Bill Gates. Warren Buffett. Mark Zuckerberg. George Soros. Charles and David Koch. On an individual level, the people that make the definitive list of the Top 50 Wealthiest Billionaires are interesting, divisive, and envied around the globe. Together, they are a real force to be reckoned with: their combined fortunes tally to $1.46 trillion, which is more money than the GDP of entire countries such as Australia or Spain. Today’s data visualization, using the latest information from Wealth-X, takes an in-depth look at the world’s wealthiest billionaires by breaking down important data on age, location, and the source of their fortunes.

Billionaires by Geography

The lion’s share of the wealthiest billionaires still come from the United States, where 58% of the list is located. The rest are mostly in Europe (16%) and China (12%), which includes those from Hong Kong. The Southern Hemisphere only has one billionaire – Jorge Lemann from Brazil. However, even he now lives in Switzerland. Surprisingly, the United Kingdom, Canada, Australia, Japan, and Russia combine to have a grand total of zero representation on the Top 50 Billionaires list.

Billionaires by Age

The youngest billionaire on the list is Mark Zuckerberg, at just 31 years of age. The oldest is Liliane Bettencourt, the principal shareholder of cosmetic giant L’Oréal. She is 93 years old. The age of tech billionaires skewed the lowest, with an average age of 51. The age of all non-tech billionaires was far higher at 72.

Family Ties

The Walton siblings, which include Rob, Alice, and Jim Walton, are all descendants of Wal-Mart founder Sam Walton, and each have healthy fortunes of over $33 billion. Meanwhile, the sons and daughters of Forrest Mars Sr., the creator of a candy empire, are not doing too bad for themselves, either. Forrest Jr., Jacqueline, and John Mars each have respective fortunes of $28.6 billion. The divisive Koch Brothers also are high on the list, inheriting their initial wealth from father Fred C. Koch, the founder of Koch Industries. They succeeded in buying out their two other brothers, Frederick and William, after highly-publicized court battles in the 1980s and 1990s. Today the Koch Brothers have a combined fortune of $94.2 billion. Other billionaires are connected by being from the same corporate family, sharing in the success of creating empires from the ground up. Bill Gates, Steve Ballmer, and Paul Allen all worked to create Microsoft, and Larry Page and Sergey Brin built Google (now Alphabet) into one of the biggest companies in the world.

Billionaires by Industry

Technology, which brings us names such as Mark Zuckerberg, Larry Page, Sergey Brin, Bill Gates, and Larry Ellison, has more billionaires than any other industry with 12.

The world’s largest fashion and retail brands, such as Wal-Mart, Zara, Nike, and H&M, also have helped to get many people on this list.

At the same time, other industries such as media are under-represented, with only two names with empires built in the sector making the top 50.

About the Money Project

The Money Project aims to use intuitive visualizations to explore ideas around the very concept of money itself. Founded in 2015 by Visual Capitalist and Texas Precious Metals, the Money Project will look at the evolving nature of money, and will try to answer the difficult questions that prevent us from truly understanding the role that money plays in finance, investments, and accumulating wealth. on A lagging stock market dented these fortunes against high interest rates, energy shocks, and economic uncertainty. But some of the world’s billionaires have flourished in this environment, posting sky-high revenues in spite of inflationary pressures. With data from Forbes Real-Time Billionaires List, we feature a snapshot of the richest people in the world in 2023.

Luxury Mogul Takes Top Spot

The world’s richest person is France’s Bernard Arnault, the chief executive of LVMH.

With 75 brands, the luxury conglomerate owns Louis Vuitton, Christian Dior, and Tiffany. LVMH traces back to 1985, when Arnault cut his first major deal with the company by acquiring Christian Dior, a firm that was struggling with bankruptcy.

Fast-forward to today, and the company is seeing record profits despite challenging market conditions. Louis Vuitton, for instance, has doubled its sales in four years.

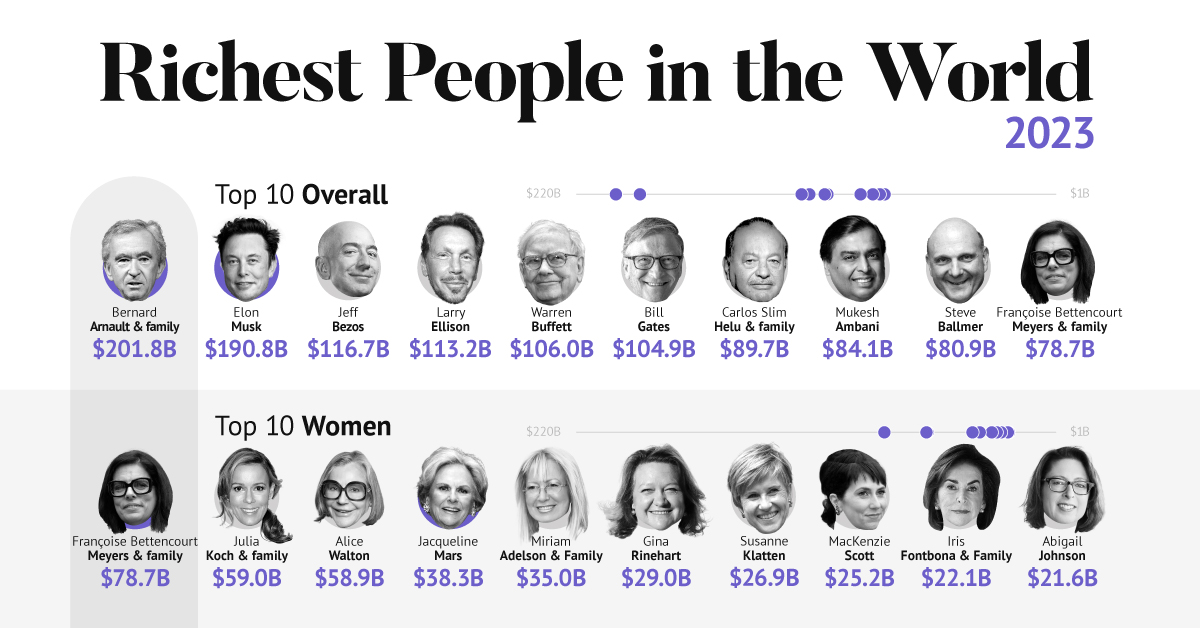

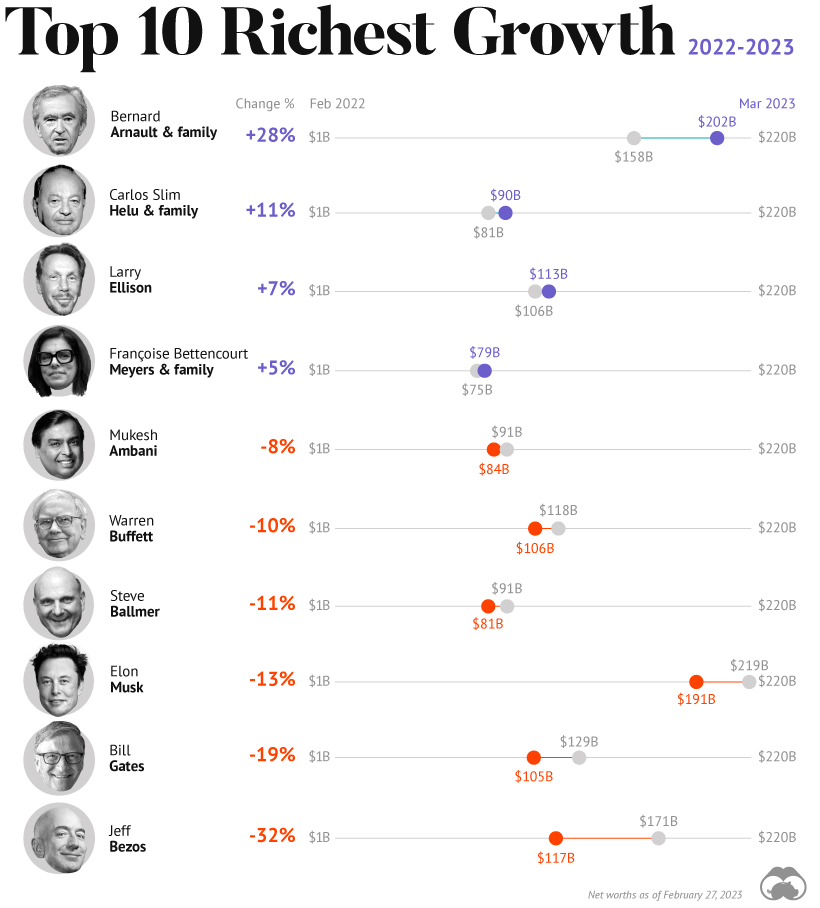

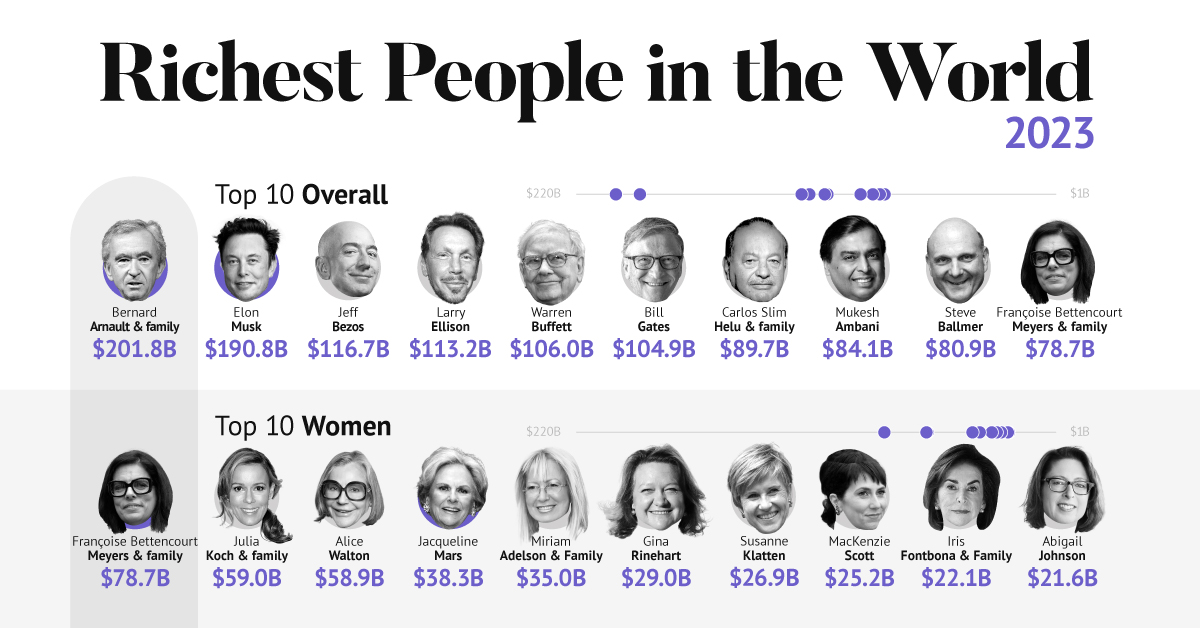

In the table below, we show the world’s 10 richest people with data as of February 27, 2023:

Elon Musk, the second-wealthiest person in the world has a net worth of $191 billion. In October, Musk took over Twitter in a $44 billion dollar deal, which has drawn criticism from investors. Many say it’s a distraction from Musk’s work with Tesla.

While Tesla shares have rebounded—after falling roughly 70% in 2022—Musk’s wealth still sits about 13% lower than in March of last year.

Third on the list is Jeff Bezos, followed by Larry Ellison. The latter of the two, who founded Oracle, owns 98% of the Hawaiian island of Lanai which he bought in 2012 for $300 million.

Fifth on the list is Warren Buffett. In his annual letter to shareholders, he discussed how Berkshire Hathaway reported record operating profits despite economic headwinds. The company outperformed the S&P 500 Index by about 22% in 2022.

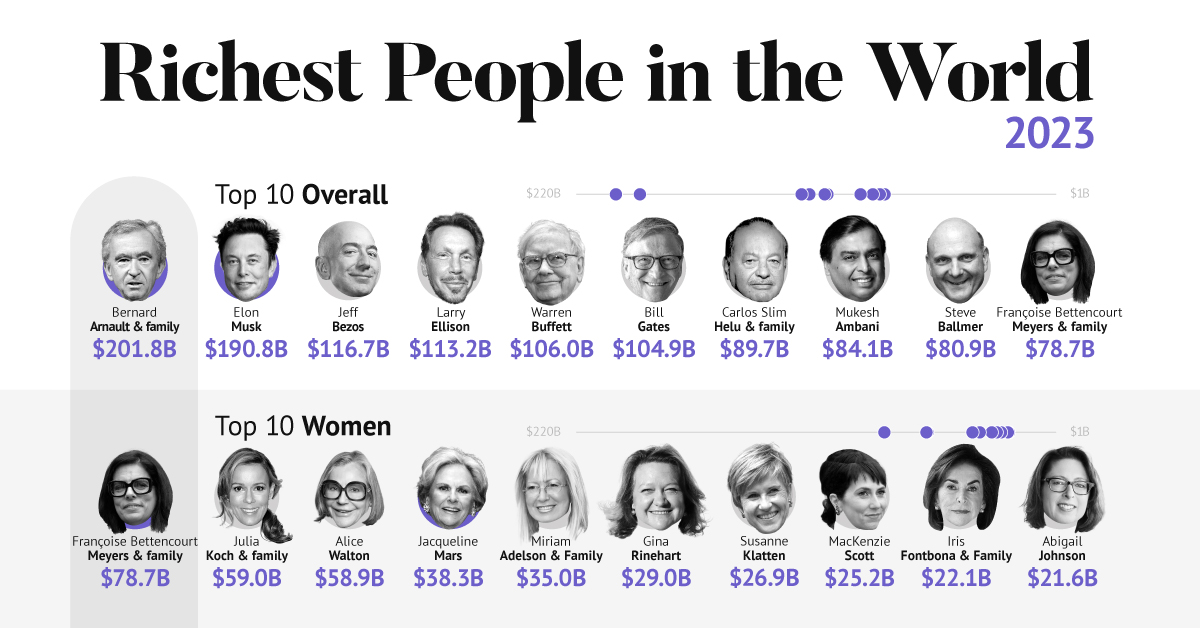

How Fortunes Have Changed

Given multiple economic crosscurrents, billionaire wealth has diverged over the last year. Since March 2022, just four of the top 10 richest in the world have seen their wealth increase. Two of these are European magnates, while Carlos Slim Helu runs the largest telecom firm in Latin America. In fact, a decade ago Slim was the richest person on the planet. Overall, as the tech sector saw dismal returns over the year, the top 10 tech billionaires lost almost $500 billion in combined wealth.

Recent Shakeups in Asia

Perhaps the most striking news for the world’s richest centers around Gautam Adani, formerly the richest person in Asia. In January, Hindenburg Research, a short-selling firm, released a report claiming that the Adani Group engaged in stock manipulation and fraud. Specifically, the alleged the firm used offshore accounts to launder money, artificially boost share prices, and hide losses. The Adani Group, which owns India’s largest ports—along with ports in Australia, Sri Lanka, and Israel—lost $100 billion in value in the span of a few weeks. Interestingly, very few Indian mutual funds hold significant shares in Adani Group, signaling a lack of confidence across India’s market, which was also cited in Hindenburg’s report. As a result, Mukesh Ambani has climbed to Asia’s top spot, controlling a $84 billion empire that spans from oil and gas and renewable energy to telecom. His conglomerate, Reliance Industries is the largest company by market cap in India.