As the global economy slows and eventually begins to retract, can precious metals offer a useful store of value to investors?

Part 1: The Start of a New Cycle

Today’s infographic comes to us from Endeavour Silver, and it outlines some key indicators that precede a coming gold-silver cycle in which exposure to hard assets may help to protect wealth.

Bankers Blowing Bubbles

Since 2008, central bankers around the world launched a historic market intervention by printing money and bailing out major banks. With cheap and abundant money, this strategy worked so well that it created a bull market in every sector — except for precious metals. Stock markets, consumer lending, and property values surged. Meanwhile, the U.S. Federal Reserve’s assets ballooned, and so did corporate, government, and household debt. By 2018, total debt reached almost $250 trillion worldwide.

Currency vs. Precious Metals

The world awash in unprecedented amounts of currency, and these dollars chase a limited supply of goods. Historically speaking, it’s only a matter of time before the price of goods increases or inflates – eroding the purchasing power of every dollar. Gold and silver are some of the only assets unaffected by inflation, retaining their value. – J.P. Morgan

The Perfect Story for a Gold-Silver Cycle?

Investors can use several indicators to gauge the beginning of the gold-silver cycle:

The Price of Gold and Silver

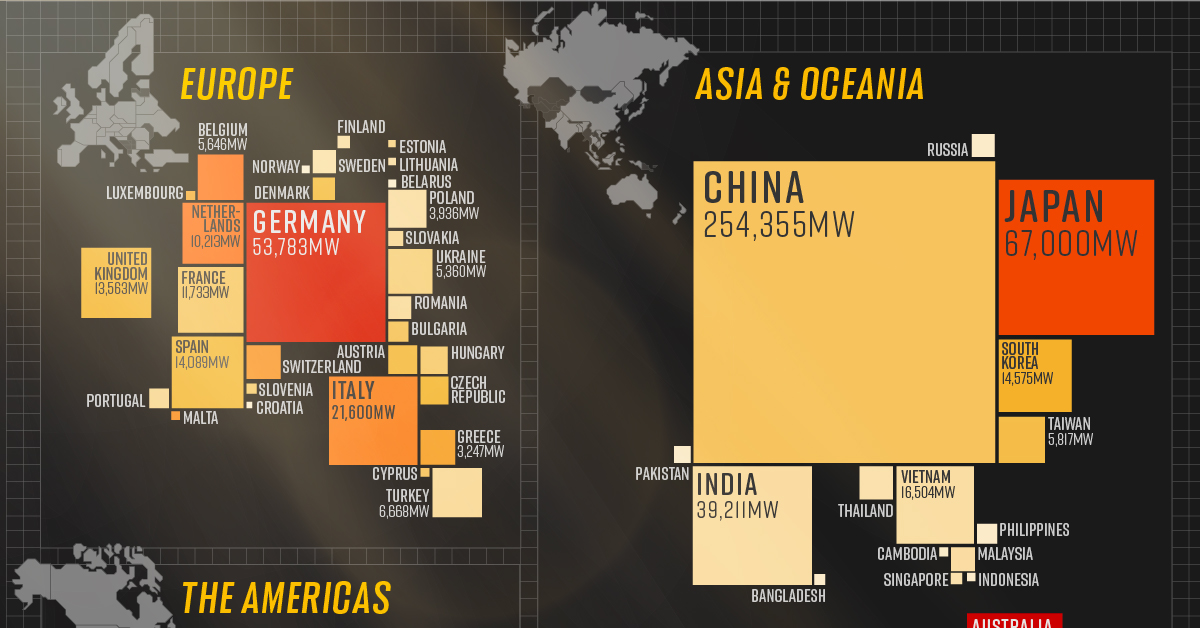

Forecasting the exact price of gold and silver is not a science, but there are clear signs that point to the direction their prices will head. The prices of gold and silver do not accurately reflect a world awash with cheap and easy money, but now may be their time to shine. Typically, speculators are long and commercial traders are short the price of gold and silver. However, when speculators and commercial traders positions reach near zero, there is usually a big upswing in the price of silver. Don’t miss another part of the Silver Series by connecting with Visual Capitalist. on The world is adopting renewable energy at an unprecedented pace, and solar power is the energy source leading the way. Despite a 4.5% fall in global energy demand in 2020, renewable energy technologies showed promising progress. While the growth in renewables was strong across the board, solar power led from the front with 127 gigawatts installed in 2020, its largest-ever annual capacity expansion. The above infographic uses data from the International Renewable Energy Agency (IRENA) to map solar power capacity by country in 2021. This includes both solar photovoltaic (PV) and concentrated solar power capacity.

The Solar Power Leaderboard

From the Americas to Oceania, countries in virtually every continent (except Antarctica) added more solar to their mix last year. Here’s a snapshot of solar power capacity by country at the beginning of 2021: *1 megawatt = 1,000,000 watts. China is the undisputed leader in solar installations, with over 35% of global capacity. What’s more, the country is showing no signs of slowing down. It has the world’s largest wind and solar project in the pipeline, which could add another 400,000MW to its clean energy capacity. Following China from afar is the U.S., which recently surpassed 100,000MW of solar power capacity after installing another 50,000MW in the first three months of 2021. Annual solar growth in the U.S. has averaged an impressive 42% over the last decade. Policies like the solar investment tax credit, which offers a 26% tax credit on residential and commercial solar systems, have helped propel the industry forward. Although Australia hosts a fraction of China’s solar capacity, it tops the per capita rankings due to its relatively low population of 26 million people. The Australian continent receives the highest amount of solar radiation of any continent, and over 30% of Australian households now have rooftop solar PV systems.

China: The Solar Champion

In 2020, President Xi Jinping stated that China aims to be carbon neutral by 2060, and the country is taking steps to get there. China is a leader in the solar industry, and it seems to have cracked the code for the entire solar supply chain. In 2019, Chinese firms produced 66% of the world’s polysilicon, the initial building block of silicon-based photovoltaic (PV) panels. Furthermore, more than three-quarters of solar cells came from China, along with 72% of the world’s PV panels. With that said, it’s no surprise that 5 of the world’s 10 largest solar parks are in China, and it will likely continue to build more as it transitions to carbon neutrality.

What’s Driving the Rush for Solar Power?

The energy transition is a major factor in the rise of renewables, but solar’s growth is partly due to how cheap it has become over time. Solar energy costs have fallen exponentially over the last decade, and it’s now the cheapest source of new energy generation. Since 2010, the cost of solar power has seen a 85% decrease, down from $0.28 to $0.04 per kWh. According to MIT researchers, economies of scale have been the single-largest factor in continuing the cost decline for the last decade. In other words, as the world installed and made more solar panels, production became cheaper and more efficient. This year, solar costs are rising due to supply chain issues, but the rise is likely to be temporary as bottlenecks resolve.