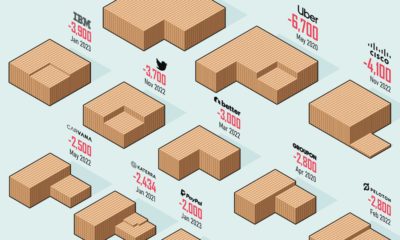

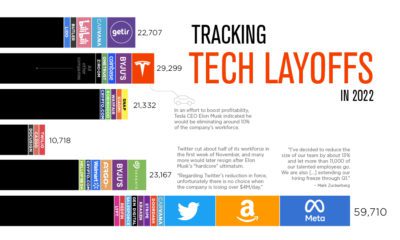

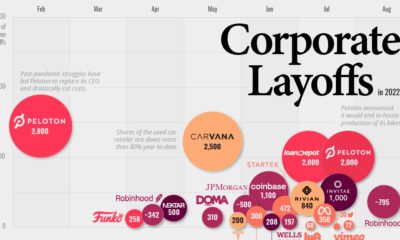

Since mid-March, countless startups and unicorns have undergone layoffs. Today’s infographic pulls data from Layoffs.fyi, and navigates the cascading layoffs across 30 of the most recognizable startups in America. Each of the companies have slashed over 250 employees between March 11 and May 26, 2020—capturing a snapshot of the continuing fallout of COVID-19.

Silicon Valley Takes a Hit

Unsurprisingly, many of the hardest hit startups are related to the travel and mobility industry. Closing 45 offices, Uber has laid off 6,700 employees since mid-March. Uber CEO Dara Khosrowshahi, who was granted a $45M earnings package in 2018, announced he will also waive his $1M base salary for the remainder of the year. *Layoffs reported between March 11-May 26, 2020 Meanwhile, as room bookings dropped by over 40% across several countries, Airbnb laid off a quarter of its workforce. The tech darling is anticipating a $2.4B revenue shortfall in 2020. Like many other big names—including Lyft, Uber, and WeWork—Airbnb is struggling to achieve profitability. In the first nine months of 2019, it lost $322M at the height of the market cycle. Until 2021, gig-economy revenues are projected to drop by at least 30%.

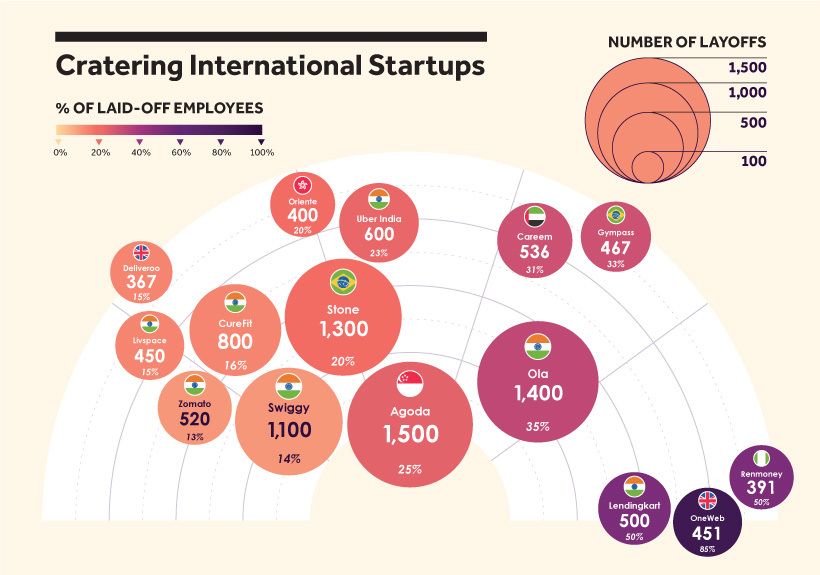

International Startups Struggling

Startups in the U.S. aren’t the only ones scrambling to conserve cash and cut costs. Brazil-based unicorn Stone has let go of 20% of its workforce. The rapidly growing digital payments company includes Warren Buffett as a major stakeholder, holding an 8% share as of March 2020. At the same time, India-based ride-hailing Ola has witnessed revenue declines of 95% since mid-March. It laid off 1,400 employees as bookings drastically declined. Similarly, Uber India has rivaled Ola in dominance across India’s $10B ride-hailing market since launching three years after Ola, in 2013. Now, almost 25% of the Uber India workforce have been laid off. Of course, these reports do not fully take into account the growing impact of COVID-19, but help paint a picture as the cracks emerge.

Pandemic-Proof?

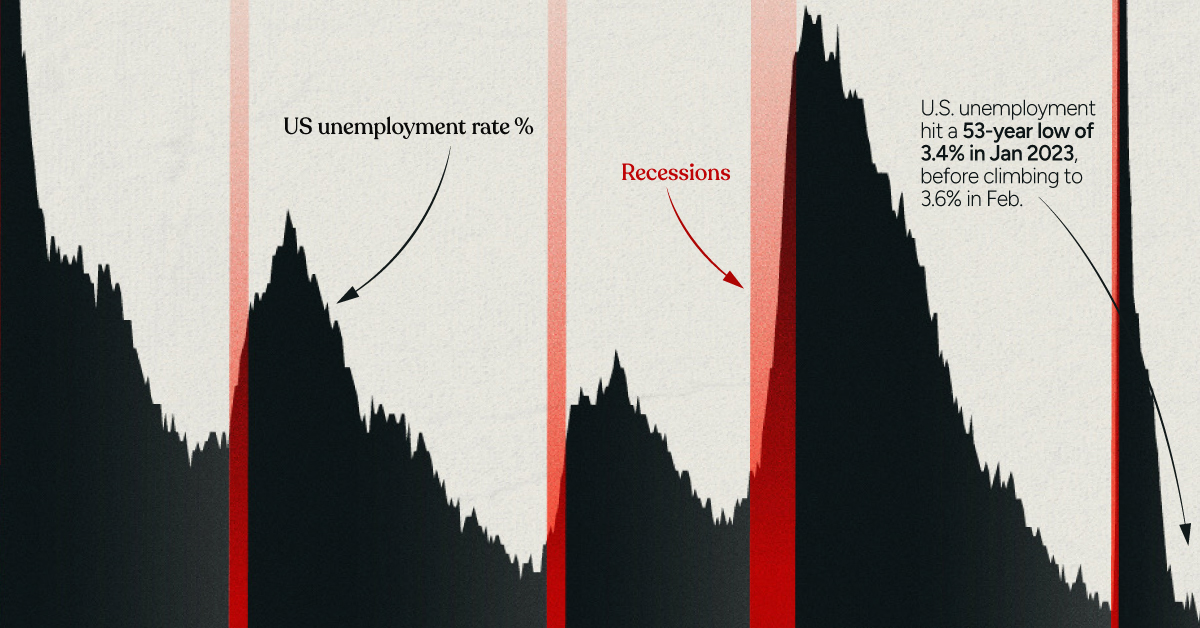

While the job market remains murky, what startups are looking to hire? Coursera, an online education startup, listed 60 openings in May. By the end of the year, the company plans to hire 250 additional staff. Within the peak of widespread global lockdowns, the platform attracted 10M new users. Meanwhile, Canva, an Australia-based graphic design unicorn, is seeking to fill 100 positions worldwide. In partnership with Google for Education, Canva offers project-based learning tools designed for classrooms, in addition to free graphic design resources. on Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%. A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement: While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession. This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter). With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation. For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022. The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make. Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation. More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession. Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes. Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.