One issue that’s been in the headlines for many years is anti-money laundering (AML). When criminals are able to successfully hide the illicit origins of their cash, both the financial institution and society suffer. So, what makes AML more important now than it has been in the past?

Rising up the Priority Ladder

Today’s infographic from McKinsey & Company explains the factors which have brought anti-money laundering urgently to the forefront in recent years.

- Regulatory Action Enforcement actions related to AML have been on the rise. Since 2009, regulators have levied approximately $32 billion in AML-related fines globally.

- Threat Evolution Criminals are using more sophisticated means to remain undetected, including globally-coordinated technology, insider information, and e-commerce schemes.

- Reputational Risk AML incidents put a financial institution’s reputation on the line. There’s a lot at stake: today, the average value of each of the top 10 bank brands is $45B.

- Rising Costs Most AML activities require significant manual effort, making them inefficient and difficult to scale. In 2018, it cost U.S. financial services firms about $25.3B to manage money laundering risk.

- Poor Customer Experience Compliance staff must have multiple touch points with a customer to gather and verify information. Perhaps not surprisingly, one in three financial institutions have lost potential customers due to inefficient or slow onboarding processes. It’s no wonder anti-money laundering has now become a top priority for many CEOs in the financial industry.

A Wave of Innovation

In the last five years, there has been an explosion of “RegTech” startups—companies that address regulatory requirements using technology.

Global RegTech Investments, 2014-2018

Over 60% of these are focused on solving Know Your Customer (KYC) and AML issues. What does this technology look like in practice? Customer onboarding A hypothetical U.S. retail firm, ABC Electronics, applies online to open an account at AML Innovators Bank. Their information is verified and screened using a fully automated process. If they are determined to be a lower-risk client, they will be fast-tracked through the approval process with decisioning in six hours or less. For high-risk clients, decisioning occurs within about 72 hours. Transaction Monitoring ABC Electronics requests to send multiple international wire payments to various beneficiaries. Each transaction is automatically screened based on various factors:

A same name or subsidiary transfer carries the lowest risk Transfers to a known, similar industry in a high-risk jurisdiction carry medium risk Transfers to an unknown industry in a high-risk jurisdiction carry high risk

These transaction scores, combined with algorithms that track a client’s expected vs. actual transaction behavior, will update ABC Electronics’ risk rating in real time. Management oversight As risk updates occur, ABC Electronics’ rating is integrated into AML Innovator Bank’s overall portfolio risk. Senior risk management teams will be able to view a heat map that highlights the highest risk areas of the business.

Structural Change, Big Gains

Just as financial crimes continue to evolve, so do AML schemes. How can organizations stay ahead of the game? They can focus on actively managing risk, deliberately investing in technology and analytics, and prioritizing areas where RegTechs will have the highest near-term impact. By investing in AML, financial institutions create competitive advantages:

Improved efficiency Superior customer experience Scalability Readiness to adapt to new regulations Reduced reputational risk Ability to attract top talent

With such benefits on the table, one thing is clear: Anti-money laundering efforts are more important now than they have ever been. on A lagging stock market dented these fortunes against high interest rates, energy shocks, and economic uncertainty. But some of the world’s billionaires have flourished in this environment, posting sky-high revenues in spite of inflationary pressures. With data from Forbes Real-Time Billionaires List, we feature a snapshot of the richest people in the world in 2023.

Luxury Mogul Takes Top Spot

The world’s richest person is France’s Bernard Arnault, the chief executive of LVMH.

With 75 brands, the luxury conglomerate owns Louis Vuitton, Christian Dior, and Tiffany. LVMH traces back to 1985, when Arnault cut his first major deal with the company by acquiring Christian Dior, a firm that was struggling with bankruptcy.

Fast-forward to today, and the company is seeing record profits despite challenging market conditions. Louis Vuitton, for instance, has doubled its sales in four years.

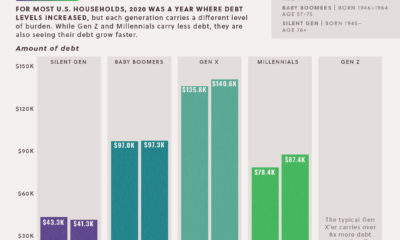

In the table below, we show the world’s 10 richest people with data as of February 27, 2023:

Elon Musk, the second-wealthiest person in the world has a net worth of $191 billion. In October, Musk took over Twitter in a $44 billion dollar deal, which has drawn criticism from investors. Many say it’s a distraction from Musk’s work with Tesla.

While Tesla shares have rebounded—after falling roughly 70% in 2022—Musk’s wealth still sits about 13% lower than in March of last year.

Third on the list is Jeff Bezos, followed by Larry Ellison. The latter of the two, who founded Oracle, owns 98% of the Hawaiian island of Lanai which he bought in 2012 for $300 million.

Fifth on the list is Warren Buffett. In his annual letter to shareholders, he discussed how Berkshire Hathaway reported record operating profits despite economic headwinds. The company outperformed the S&P 500 Index by about 22% in 2022.

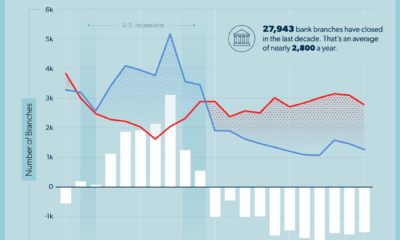

How Fortunes Have Changed

Given multiple economic crosscurrents, billionaire wealth has diverged over the last year. Since March 2022, just four of the top 10 richest in the world have seen their wealth increase. Two of these are European magnates, while Carlos Slim Helu runs the largest telecom firm in Latin America. In fact, a decade ago Slim was the richest person on the planet. Overall, as the tech sector saw dismal returns over the year, the top 10 tech billionaires lost almost $500 billion in combined wealth.

Recent Shakeups in Asia

Perhaps the most striking news for the world’s richest centers around Gautam Adani, formerly the richest person in Asia. In January, Hindenburg Research, a short-selling firm, released a report claiming that the Adani Group engaged in stock manipulation and fraud. Specifically, the alleged the firm used offshore accounts to launder money, artificially boost share prices, and hide losses. The Adani Group, which owns India’s largest ports—along with ports in Australia, Sri Lanka, and Israel—lost $100 billion in value in the span of a few weeks. Interestingly, very few Indian mutual funds hold significant shares in Adani Group, signaling a lack of confidence across India’s market, which was also cited in Hindenburg’s report. As a result, Mukesh Ambani has climbed to Asia’s top spot, controlling a $84 billion empire that spans from oil and gas and renewable energy to telecom. His conglomerate, Reliance Industries is the largest company by market cap in India.