One such shake-up to ingrained investment habits is the changing landscape of income investing. In today’s infographic from New York Life Investments, we explain why traditional long-term bonds may not be as effective as they were in the past, and which additional income strategies investors can consider.

The Status Quo

For years, investors have relied on traditional longer-term bonds as the centerpiece in an income portfolio. These debt instruments usually pay out interest to investors on a predetermined schedule, providing a steady income stream investment. Historically, they have also been subject to less volatility than equities. The typical bond portfolio is diversified, much like the Bloomberg Barclay’s U.S. Aggregate Index. Here’s how the sectors are broken down in the index: Unfortunately, this income strategy has been less effective in recent years. Over the last decade, core bond duration has increased by 1.5 years while yields have decreased by almost 2%. Essentially, interest rate volatility has increased—but investors are less compensated for the risk. In light of low rates and higher expected market volatility, it’s critical that investors explore other income solutions. Luckily, there are many lesser-known asset classes for investors to consider.

Additional Income Strategies: An Investor’s Choice

When investors decide how to re-allocate, they can keep these objectives in mind: Which additional income strategies can they explore?

Taxable Municipal Bonds

Issued by state and local governments, the yield of taxable munis has historically been higher than that of other sectors. Taxable munis also have a strong credit rating—over 76% of U.S. municipal bonds outstanding are A+ rated or better.

Insured Municipal Bonds

Investors can get additional downside protection with insured municipal bonds, which are guaranteed to pay interest and principal back by private insurers. They have historically performed similar to munis while capturing less of the “downside”, often providing an attractive risk-adjusted return for income investors.

Short-duration, High-yield Bonds

Bonds with a shorter duration and higher yield can be a lower volatility approach to achieving the same income investing goals. Yield and Risk in Bonds (July 1, 2014 – June 30, 2019):

Yield-Centric Equities

Equities can also play a role in an income focused portfolio. Investors should look for established companies that are achieving:

Growth in free cash flow Stable or growing dividends Share buybacks or debt reduction

Over the last 40+ years, the annual compound return of stocks with growing dividends have outperformed dividend cutters on the S&P 500 by more than 4%.

Preparing for Your Future

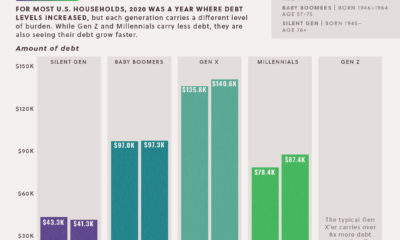

Maximizing the benefit from new income opportunities can take time. For this reason, it’s important to consider potential portfolio changes now, so that these strategies can play out in the lead up to retirement years. It may be tempting to stick with the status quo—both in daily routines and investment strategies—but those who proactively adjust their approach will be able to maximize their potential. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.