process is far from profitable. Energy costs are so expensive in the country that miners would be out $225,667.05 for just one bitcoin.

On the opposite end of the spectrum, the cheapest place to mine bitcoin is in Kuwait. It costs $1,393.95 to mine a single bitcoin in Kuwait, meaning miners could gain $19,469.74 in profits.

The Middle Eastern country has some of the cheapest electricity in the world, with one kWh costing an average of just 3 cents. For context, the average cost of one kWh in North America is 21 cents.

The Race is On

Despite the steep costs of bitcoin mining, many people believe it’s worth the upfront investment. One thing that makes bitcoin particularly appealing is its finite supply—there are only 21 million coins available for mining, and as of this article’s publication, more than 19 million bitcoin have already been mined. While the price of bitcoin (BTC) is notorious for its volatility, its value has still grown significantly over the last decade. And if cryptocurrencies become mainstream as many people believe they will, this could boost the price of bitcoin even further.