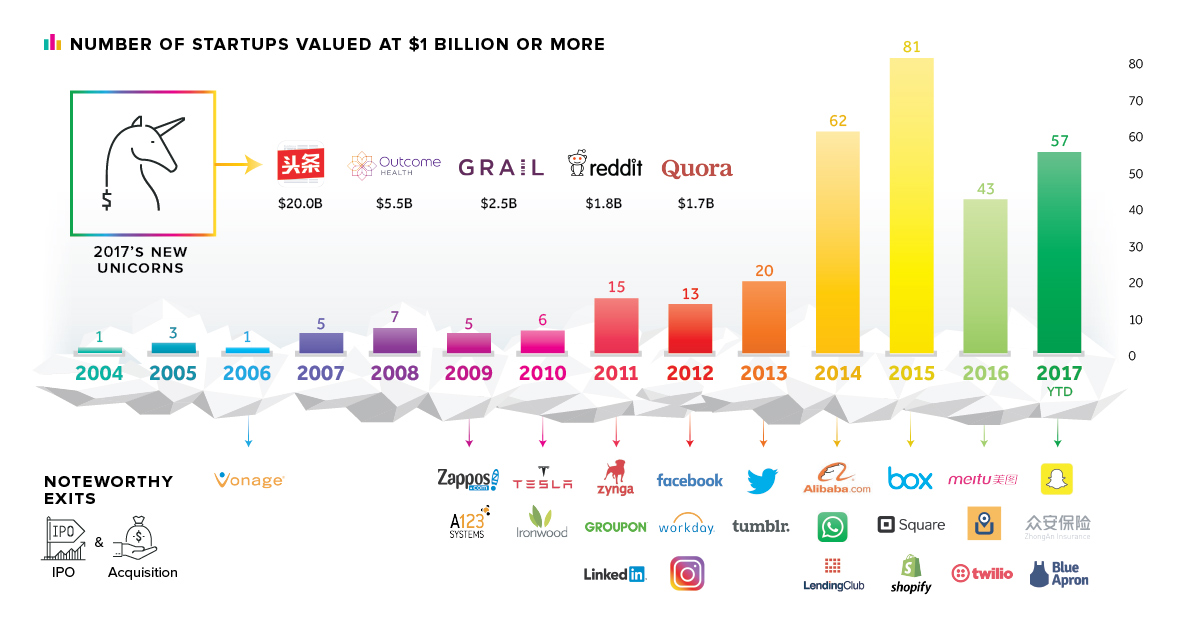

For a startup, reaching the coveted $1 billion unicorn valuation is an important milestone – but as we’ve found out in recent years, it’s not necessarily a guarantee of future success. In 2017, there were 57 startups that crossed the unicorn threshold, and they range from well-known companies, such as Reddit or Quora, to rapid-risers like China’s Toutiao (now valued at $20 billion), which has seemingly come out of nowhere. Investors have conviction that these companies will provide the platforms and products of the future, and they are placing big bets on them to deliver. Will they live up to the hype, or will they ultimately end up in the unicorn graveyard?

Unicorn Births by Year

With 57 new unicorns, this year ranks third overall in terms of births per year. While 57 unicorns in 2017 is still a high number, it’s also clear that the froth has died down from the unicorn bonanza that occurred in 2015. Venture capitalists have clearly dialed it down a notch, re-focusing on the selective quality of investments rather than the overall quantity of big bets.

Notable Unicorns in 2017

Based on data from PitchBook, we’ve included the full list of unicorns in the chart today. However, here are some that caught our eye: Toutiao (China) Valuation: $20 billion Founded in 2012, Toutiao is the behemoth on this year’s new unicorn list. Based in Beijing, Toutiao is a news and information platform that focuses on recommendations using AI technology. The company pushes content to users based on previous user interactions as well as the detailed analysis of new content. The platform has 120 million active users and has also gone on a recent buying spree, acquiring names like Flipagram and Musical.ly. Coinbase (United States) Valuation: $1.6 billion The cryptocurrency sector is exploding with growth, and Coinbase has been along for the ride since 2012. The most important crypto platform in the U.S. has such a strong influence in the sector, that the “Coinbase Effect” is now a talking point for traders everywhere. Whenever Coinbase introduces a cryptocurrency to its base of 10 million users, the added visibility and liquidity can make the price go bananas. It’s happened with Litecoin and Bitcoin Cash so far, and now every move by Coinbase is closely tracked by crypto power users and influencers. Alisports (China) Valuation: $1.0 billion Alibaba’s foray into sports isn’t going unnoticed. In conjunction with Sina Corp (a Chinese telecom) and Yunfeng Capital Co (venture capital), Alibaba hopes that Alisports will carve out a huge chunk of the RMB 5 Trillion Chinese sports market. It’s also worth noting that Alisports sees e-sports as having huge potential, and as a central piece of its platform. on Today’s chart measures the extent to which 41 major economies are reopening, by plotting two metrics for each country: the mobility rate and the COVID-19 recovery rate: Data for the first measure comes from Google’s COVID-19 Community Mobility Reports, which relies on aggregated, anonymous location history data from individuals. Note that China does not show up in the graphic as the government bans Google services. COVID-19 recovery rates rely on values from CoronaTracker, using aggregated information from multiple global and governmental databases such as WHO and CDC.

Reopening Economies, One Step at a Time

In general, the higher the mobility rate, the more economic activity this signifies. In most cases, mobility rate also correlates with a higher rate of recovered people in the population. Here’s how these countries fare based on the above metrics. Mobility data as of May 21, 2020 (Latest available). COVID-19 case data as of May 29, 2020. In the main scatterplot visualization, we’ve taken things a step further, assigning these countries into four distinct quadrants:

1. High Mobility, High Recovery

High recovery rates are resulting in lifted restrictions for countries in this quadrant, and people are steadily returning to work. New Zealand has earned praise for its early and effective pandemic response, allowing it to curtail the total number of cases. This has resulted in a 98% recovery rate, the highest of all countries. After almost 50 days of lockdown, the government is recommending a flexible four-day work week to boost the economy back up.

2. High Mobility, Low Recovery

Despite low COVID-19 related recoveries, mobility rates of countries in this quadrant remain higher than average. Some countries have loosened lockdown measures, while others did not have strict measures in place to begin with. Brazil is an interesting case study to consider here. After deferring lockdown decisions to state and local levels, the country is now averaging the highest number of daily cases out of any country. On May 28th, for example, the country had 24,151 new cases and 1,067 new deaths.

3. Low Mobility, High Recovery

Countries in this quadrant are playing it safe, and holding off on reopening their economies until the population has fully recovered. Italy, the once-epicenter for the crisis in Europe is understandably wary of cases rising back up to critical levels. As a result, it has opted to keep its activity to a minimum to try and boost the 65% recovery rate, even as it slowly emerges from over 10 weeks of lockdown.

4. Low Mobility, Low Recovery

Last but not least, people in these countries are cautiously remaining indoors as their governments continue to work on crisis response. With a low 0.05% recovery rate, the United Kingdom has no immediate plans to reopen. A two-week lag time in reporting discharged patients from NHS services may also be contributing to this low number. Although new cases are leveling off, the country has the highest coronavirus-caused death toll across Europe. The U.S. also sits in this quadrant with over 1.7 million cases and counting. Recently, some states have opted to ease restrictions on social and business activity, which could potentially result in case numbers climbing back up. Over in Sweden, a controversial herd immunity strategy meant that the country continued business as usual amid the rest of Europe’s heightened regulations. Sweden’s COVID-19 recovery rate sits at only 13.9%, and the country’s -93% mobility rate implies that people have been taking their own precautions.

COVID-19’s Impact on the Future

It’s important to note that a “second wave” of new cases could upend plans to reopen economies. As countries reckon with these competing risks of health and economic activity, there is no clear answer around the right path to take. COVID-19 is a catalyst for an entirely different future, but interestingly, it’s one that has been in the works for a while. —Carmen Reinhart, incoming Chief Economist for the World Bank Will there be any chance of returning to “normal” as we know it?